Crypto Drama: Pump.fun Co-Founder Fires Back at Kraken Cash-Out Allegations

Another day, another crypto controversy—because what's decentralized finance without a little centralized drama?

The Accusation

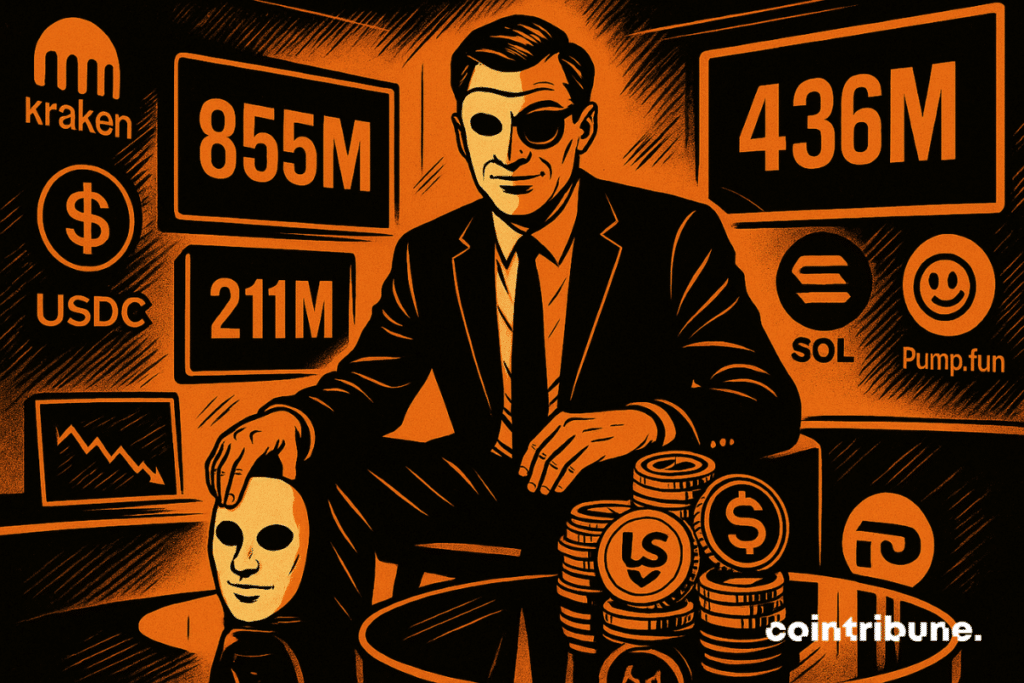

Whispers turned to shouts as allegations swirled around Pump.fun's co-founder allegedly cashing out millions through Kraken. The crypto community's favorite pastime—speculating about other people's money—kicked into high gear.

The Response

Pump.fun's co-founder didn't just deny the claims—they launched a full-scale counteroffensive. Calling the accusations 'baseless' and 'financially illiterate,' they painted the narrative as everything from market manipulation to pure jealousy.

The Fallout

Trading volumes spiked, social media exploded, and everyone suddenly became a forensic accountant. Because nothing says 'trustless system' like needing to trust that founders aren't secretly dumping bags.

The crypto world watches as another 'building for the future' project faces the oldest question in finance: follow the money or follow the narrative?

Read us on Google News

Read us on Google News

In brief

- Pump.fun denies cash-out accusations and speaks of simple internal fund management.

- The crypto community remains divided, between suspicions of manipulation and defense of the project.

Suspicions of Massive Cash-Out on Kraken: The Crypto Case Shaking Pump.fun

It all started with an alert issued by Lookonchain. According to the onchain analysis company, crypto wallets linked to Pump.fun allegedlysince October. An operation interpreted as a massive cash-out!

This comes at a time when the crypto platform’s revenues plunging to $27.3 million in November, down from $40 million in previous months.

Another worrying sign:. It is currently trading around $0.0027.

Specifically, this crypto asset has declined:

- by 32% compared to its introduction price;

- by nearly 70% since its September peak.

The Co-founder Strikes Back and Mentions Treasury Management

In response to the suspicions, Sapijiju reacted publicly via a post on X. He explains that these crypto fund movements are simply part of a treasury management strategy. More specifically, the goal is tointo different wallets to extend the life of the crypto project.

He even specifies that Pump.fun has never collaborated with Circle, the issuer of USDC.

According to the latest data, wallets associated with the crypto project still hold over 855 million stablecoins and 211 million in SOL. This suggests that.

Of course, the co-founder’s response divides opinion. Some netizens highlight contradictions in his statements. Others denounce opaque management, particularly regarding allegedly arbitrary airdrops. Conversely, more moderate voices remind that Pump.fun retains control of its revenues and freedom over its financial choices.

In any case, this case highlights a central issue in the crypto world: transparency of projects, especially when they handle hundreds of millions. In an ecosystem where trust relies on algorithmic promises, words must reassure as much as numbers.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.