Bitcoin’s Pivotal Week: Why This Downturn Could Define Your 2025

Bitcoin stumbles into December's final stretch. The market holds its breath.

This isn't just another weekly dip. The closing act of 2025 is on the line, and the next few trading sessions carry an outsized weight. Price action this week could cement the year's narrative—bullish resilience or bearish surrender.

The Technical Crucible

Charts don't lie, but they do whisper warnings. Key support levels are getting a stress test. A hold here builds a foundation for a January rally. A breakdown risks flushing out the late-year optimism that fueled the last leg up. Traders are watching moving averages and volume like hawks, knowing institutional money often makes its quiet moves before the holidays.

Sentiment on a Knife's Edge

Fear and greed are doing their familiar dance. Social media chatter swings from 'buy the dip' to 'winter is coming.' This volatility isn't a bug; it's a feature. The real question is whether weak hands capitulate or diamond hands see a fire sale. Remember, the crowd is usually wrong at extremes—a timeless truth Wall Street conveniently forgets between bonus cycles.

The week closes. The ledger for 2025 awaits its final, decisive entry.

Read us on Google News

Read us on Google News

In brief

- Bitcoin falls below $84,000 in early December, due to selling pressures and adverse macroeconomic headwinds.

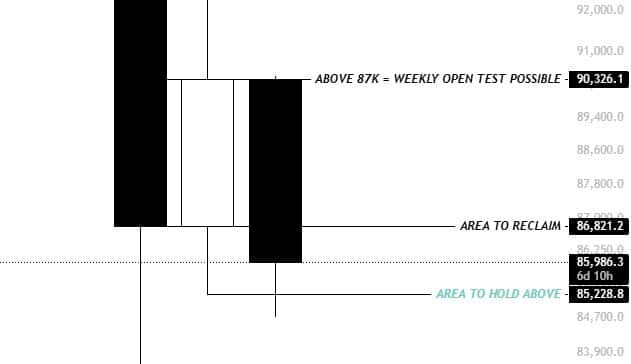

- $85,200 and $87,000 levels are critical: their maintenance will determine stabilization or worsening of the drop to close 2025.

- December could offer a bitcoin buying opportunity if the market stabilizes, but caution remains necessary amid volatility.

Why Is Bitcoin Collapsing Below $84,000?

Bitcoin starts December 2025 with a sharp drop to $84,000. A collapse explained in part by the selling pressure exerted by institutional players on Wall Street. Indeed, from the opening of the US markets, massive sales accelerated the decline, reducing available liquidity and amplifying price movements. Investors, already nervous, reacted by liquidating their positions, worsening the downward trend.

In Asia, adverse macroeconomic headwinds played a key role. The rise in interest rates in Japan and geopolitical tensions reduced liquidity, creating an unfavorable environment for risky assets like bitcoin. Cascade liquidations triggered by margin calls then amplified the drop, turning a correction into a deeper movement.

Finally, the end of “Quantitative Tightening” in the United States, though supposed to favor risk assets, has not yet had the expected effect on bitcoin. Capital flows remain cautious, and investors await clearer signals before repositioning massively on cryptocurrencies.

Which Levels Will Tip BTC in December 2025?

The $85,200 and $87,000 levels are now under close watch following bitcoin’s fall to $84,000. The first, $85,200, represents a critical support: if Bitcoin fails to hold there, a new wave of selling could drive the market to new lows. Conversely, a rebound above this threshold could indicate a gradual stabilization.

The second level, $87,000, is just as crucial. Crossing this mark would allow bitcoin to retest the weekly open and give a positive signal to investors. They must therefore remain vigilant, as a break below $85,200 could dash hopes of a rebound and extend the downtrend.

Bitcoin in December: Is a Down Start a Good Omen?

Historically, December has often been a volatile month for bitcoin. In 2017 and 2020, this period was marked by spectacular rallies, while in 2018 and 2022, corrections dominated. For this year, predictions for December are mixed. Some analysts, like Ryan Lee from Bitget Research, believe BTC could soar to $100,000:

Despite the pullback, the underlying structure remains constructive. If the Federal Reserve adopts a more accommodating tone under new leadership, expectations of rate cuts could fuel a new rally, potentially driving bitcoin to $110,000.

Accordingly, Michaël van de Poppe fairly believes that this drop in bitcoin could offer a buying opportunity at a low price.

On the other hand, others, more pessimistic, fear a continuation of the fall, especially if key levels do not hold. The general sentiment thus remains mixed, between fear and opportunism.

This week is decisive for bitcoin, with key levels to watch and macroeconomic factors to consider. Between opportunities and risks, December 2025 promises to be a pivotal month for BTC. Will bitcoin manage to reverse the trend or does this drop herald a prolonged crypto winter?

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.