China’s Central Bank Doubles Down: The Crypto Crackdown Just Got Real

The People's Bank of China isn't just talking—it's tightening the screws. Forget the old warnings; this is a coordinated, system-wide clampdown designed to snuff out digital asset activity within its borders.

The Regulatory Noose Tightens

New directives are flooding out, targeting everything from mining operations to peer-to-peer transactions. The message is unequivocal: crypto has no place in China's financial ecosystem. Exchanges? Blocked. Trading platforms? Shuttered. The Great Firewall now has a dedicated crypto-filter.

A Global Ripple Effect

While Beijing walls off its economy, the rest of the world watches. Every regulatory tremor in China sends shockwaves through global markets—a stark reminder of where a huge chunk of mining power and trading volume once lived. It's a masterclass in financial containment, executed with the subtlety of a sledgehammer.

The Irony of Control

Here's the cynical finance jab: nothing boosts decentralized tech's appeal quite like a centralized crackdown. For every door Beijing slams shut, a dozen digital windows open elsewhere. The capital, as always, finds a way—even if that way involves encrypted keys and offshore wallets.

So, the crackdown is real. But in the grand, global casino of crypto, one nation's 'exit' sign is another's flashing 'open for business' neon.

Read us on Google News

Read us on Google News

In Brief

- China reaffirms the illegality of cryptos and stablecoins and highlights risks to economic stability.

- Despite repression, the country benefited from $3.2 million in crypto donations for Hong Kong.

- Former leader in Bitcoin mining, China’s strict policy could weigh on BTC prices.

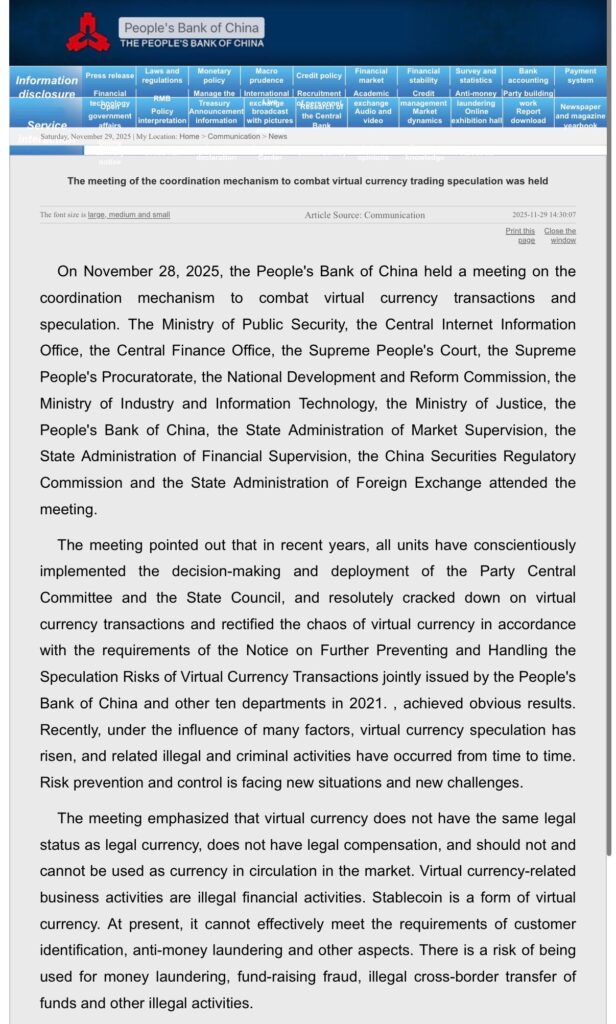

China Reaffirms Its Crypto Ban

On November 28, the People’s Bank of China (PBC) gathered 13 government agencies to reiterate the ban on cryptocurrencies and stablecoins. Since 2021, these assets have been considered illegal, lacking legal status equivalent to fiat currency. The meeting aimed to strengthen the fight against speculation, money laundering, and illegal capital transfers.

Stablecoins, often pegged to traditional currencies, were criticized for their inability to meet compliance standards. The PBC stressed their potential to bypass capital controls, thereby threatening the country’s financial stability. This meeting marks a new phase in China’s crypto crackdown, confirming that the country will tolerate no deviation from its strict financial policy.

China Bans Cryptos but Receives $3.2 Million for Hong Kong

While China firmly bans cryptocurrencies, a paradoxical situation emerged after the devastating Hong Kong fire. The crypto industry mobilized to collect $3.2 million in crypto, intended for disaster victims. These donations, legal in Hong Kong, raise questions about the coherence of Chinese policy. Could the “resurgence of speculation” mentioned by the PBC include these fundraising efforts? Or is it a temporary tolerance for humanitarian reasons?

Hong Kong, as a special administrative region, enjoys a distinct status allowing some regulatory flexibility. However, this situation highlights tensions between mainland repression and local economic realities. This contradiction illustrates the challenges China faces: how to reconcile a strict crypto ban with their inevitable use in specific contexts?

China, Former Pillar of Bitcoin Mining: What Impact on BTC?

Before 2021, China dominated Bitcoin mining with over 65% of the global hashrate. Despite miners’ exodus following the ban, it remains third in 2025 thanks to clandestine operations and its industrial legacy, proving a persistent influence in the ecosystem. With increased crackdown, could BTC face additional pressure on its price?

Chinese investors, although forced to circumvent restrictions, remain major crypto market players. An intensification of controls could lead to massive sell-offs, causing a short-term drop. However, bitcoin, decentralized by nature, could continue thriving beyond China’s borders. In the long term, BTC’s resilience will mainly depend on its ability to adapt to an increasingly hostile regulatory environment.

China maintains a rigid stance on cryptocurrencies while allowing their use in exceptional cases. This duality raises questions about the future of cryptos in Asia and their impact on the global market. In your opinion, will China eventually reconsider its position, or will this crackdown mark a lasting turning point?

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.