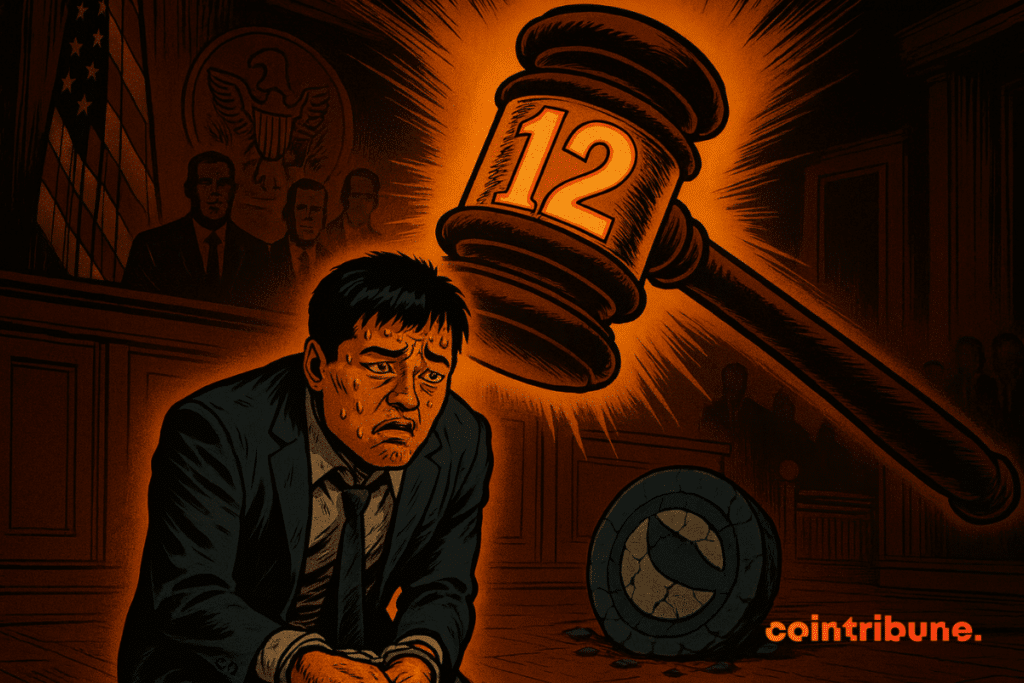

Do Kwon Faces 12 Years in Prison: US Prosecutors Demand Maximum Sentence for Terra Founder

The gavel is coming down. US prosecutors just demanded a 12-year prison sentence for Do Kwon, the fallen founder behind Terra's catastrophic collapse. That's not a request—it's a statement.

The Price of Failure

Forget the hype cycles and the moon-shot promises. This is the cold, hard math of accountability. When $40 billion in market value evaporates overnight, someone has to answer. Prosecutors aren't just arguing about broken algorithms; they're talking about shattered lives and a systemic shockwave that still rattles the industry.

A New Era of Enforcement

This move signals a brutal shift. Regulatory bodies worldwide are done playing nice. The 'move fast and break things' mantra now carries a potential prison sentence. For builders and founders, the message is clear: innovate, but understand the legal framework you're operating in. The free pass era is over.

Market Implications & The Bull Case

Paradoxically, this is bullish. Severe enforcement purges bad actors and builds the foundation for legitimate growth. It separates the signal from the noise, pushing capital toward projects with real utility and compliant structures. Long-term, a regulated, accountable ecosystem attracts institutional money—the kind that doesn't flee at the first sign of trouble.

The industry's biggest growth spurt might just come from its most painful reckoning. Sometimes, you have to burn down the old forest for new, stronger trees to grow. Just ask any banker from 2008—they got their bailout, but crypto founders get the book thrown at them. Funny how that works.

Read us on Google News

Read us on Google News

In Brief

- US prosecutors request twelve years in prison for Do Kwon after Terra’s collapse.

- They believe his actions triggered a major crisis in the crypto ecosystem.

- Kwon faces legal risks in the United States as well as in South Korea.

A harsh sentencing recommendation for Terraform

US prosecutors did not hold back. In a case submitted to the federal court in New York, they demand twelve years in prison and confiscation of profits deemed criminal. In their view, the damage caused by Do Kwon surpasses that of notoriously infamous figures such as Sam Bankman-Fried, Alex Mashinsky, or Karl Sebastian Greenwood, while he acknowledges the facts and requests a reduced sentence. A heavy, almost provocative comparison, illustrating the scale of the fiasco.

This severity does not come out of nowhere. Since his guilty plea on two charges, wire fraud and conspiracy, the judicial framework has tightened. Prosecutors emphasize that the collapse of Terra in 2022 triggered a chain reaction. A real tidal wave that helped establish the notorious “Crypto Winter,” a freezing period for the entire sector.

This dynamic, still palpable today, has left a deep scar. The prosecution’s argument precisely rests on this idea: Kwon did not just deceive investors, he weakened an entire crypto market already shaken by a succession of scandals.

A judicial path already complex and far from over

This dynamic, still palpable today, has left a DEEP scar. The prosecution’s argument precisely rests on this idea: Kwon did not just deceive investors, he weakened the entire crypto and Terraform market already shaken by a succession of scandals.

Because another threat looms: the South Korean justice system. Prosecutors in his country WOULD demand a sentence that could rise up to forty years. A prospect his legal team brandishes before the American judge to obtain a milder sanction.

In clear terms: no matter what happens in the United States, Kwon will probably not regain his freedom anytime soon. Even if each party proposes its own recommendation, the final arbiter remains the judge. And the range of possibilities remains wide: from a few years to several decades.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.