Why the Next Fed Chairman Could Send Bitcoin to the Moon

The Federal Reserve's leadership shuffle might just be rocket fuel for Bitcoin.

Monetary Policy Whiplash

When new leadership takes the helm at the Fed, markets brace for turbulence. Bitcoin thrives on uncertainty—it's the ultimate hedge against central bank experimentation. The transition could expose dollar weaknesses that digital assets exploit perfectly.

Institutional Flight to Safety

Traditional finance hates uncertainty more than it hates volatility. A Fed regime change sends institutional money scrambling for non-correlated assets. Bitcoin's fixed supply looks mighty attractive when central bankers start playing musical chairs with monetary policy.

The Digital Gold Narrative Strengthens

Every Fed transition reminds investors why Satoshi created Bitcoin in the first place. No chairman can print more BTC—try that with your fiat currency. The harder central banks try to control the economy, the brighter Bitcoin's decentralized alternative shines.

Wall Street might need another bailout, but Bitcoin's just getting started.

Read us on Google News

Read us on Google News

In brief

- A dovish Fed chair could weaken the dollar and strongly boost bitcoin.

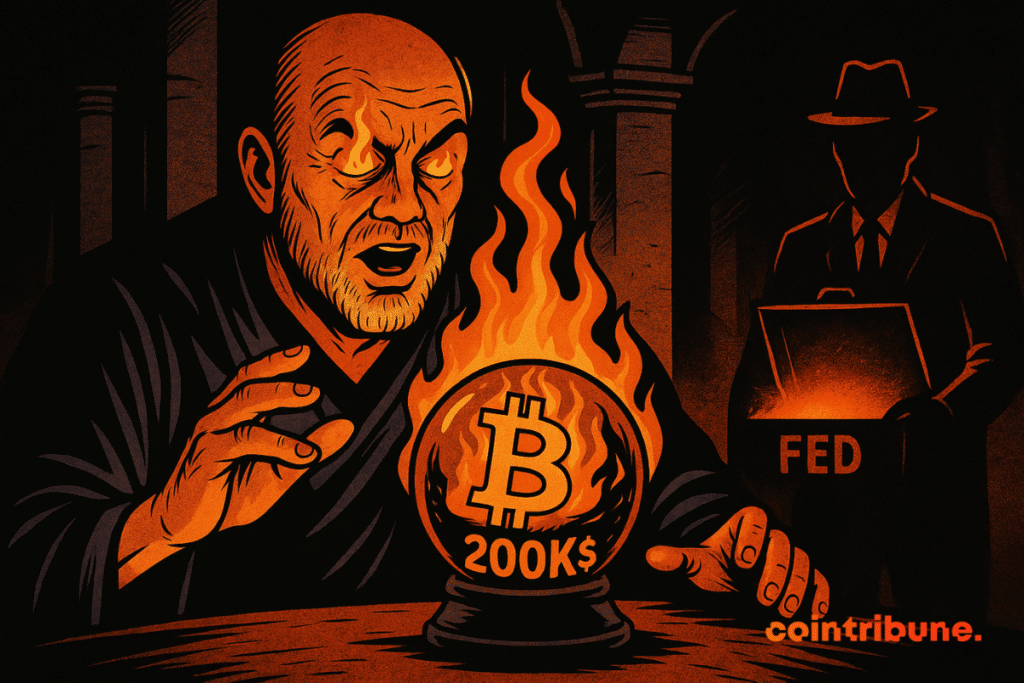

- Mike Novogratz sees BTC at $200,000 if markets perceive a too soft Fed.

- He combines faith in crypto and protection via puts on the Nasdaq as hedging.

- Bitcoin could become the backbone of a tokenized system mixing stocks, stablecoins, and credits.

A dovish Fed chair: the ultimate catalyst for Bitcoin

Changing the Fed governor to a “dove” profile would be one of the most feared and hoped-for scenarios in the crypto ecosystem. Mike Novogratz calls this the “potential biggest bullish catalyst” for bitcoin and the rest of crypto. In this view, the Fed would cut rates even when the economy showed signs of strength, weakening the dollar and making alternative assets like BTC even more attractive.

This is not pure fantasy: Novogratz even mentions the possibility that bitcoin’s price could reach $200,000.

But this trajectory has a cost: Novogratz notes that dollar weakening caused by an overly accommodative Fed could weaken the U.S. economic position. The status quo, where the Fed refuses to buckle under political pressure, has preserved institutional credibility. But the alternative could trigger an explosion in demand for BTC.

This bet of narrative against the economy highlights how much the marketplace of ideas and emotions matters in crypto cycles.

Macro, hedging and cycles: Novogratz plays the market tightrope

One of the paradoxes Novogratz embodies is strongly believing in the crypto cycle while adopting a cautious stance. He says: “I’m optimistic and I’m scared.” Midway between technological faith and strategic caution, he does not hesitate to buy puts on the Nasdaq to hedge against a quantitative reversal.

This ambivalence overturns the idea of a simple bullish frenzy: BTC is no longer an all-out bet but a component of a structured portfolio where risk management counts as much as conviction. He anticipates a more mature cycle, less subject to irrational spikes, where crypto becomes an asset, not a pure casino game.

From this perspective, the old 4-year crypto cycle model loses its strength. For Mike Novogratz, institutional catalysts, tokenization, regulation, all change the market’s architecture. It’s not just spectacular parabolas but foundations to build.

The challenge is to follow this shift without losing sight of macro trends. BTC then becomes as much an ideological bet as a macro bet.

Beyond the hype: building Bitcoin as the backbone of the system

The third dimension of the narrative is construction, not euphoria. Novogratz imagines a future where everything is tokenized: stocks, credits, private funds, and where the simple “wallet” combines bank deposits, stablecoins, securities, and crypto. He wants to shift finance from accounts to wallets.

In this world, bitcoin stops being just a speculative asset and becomes an essential building block of this arrangement. It is no longer about “betting on BTC” but integrating it as a structural store of value. We enter the builders’ phase: less warrior promises, more resilient infrastructures.

Here are some key figures/facts to understand this shift:

- $9 billion: amount of bitcoin sold by Novogratz for a client, showing how large flows can influence the market;

- Several billions in capitalization expected if the BTC price reaches $200,000;

- Solana and Hyperliquid are positioned as pillars of future infrastructure (he often mentions Solana);

- The narrative currently dominates 90% of crypto valuations, according to him;

- He projects a multiplication of tokenized asset classes (stocks, credit, “per exchanges”, etc.).

It is in this scenario that bitcoin could become less a “meme-money” and more the backbone of the modular decentralized financial system.

Changing the Fed chair is not an easy checkmate move: Jerome Powell will not be ousted just to please, even Trump. The chairman is already facing difficulties: his candidate to the CFTC was stopped by a simple SMS from the Winklevoss brothers, proving that even in easy appointments, obstacles can arise.

Maximize your Cointribune experience with our "Read to Earn" program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.