Digital Euro Revolution: ECB’s Game-Changer for European Economic Dominance

Central Bank Digital Currency Breaks Traditional Banking Chains

The European Central Bank's digital euro isn't just another cryptocurrency—it's a strategic power move. While Bitcoin maximalists scoff and traditional bankers sweat, this government-backed digital asset could actually work for real people.

No More Middlemen Cuts

Instant settlements slash transaction costs to near-zero. Cross-border payments that used to take days now happen in seconds. The eurozone's financial infrastructure just got a blockchain-powered upgrade that actually makes sense.

Privacy Versus Control Battle

Yes, the ECB will track transactions—but so does your current bank. The difference? This system cuts out the profit-hungry intermediaries that have been skimming off your payments for decades. Sometimes centralized efficiency beats decentralized anarchy.

Global Financial Arms Race

While China's digital yuan advances and the US debates digital dollar options, Europe just positioned itself at the forefront of the coming currency wars. Traditional finance may never recover from this disruption.

Because nothing says 'financial innovation' like government-backed digital money that actually works—unlike those 'stablecoins' that keep proving they're anything but stable.

Read us on Google News

Read us on Google News

In brief

- Christine Lagarde presents the digital euro as a symbol of unity and trust, meant to strengthen Europe’s financial sovereignty.

- Voices denounce a risk of surveillance and centralization of the digital euro, preferring bitcoin as an alternative.

- The EU blocks the Russian stablecoin A7A5, fueling debates over a possible strategy to impose its CBDC against the rise of independent cryptos.

Christine Lagarde and the promise of an inclusive and secure digital euro

Christine Lagarde presents the digital euro as:

- A symbol of unity and trust;

- A major advancement for Europe;

- A tool designed to strengthen financial sovereignty and facilitate daily transactions.

According to her, this digital currency will enable instant, free, and accessible payments to all, even without an internet connection. All this while guaranteeing confidentiality comparable to current systems.

The project, budgeted at 1.3 billion euros, aims for a gradual launch by 2027. Lagarde emphasizes its complementary nature to cash. Indeed, it offers a public alternative to private solutions such as bank cards or electronic wallets. For the ECB, the goal is to meet the needs of an increasingly digitalized economy while preserving the stability of the European financial system.

Criticism of the digital euro: between surveillance and centralization

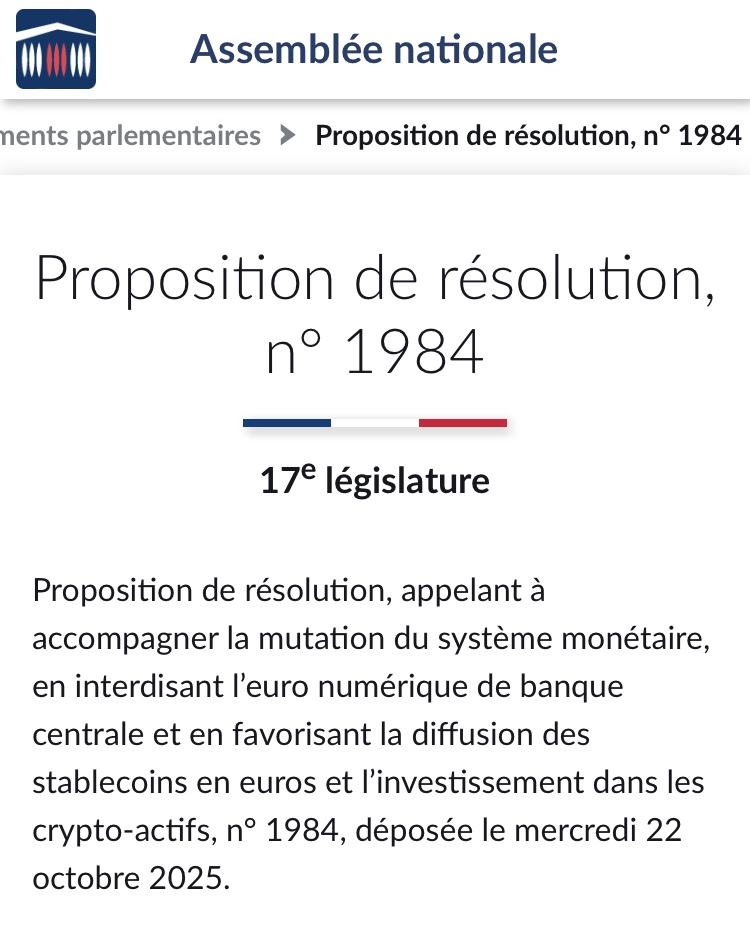

The digital euro is not unanimous, especially in the crypto ecosystem. Critics point to risks of increased surveillance and state control over financial transactions. For them, a digital currency issued by a central bank opposes the decentralization principles that underpin the spirit of cryptocurrencies. In France, political voices rise to denounce this project. Éric Ciotti even proposed a law aiming to ban the digital euro, advocating instead for adopting Bitcoin as an alternative currency.

In Germany, parties such as the AfD call to recognize bitcoin as a national priority, arguing that the digital euro could lead to an overly intrusive financial system. These criticisms reflect growing mistrust towards central institutions and their ability to guarantee privacy.

The EU blocks the Russian stablecoin A7A5: a strategy to impose its CBDC?

At the end of October 2025, the European Union banned the Russian stablecoin A7A5, accused of circumventing sanctions and financing the war in Ukraine. This stablecoin, backed by the ruble, allowed Russia to maintain financial exchanges despite embargoes. By banning it, the EU displays its intention to control monetary flows on its territory and limit the influence of foreign digital currencies.

This decision raises questions: is the EU looking to eliminate competition to facilitate the adoption of its own CBDC? In this context, bitcoin emerges as a neutral and censorship-resistant solution. While states develop their sovereign digital currencies, BTC remains the only fully decentralized asset, favored by those who reject a financial system controlled by central banks. A symbolic but also practical resistance in a landscape where crypto redraws the frontiers of finance.

The digital euro crystallizes hopes for a modern financial Europe according to Christine Lagarde, but also fears of an overly controlled system. Between innovation and preservation of freedoms, the debate remains intense. As states and central banks MOVE their pieces, crypto, and particularly bitcoin, continues to represent a decentralized alternative. Will the balance between regulation and financial freedom be possible?

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.