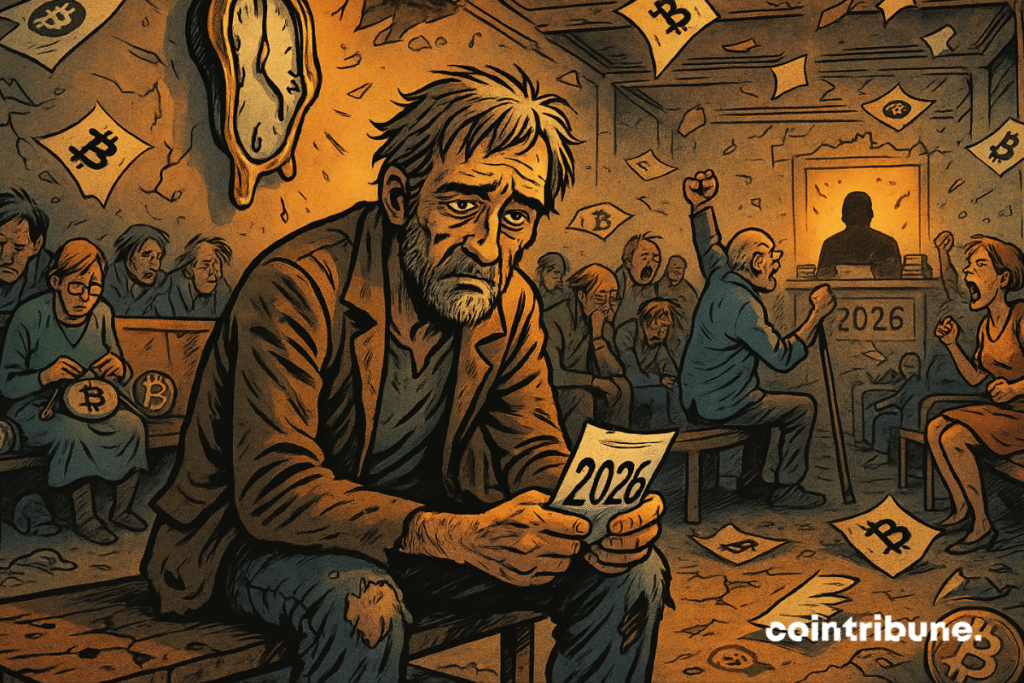

Mt. Gox Pushes Creditor Payouts to 2026 - Delayed Again

Another extension hits the crypto world's longest-running saga.

The Timeline Stretch

Mt. Gox creditors face another two-year wait as the collapsed exchange pushes its repayment deadline to 2026. The move marks the latest in a decade-long series of delays that would make even traditional finance bureaucrats blush.

Creditor Fatigue Sets In

Original claimants from the 2014 hack continue watching Bitcoin's price surge while their funds remain locked. The extension suggests administrative complexities still outweigh urgency—surprising exactly no one in crypto circles.

Legacy of Limitations

Trustee Nobuaki Kobayashi's team cites processing bottlenecks and verification requirements for the delay. Meanwhile, the crypto market evolves at light speed around these glacial traditional finance proceedings.

Because when you've already waited eleven years, what's another twenty-four months? Just ask your grandchildren to check the mailbox in 2026.

Read us on Google News

Read us on Google News

In brief

- Mt. Gox has postponed its creditor repayment deadline to October 31, 2026, marking the third extension since the process began.

- Many creditors are still waiting for payments due to incomplete procedures or issues during the repayment process.

- Arkham Intelligence data indicates Mt. Gox continues to hold 34,689 Bitcoin, worth roughly 4 billion dollars.

Third Extension for Mt. Gox Repayments

In a statement released on Monday, Mt. Gox announced that customer repayments have been postponed to October 31, 2026, moving from the earlier deadline of October 31, 2025.

According to the Rehabilitation Trustee, most of the Base Repayment, Early Lump-Sum Repayment, and Intermediate Repayment have been completed, mainly for creditors who successfully fulfilled all necessary procedures without complications.

Nevertheless, a significant number of creditors have yet to receive their repayments, as some have not completed the required procedures, while others encountered issues during the process.

To address this, the trustee stated that “as it is desirable to make the Repayments to such rehabilitation creditors to the extent reasonably practicable, the Rehabilitation Trustee, with the permission of the court, has changed the deadline for the Repayments from October 31, 2025 (Japan Standard Time) to October 31, 2026.” This adjustment marks the third postponement, following previous delays from October 2023 and October 2024.

After the Hack: Recovery and Missing Funds

Mt. Gox was founded in 2010 and quickly became one of the leading global platforms for cryptocurrency trading. By early 2014, it reportedly managed a significant share of worldwide Bitcoin activity. However, in 2014 the exchange disclosed a severe hacking incident that led to the disappearance of about 850,000 BTC. Following the loss, Mt. Gox filed for bankruptcy protection in Japan, ending operations and leaving thousands of users without access to their funds.

In the aftermath, roughly 200,000 BTC were recovered, but around 650,000 BTC remained missing as the case moved forward under a court-managed rehabilitation process.

Mt. Gox Compensation Plan and Initial Payouts

Subsequently, in September 2023, the rehabilitation trustee outlined a compensation framework using recovered assets. The plan included the distribution of 142,000 Bitcoin, 143,000 Bitcoin Cash, and 69 billion Japanese yen—equivalent to around $510 million—to verified creditors. After court approval, the repayment program officially began in 2024, with distributions made in both Bitcoin and Bitcoin Cash.

During mid-2024, several creditors reported receiving their repayments through established exchanges, including Kraken and Bitstamp, which were chosen as channels for transferring assets. By March 27, 2025, the Rehabilitation Trustee confirmed that 19,500 creditors had been reimbursed in bitcoin and Bitcoin Cash.

While the repayment program continues, data from Arkham Intelligence indicates that Mt. Gox still holds 34,689 Bitcoin, estimated to be worth around $4 billion, which is expected to be used in the remaining repayment phases.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.