Bitcoin Profit Tsunami: 97% of Supply Now in Green Territory as Prices Shatter Records

Bitcoin holders are swimming in profits as nearly all circulating supply turns profitable amid unprecedented price surges.

The Profit Domination

With 97% of Bitcoin's total supply now sitting comfortably in profit territory, the network demonstrates its resilience and investor confidence. This staggering percentage represents one of the highest profit ratios in Bitcoin's history, signaling massive adoption and long-term holder conviction.

Market Momentum Unleashed

As prices continue their relentless climb to new heights, the profit wave sweeps across both retail and institutional portfolios. The 97% profit metric showcases how widespread the gains have become—from early miners to recent accumulators.

Traditional finance analysts scratching their heads while Bitcoin continues printing profits for nearly every holder in the ecosystem. Some things never change—like bankers missing the boat on digital gold.

Read us on Google News

Read us on Google News

In brief

- Nearly the entire Bitcoin market is currently profitable, with 97% of circulating supply valued above its original purchase price.

- Despite widespread gains, realized profits remain modest, indicating that investors are holding positions.

Broad Profitability Across Bitcoin’s Supply

Blockchain analytics platform Glassnode reported in its latest weekly on-chain update on October 8 that 97% of Bitcoin’s circulating supply is currently profitable. The figure jumped as the cryptocurrency broke above $126,000, setting a new all-time high and pushing nearly all holders into profit.

However, despite the high levels of profitability, realized profits remain modest, indicating that investors are not rushing to sell. This suggests the market is experiencing a steady and orderly rotation rather than facing significant selling pressure. Glassnode noted, “Overall, selling remains controlled and consistent with a healthy bullish phase, though continued monitoring is warranted as prices advance.”

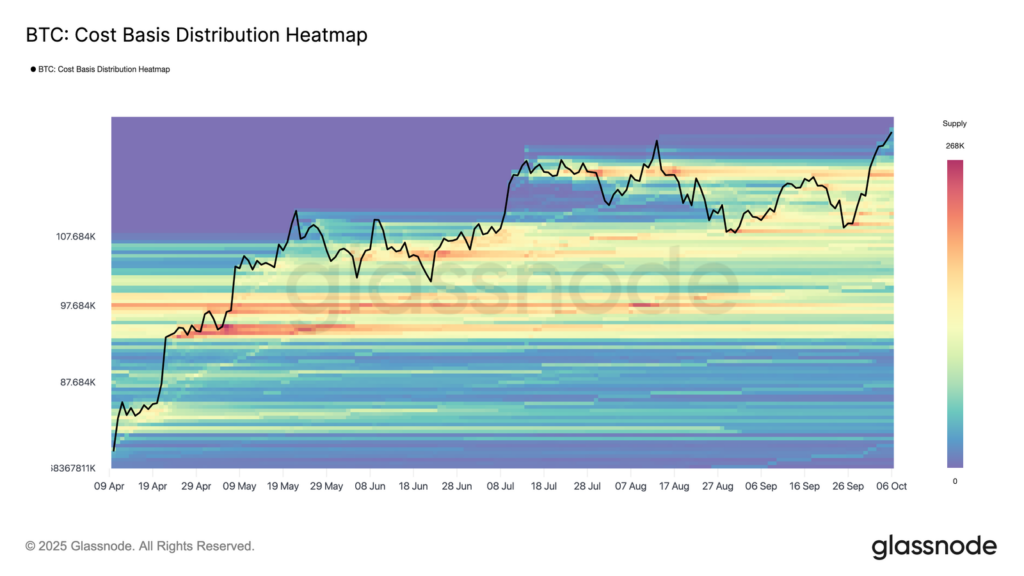

The firm also examined price levels where investors are likely to defend their positions. Using the Cost Basis Distribution Heatmap, Glassnode highlighted thin support between $120,000 and $121,000, meaning fewer coins were acquired there and price stability might be weaker in that zone. A stronger price base was identified NEAR $117,000, where around 190,000 BTC were previously acquired.

If bitcoin dips toward this level, previous buyers may step in again to protect their gains. This makes the $117,000 range an important zone for potential market stability and a possible point of momentum recovery if prices ease.

ETF Inflows Drive Demand and Trading Surge

Glassnode attributed Bitcoin’s latest breakout largely to a sharp increase in inflows into U.S. spot BTC exchange-traded funds (ETFs). These investment vehicles, which directly hold Bitcoin, have seen renewed interest from both institutions and retail participants.

Data from market intelligence firm Farside shows that more than $2.5 billion has entered U.S. spot BTC ETFs so far this week. This consistent inflow has fueled demand and added upward pressure to Bitcoin’s price.

The surge in ETF activity has also energized the broader spot market.

- Spot trading volumes have climbed sharply, reaching their highest levels since April, as renewed demand from ETF inflows draws more participants into direct Bitcoin trading.

- This rise in activity has carried over to the futures market, where open interest has hit new highs after Bitcoin moved above $120,000, signaling increased confidence and stronger speculative positioning.

- Alongside that growth, funding rates have pushed past 8% on an annualized basis, reflecting the growing appetite for leveraged long positions as traders bet on further price gains.

The collection of indicators from Glassnode paints the picture of a robust but increasingly sensitive uptrend. Demand remains solid, underpinned by heavy ETF inflows and greater engagement in spot and derivatives markets. The broad profitability across Bitcoin’s supply shows investor confidence and sustained buying interest.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.