Bitcoin’s Critical Juncture: 5 Warning Signs as Retail Retreats Under Institutional Pressure

Bitcoin faces its toughest test yet as market dynamics shift dramatically

Retail Exodus Meets Wall Street Onslaught

The five alarming signals flashing across trading desks worldwide suggest we're witnessing a fundamental market transformation. Retail investors are pulling back just as institutional pressure reaches unprecedented levels.

Liquidity patterns show clear divergence between small and large holders. Trading volumes tell the real story—retail participation drops while institutional positioning grows more aggressive.

Market structure fractures appear where traditional finance meets crypto-native capital. The five signals combine to create a perfect storm of volatility and opportunity.

Regulatory pressure mounts as institutions demand clearer frameworks. Meanwhile, retail traders face margin calls and liquidation events that reshape the investor landscape.

This isn't just another market cycle—it's a battle for Bitcoin's soul between Main Street and Wall Street. The outcome will determine whether crypto remains the people's money or becomes just another asset class for the suits. Because nothing says 'financial revolution' like watching hedge funds repackage decentralization into quarterly earnings reports.

Read us on Google News

Read us on Google News

En bref

- Bitcoin begins November 2025 down 2%, testing key support levels at $100,000 and the moving average at $101,150.

- The positive seasonality of November (+40% on average) is absent for bitcoin, with market sentiment in “fear” territory.

- The Fed maintains a restrictive policy, limiting liquidity and isolating bitcoin from equity markets.

- Institutional flows declined for the first time in 7 months, with net outflows from Bitcoin ETFs and demand falling short of supply.

- Retail investors are withdrawing, reducing active addresses by 26% and exposing bitcoin to a risk of correction towards $98,500.

A difficult trading week: bitcoin under technical pressure

After the massive Bitcoin withdrawal from exchanges, BTC started November down, returning to $107,000. Traders anticipate a complex week, with a risk of retreat towards $100,000, a major psychological threshold. Technical analyses highlight the fragility of supports! Notably, the 50-week exponential moving average, located at $101,150.

Order books reveal critical liquidity zones between $105,000 and $106,000, as well as at $117,000. Experts mention a ranging environment, where sideways movements could dominate. Caution is advised, as a test of lows could trigger an aggressive buyer reaction or, conversely, increase selling pressure.

Disappointing seasonality: why November’s rebound does not happen

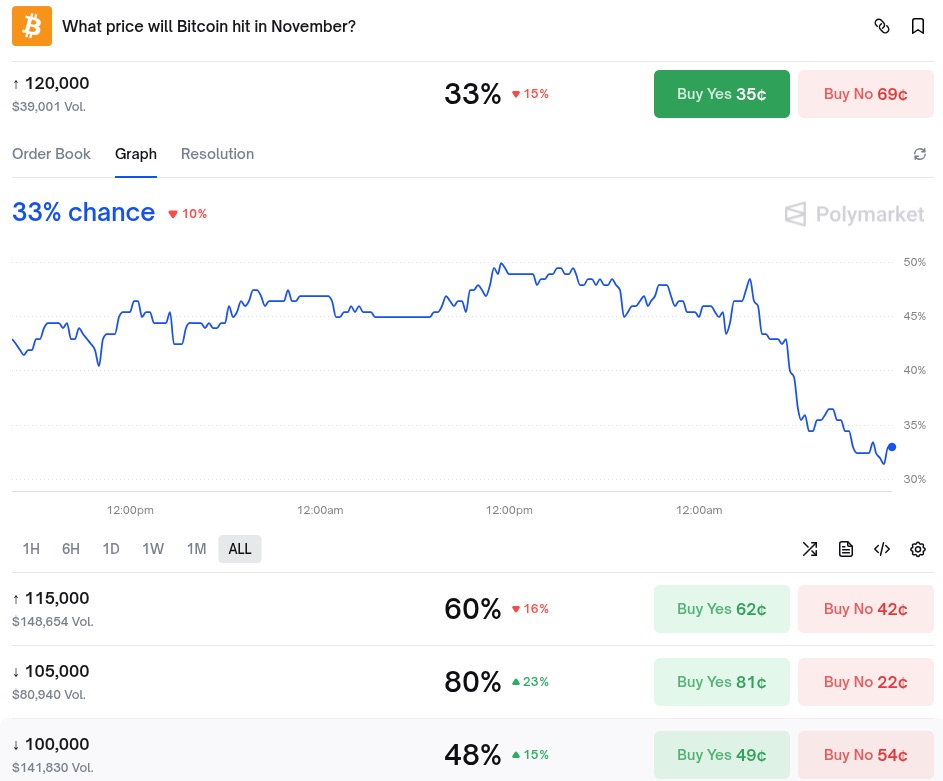

Historically, November is a strong month for bitcoin, with average gains of 40% since 2013. Yet in 2025, the cryptocurrency shows a negative performance of 2%. Prediction markets, like Polymarket, give only a 33% chance for bitcoin to finish the month above $120,000.

The crypto Fear & Greed Index remains anchored in “fear” territory, reflecting a gloomy market sentiment. Analysts note a resurgence of bearish predictions below $100,000. A sign that investor psychology could worsen the trend. Without a clear catalyst, bitcoin seems doomed to prolonged consolidation, far from seasonal expectations.

Macroeconomic context: between trade hope and the Fed

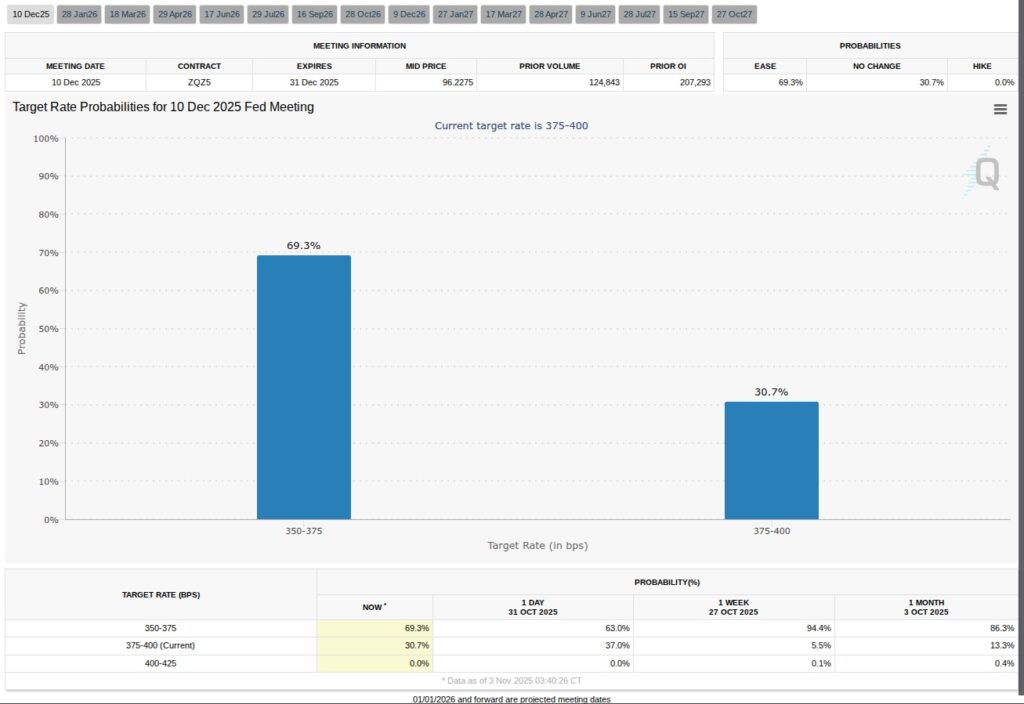

Equity markets benefit from hopes of a trade agreement between the United States and China, but bitcoin remains apart from this dynamic. The correlation between bitcoin and tech stocks, once strong, weakens, isolating crypto from traditional market movements. Moreover, the Fed maintains a restrictive stance, with only a 69.3% chance of a rate cut in December.

This uncertainty limits liquidity available for risky assets, including bitcoin. Ryan Lee, chief analyst at Bitget, describes the current phase of crypto markets as a “cautious calm”, a healthy consolidation after volatility induced by the Fed:

We consider the current “cautious calm” in crypto markets as a healthy consolidation phase after recent volatility linked to the Fed. This allows Bitcoin to stabilize around $110,000.

Declining institutional demand: an alarming signal for bitcoin

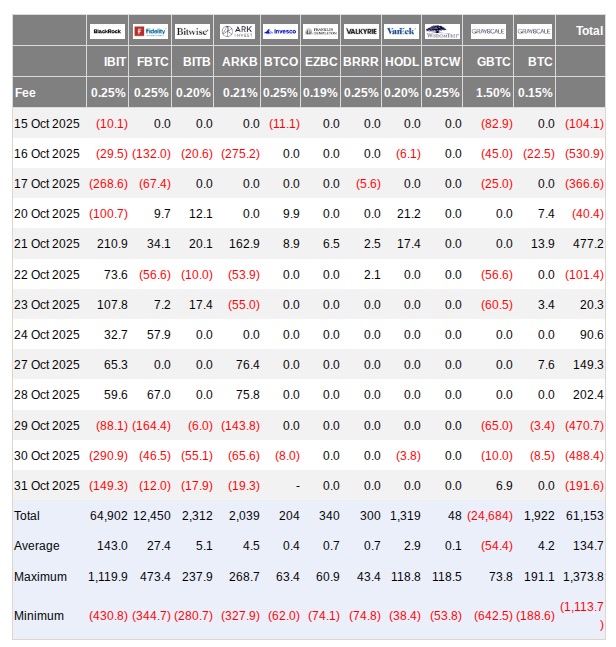

Net flows of US bitcoin ETFs record three consecutive days of net outflows, a rare phenomenon. The BlackRock IBIT fund notably contributed to more than half of the outflows, totaling over $500 million. For the first time in seven months, institutional purchases are less than the newly mined supply, a historic bearish signal.

Analysts emphasize that this decline recalls the period before the local bottom at $75,000 in April 2025. The growing maturity of the market, marked by the entry of sovereign funds and companies, could however mitigate extreme volatility risks in the long term.

Retail withdrawal: a dormant bitcoin network

The number of active addresses on the bitcoin network has dropped by 26.1% since November 2024, falling from 1.18 million to 872,000. This retail withdrawal limits liquidity and extends market cycles. Furthermore, the NVM (Network Value to Metcalfe) ratio indicates an overvaluation of bitcoin relative to the size of its network.

Experts estimate that this overvaluation could lead to a correction towards $98,500. Without retail participation, the “strong hands” struggle to optimally liquidate their positions, delaying the natural end of market cycles.

Bitcoin is therefore going through a delicate period, marked by a technical retreat, weak institutional demand, and retail disengagement. The coming weeks will be decisive to confirm or deny a rebound. Should we expect a return of buyers or a worsening of the bearish trend?

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.