ESMA Steps In: MiCA Regulation Falters Across EU, Watchdog Ready to Reclaim Control

Europe's grand crypto experiment hits a wall. The Markets in Crypto-Assets (MiCA) framework, hailed as the world's first comprehensive rulebook, is stumbling out of the gate with patchy and inconsistent application across member states.

The Enforcement Gap

National regulators are interpreting key provisions differently—creating a fragmented landscape that undermines the regulation's core promise of a unified market. Some jurisdictions are dragging their feet on licensing, while others apply rules with a startling lack of rigor. The result? A regulatory arbitrage playground that MiCA was specifically designed to dismantle.

ESMA Loads the Canon

No longer content to watch from the sidelines, the European Securities and Markets Authority (ESMA) is signaling a major intervention. The top watchdog is preparing to issue stricter, more granular guidelines and is asserting its authority to ensure uniform supervision. Think of it as a central bank stepping in to discipline unruly regional branches—only with more blockchain jargon and less physical cash.

The message is clear: if national authorities can't or won't apply the rules correctly, ESMA will do it for them. This could mean direct oversight of significant crypto asset service providers and harmonized enforcement actions. For crypto firms banking on regulatory divergence, the party might be over before the first real bull run under MiCA even begins.

A cynical take? The finance sector excels at building elegant frameworks and then lobbying furiously to avoid implementing them—until the watchdog finally barks loud enough to spook the markets. ESMA just found its voice.

Read us on Google News

Read us on Google News

In brief

- MiCA has come into effect, but its application varies greatly between European countries.

- Germany issues crypto licenses while Luxembourg remains very restrictive in this regard.

- ESMA criticizes Malta and wants to unify practices to avoid persistent regulatory loopholes.

- Local regulators will need to become technicians, as Europe moves toward stronger centralization.

MiCA: when European ambition meets the reality of Member States

Since January 2025, the MiCA regulation (Markets in Crypto-Assets) has officially come into force. It promised harmonization of rules for all crypto sector players within the EU. But the unity shown on paper erodes on the ground.

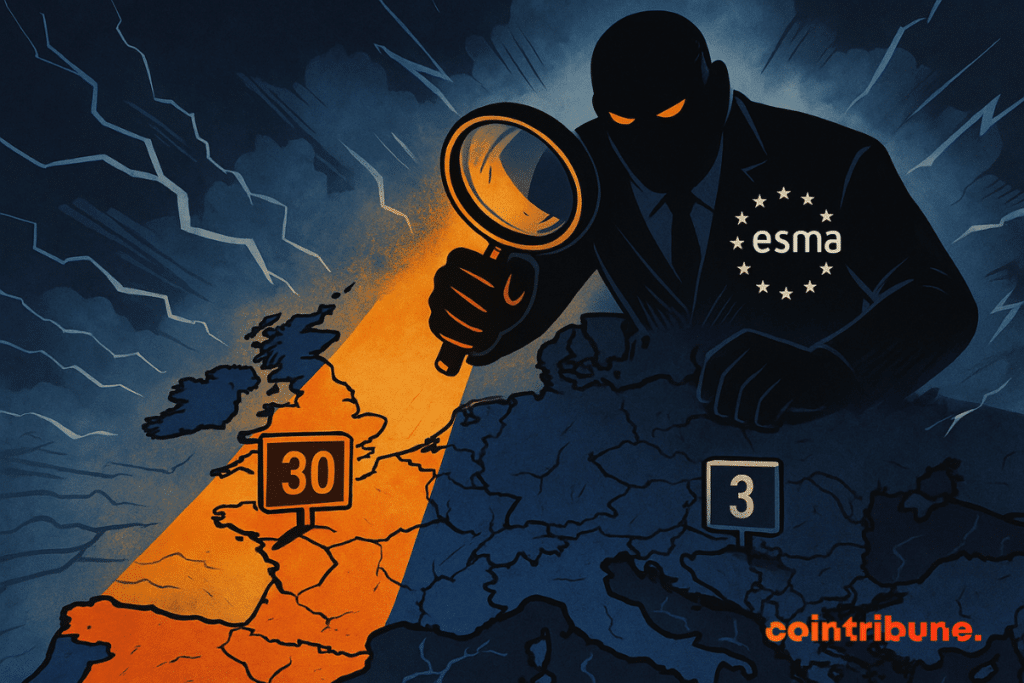

Germany, for example, has already granted over 30 crypto licenses, often to traditional banks. Meanwhile, Luxembourg has only approved three, solely for well-established heavyweights. This disparity fuels a risk of regulatory arbitrage: some players choose the most lenient jurisdictions, distorting competition.

Lewin Boehnke, Chief Strategy Officer at Crypto Finance Group, did not mince his words:

There is a very, very uneven application of regulation.

ESMA (European Securities and Markets Authority) recently stirred the pot by singling out Malta’s MFSA: according to an official report, the Maltese regulator only partially met expectations in issuing crypto licenses.

ESMA wants to move from the shadows to the spotlight in crypto supervision

What was just a technical debate becomes a political question. Should each country play its part, or should the baton be handed to a single conductor? For several Member States, the choice seems made.

France, Italy, and Austria support a strengthening of ESMA’s role. The idea is not to deprive local regulators of power, but to accelerate efficiency and unify practices.

Also according to Boehnke:

From a purely practical point of view, I think it WOULD be a good idea to have a unified application of the regulation.

But grey areas persist. MiCA, for example, requires the “immediate” return of assets held by custodians. Problem: no one knows what “immediate” means in the crypto world. This slows adoption, especially among banks. Uniform interpretation of these sensitive points therefore becomes crucial.

Crypto and regulation in Europe: the future will be played out in Brussels

According to an op-ed published by GlobalCapital, national regulators must reinvent themselves. The future would no longer be in exclusive governance, but in technical support for a central authority.

A model already exists: the European Central Bank directly supervises major banks while collaborating with national regulators. This hybrid model could apply to the crypto market.

On the ground, the rise of ESMA is not seen as a competence conflict. It is viewed as an opportunity to create a single standard capable of competing with the US SEC. And with the rise of blockchains such as Solana, Avalanche, or Cosmos, clear regulation becomes essential to protect investors and make the crypto market credible.

Crypto & EU: key landmarks to better understand

- 2025: MiCA comes into effect, except for stablecoins (postponed to 2026);

- 30+ crypto licenses already granted in Germany versus only 3 in Luxembourg;

- ESMA published a critical report on Malta in November 2025;

- France, Italy, Austria: declared support for centralized supervision;

- Major technical debate: legal definition of “immediate return” in MiCA.

With ESMA at the forefront, Europe no longer wants to suffer the American agenda. It attempts to impose its own vision of financial regulation in the Web3 era. And in the global crypto arena, it intends to become the sovereign alternative to the SEC model.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.