JPMorgan Denies Political Motive Behind Crypto Account Closure Tied to Trump

JPMorgan Chase just shut down a cryptocurrency account linked to former President Donald Trump's fundraising efforts. The bank insists it's standard procedure—not political warfare.

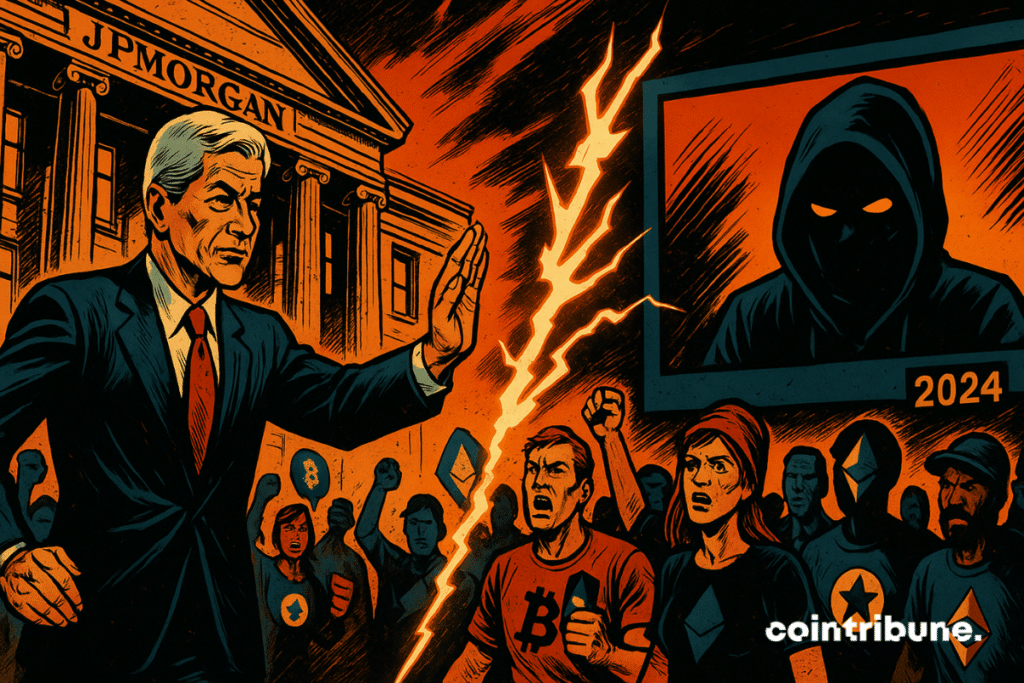

Banking Giants vs. Crypto Politics

Wall Street's biggest player claims the closure followed its standard risk assessment protocols. No special treatment, no political targeting—just another day in compliance. The timing, however, raises eyebrows across both political and financial circles.

Decentralization's Ironic Twist

The incident highlights a core tension in crypto's journey to mainstream finance. Proponents champion decentralization and freedom from traditional gatekeepers. Yet, when major campaigns or figures dive in, they still bump against the old guard's rules—the very system crypto aimed to bypass. It's the ultimate irony: using revolutionary tech to navigate legacy banking hurdles.

Regulatory Shadow Boxing

This isn't just about one account. It's a spotlight on the uneasy dance between crypto and regulated finance. Banks face intense scrutiny over politically exposed persons and fund sources. Every move gets dissected, every decision questioned. The result? A hyper-cautious environment where optics often trump innovation—pun somewhat intended.

Future-Proofing or Fear?

JPMorgan's move signals how traditional finance manages crypto's perceived risks. For banks, it's less about ideology and more about liability. They'd rather avoid a regulatory headache than embrace a potential PR win—typical finance, prioritizing cover-your-ass strategies over groundbreaking opportunities. The 'why' behind closed doors often boils down to cold, hard risk calculus, not conspiracy.

So, while the political world sees a scandal, the finance world sees standard ops. Crypto's promise of borderless, permissionless finance keeps crashing into the brick wall of real-world compliance. The revolution will be banked—but only after jumping through all the old hoops first.

Read us on Google News

Read us on Google News

In brief

- JPMorgan denies targeting crypto actors for political or ideological reasons.

- Jamie Dimon calls for reform of debanking rules deemed unclear and unfair.

Crypto and account closure: accusations rain down on JPMorgan

Several personalities in the crypto sector denounce the, without clear justification.

- The CEO of Strike Jack Mallers claims, for example, to have lost access to his personal funds.

- Trump Media, headed by Devin Nunes, mentions a similar blockage.

- The same scenario on the crypto platform ShapeShift.

These incidents revive fears of a. Some administrations use this controversial method to restrict access to crypto banking services.

Jamie Dimon, JPMorgan CEO, categorically rejects these allegations during an interview with Fox News.

The debate actually touches a sensitive point: the neutrality of banks in the face of the rise of digital assets. More precisely referring to thethat raises the question of possible financial censorship hidden behind vague compliance rules.

Crypto, Trump and regulation: Jamie Dimon’s strong defense

Jamie Dimon affirms he has been advocating for 15 years to reform the rules that push banks to close accounts on mere suspicion or media reporting. He thus calls for a.

Dimon reminds that JPMorgan never delivers information to authorities without a subpoena. However, he accuses the political climate of turning banks into easy targets. For him, the problem comes from the law (and not the intentions of the institution).

The crypto community therefore fears, seen as a barrier to decentralized finance. In a context where digital wallets are gaining popularity, each incident fuels distrust toward traditional actors.

In any case, the war between crypto supporters and traditional banks seems far from settled. Regulation will have to decide between control and innovation, before a real gap grows between two visions of finance.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.