Juventus Rejects Tether’s Record-Breaking Sponsorship Offer—Exor Backs the Block

Italian football giant Juventus just punted on the biggest sponsorship deal in sports history—and their controlling shareholder, Exor, backed the play.

The Crypto Pitch That Missed the Net

Tether, the stablecoin behemoth, reportedly tabled an offer so massive it would have shattered every previous record. We're talking nine figures. The kind of money that makes even the most traditional boardrooms sweat. Yet, the Turin-based club, with the full support of its Agnelli-family holding company, said no.

Why Reject a Financial Hat-Trick?

It's the ultimate clash of cultures: legacy versus ledger. On one side, a 127-year-old institution synonymous with Italian heritage and black-and-white stripes. On the other, a digital asset powerhouse born from the blockchain revolution, looking to score a major branding coup in the real world.

Exor's backing of the rejection signals a fascinating calculus. It's not just about the money—it's about the brand. In the high-stakes game of global perception, some risks outweigh even a record-breaking cash injection. A move some might call prudent, others might call leaving a fortune on the table to avoid a reputational yellow card.

The New Playing Field

This isn't just a football story. It's a landmark moment for crypto's march into the mainstream. When the biggest offer in history gets blocked by one of the world's most iconic clubs, it sends a shockwave. It tells every major brand that crypto money, for all its weight, still carries baggage in certain elite circles. The beautiful game just demonstrated that sometimes, tradition holds the line against the most aggressive financial play imaginable—proving that in the end, even in finance, not every deal is about the numbers. Sometimes, it's just about the name on the front of the shirt.

Read us on Google News

Read us on Google News

In brief

- Tether offered a cash buyout of 65.4% of Juventus for over $1 billion, but Exor rejected the offer outright.

- This rejection slows Tether’s ambitions in football, but other crypto-friendly clubs could become targets.

- After Tether’s failure to acquire Juventus, could supporters grow more wary of USDT and cryptos?

Tether will not have Juventus: a bold offer, a rejection without appeal

Tether, the issuer of the USDT stablecoin, attempted to buy 65.4% of Juventus’s shares, held by Exor, the Agnelli family’s company. The offer, entirely in cash, included a promise to invest an additional $1 billion to modernize the club. An enticing proposal, but it was rejected without hesitation by Exor’s board of directors.

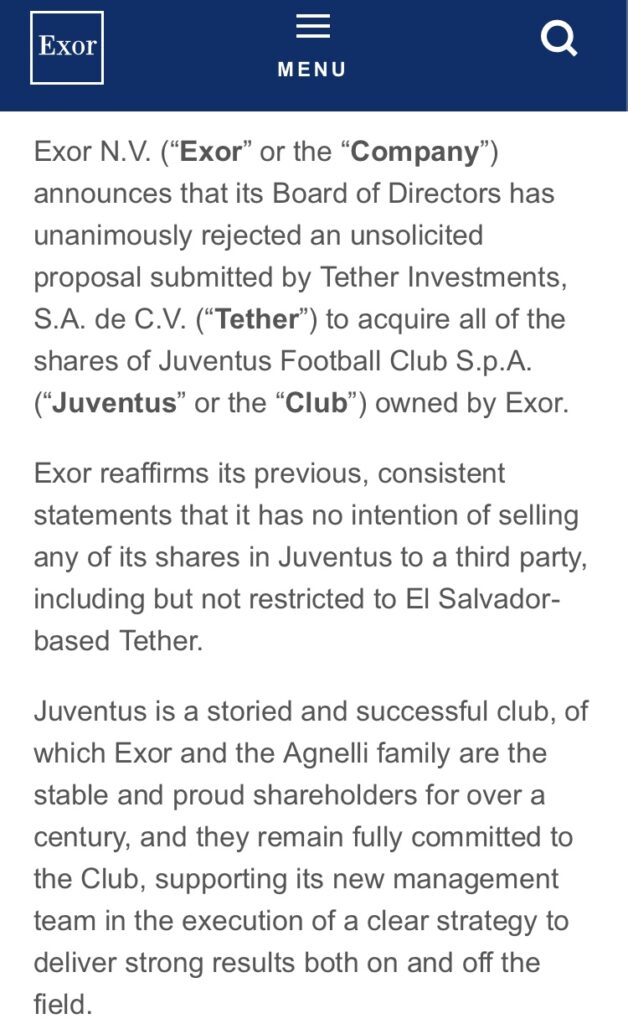

For Exor, the refusal is explained by a historic attachment to Juventus. Indeed, the Old Lady has been owned by the Agnelli family for over a century. In a statement, Exor reaffirmed its long-term commitment and support for the club’s new management. Tether’s offer, described as “unsolicited“, did not convince, despite the crypto company’s stated ambitions.

This rejection highlights a mistrust of outside players, especially in a sector as traditional as Italian football. For Tether, this is a first failure in its sports expansion strategy but likely will not mark the end of its ambitions.

Tether: which football clubs could succumb to the crypto temptation?

Exor’s refusal represents a setback for Tether, which saw Juventus as a major gateway into European football. However, other clubs, struggling financially, might be more open to investors like Tether. FC Barcelona, in debt, or Inter Milan, seeking stability, could become prime targets.

Some clubs have already taken the step into crypto. PSG, Manchester City, and others have partnered with platforms like Socios.com to launch fan tokens. These partnerships show that football is not immune to financial innovation, even if full acquisitions remain rare. Tether could therefore turn to more receptive clubs or focus on less ambitious collaborations.

Tether (USDT): Could Juventus buyout refusal hurt the stablecoin?

USDT, Tether’s stablecoin, is already controversial due to its lack of transparency. Could this refusal by Juventus worsen that distrust? Supporters, attached to their club’s history, might view crypto’s intrusion into traditional football negatively. For Tether, the challenge is twofold: improve its image and convince fans that crypto can add value.

Partnerships with clubs, if well executed, could help legitimize USDT. But following this refusal, the task looks tougher. Juventus fans, in particular, might be reluctant to adopt USDT out of loyalty to Exor and the Agnelli family. This rejection could therefore impact cryptocurrency adoption in sport, at least in the short term.

Tether’s rejection by Exor shows that football remains cautious about crypto in general and stablecoins in particular. Yet, with indebted clubs and an industry seeking innovation, this alliance might become inevitable. The question remains: at what cost? The debate about the future of cryptocurrencies in sport is far from over.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.