BlackRock’s IBIT Smashes 800,000 BTC Milestone - Institutional Bitcoin Dominance Solidified

Wall Street's crypto embrace hits unprecedented levels as BlackRock's Bitcoin ETF crosses the 800,000 BTC threshold.

The Institutional Takeover

BlackRock's IBIT isn't just participating in the Bitcoin market - it's rewriting the rules of institutional adoption. With over 800,000 BTC under management, the world's largest asset manager now controls a stake that would make most nation-states envious. This isn't dipping toes in crypto waters anymore; it's building an ark while traditional finance skeptics still debate whether it might rain.

The New Gold Standard

While gold bugs cling to their shiny rocks, BlackRock's massive Bitcoin accumulation signals a fundamental shift in how institutions view store-of-value assets. The 800,000 BTC milestone represents more than just numbers - it's a statement that digital scarcity now competes with physical scarcity in the portfolios of the world's most sophisticated investors. Who needs Fort Knox when you've got cryptographic keys?

Traditional finance purists might call it reckless - until they check their own pension funds' latest allocations. The revolution isn't coming; it's already being managed by people in suits.

Read us on Google News

Read us on Google News

In brief

- BlackRock’s IBIT ETF surpasses 800,000 BTC, valued at about $97 billion, after eight straight days of inflows.

- IBIT now controls 3.8% of Bitcoin’s total supply, outpacing MicroStrategy’s 640,031 BTC holdings.

- Bitcoin ETFs recorded $1.21B in daily inflows, marking the largest surge since Trump’s pro-crypto election win.

- Institutional demand grows as easing geopolitical risks and treasury participation boost Bitcoin’s stability.

BlackRock’s IBIT Now Holds 3.8% of Bitcoin Supply Amid Record Inflows

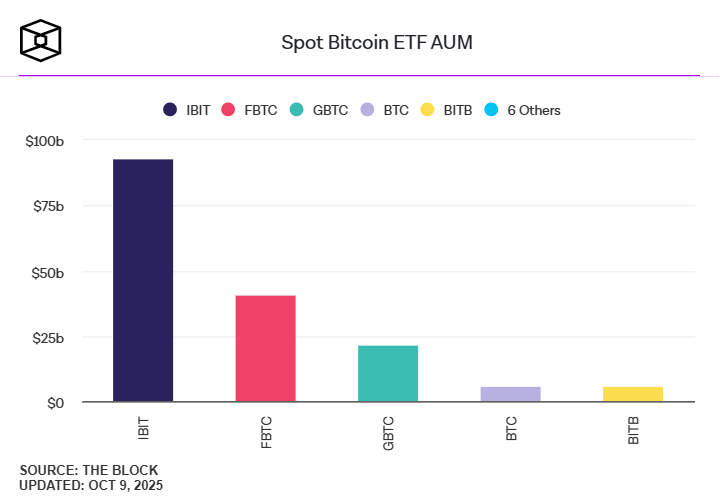

According to the latest disclosures, BlackRock’s IBIT held approximately 802,257 BTC as of Wednesday, valued at around $97 billion. The ETF received $426.2 million (about 3,510 BTC) in net inflows on Tuesday alone, pushing it beyond the 800,000-BTC threshold. The holdings now represent 3.8% of Bitcoin’s fixed 21-million supply.

This achievement places BlackRock’s bitcoin fund well ahead of Michael Saylor’s MicroStrategy, which holds 640,031 BTC (roughly $78 billion), accounting for 3.1% of total supply. The rapid growth underscores how quickly regulated investment vehicles have come to dominate institutional Bitcoin exposure.

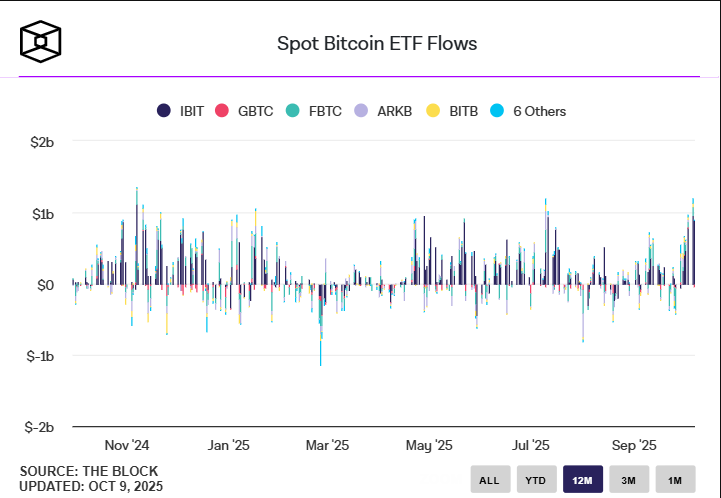

Across all U.S. spot Bitcoin ETFs, inflows totaled $440.7 million on Wednesday, contributing to an eight-day run exceeding $5.7 billion, according to data from The Block. Of that, IBIT alone has attracted more than $4.1 billion in net inflows over the past week.

Eight-Day Bitcoin ETF Inflow Streak Reinforces Institutional Bullishness

Timothy Misir, Head of Research at BRN, said the recent eight-day streak of ETF inflows highlights sustained structural demand for Bitcoin. He noted that growing corporate treasury participation is strengthening Bitcoin’s position as a strategic reserve asset. At the time of writing, Bitcoin is trading at around $122,500 following a 97% surge in the past year.

The eight-day streak of ETF inflows underscores persistent structural demand, while corporate treasury participation continues to expand, adding ballast to Bitcoin’s narrative as a strategic reserve asset.

Timothy MisirMisir added that easing geopolitical risks, following the Trump-brokered Middle East peace framework, has helped reduce short-term volatility, giving traders a clearer outlook heading into Q4.

BlackRock’s IBIT Leads ETF Inflows as BTC Funds Log $1.21B in a Single Day

On Monday, Bitcoin ETFs logged their largest daily inflow since Donald Trump’s pro-crypto election victory last November, pulling in $1.21 billion. Since their launch, U.S. spot Bitcoin ETFs have recorded nearly $63 billion in cumulative inflows—led by BlackRock’s IBIT with approximately $65 billion—though outflows from Grayscale’s converted fund have slightly offset the total.

Nate Geraci, President of NovaDius Wealth Management, noted that spot Bitcoin ETFs are experiencing unprecedented momentum, with $5.3 billion in inflows over the past seven trading days, including $2 billion in just the last two. In his view, the surge has surpassed early expectations, proving wrong initial skeptics who predicted the category WOULD peak at $5 billion.

In a Wednesday post, Bloomberg Senior ETF Analyst Eric Balchunas reported that IBIT led all ETFs in weekly inflows, capturing $3.5 billion—about 10% of total net flows across all ETF products. Balchunas added that even Grayscale’s GBTC recorded inflows during the week, reinforcing the strength of current market demand.

In another milestone, IBIT has also become the world’s largest Bitcoin options platform, holding $38 billion in open interest and surpassing Deribit, which was recently acquired by Coinbase.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.