Ethereum Holds Firm at $4,500 - Can Bulls Smash Through $4,774 Resistance?

Ethereum defies gravity at $4,500 as bulls gather momentum for the next major breakout.

The Battle for $4,774

Traders watch the $4,774 level like hawks—this isn't just another resistance point. It's the gateway to new all-time highs and potentially the next leg of this historic bull run. Breaking this barrier could trigger a cascade of institutional FOMO that would make traditional finance veterans blush at their own hesitation.

Market Sentiment Turns Greedy

Whales accumulate while retail traders finally wake up to Ethereum's fundamental strength—deFi ecosystems booming, NFT volumes exploding, and institutional adoption accelerating. Meanwhile, traditional bankers still debate whether crypto is 'a real asset class' as they miss yet another generational wealth transfer.

Either ETH shatters $4,774 and charts a course for $5,000+, or we see a healthy pullback to consolidate gains. One thing's certain—volatility is back on the menu.

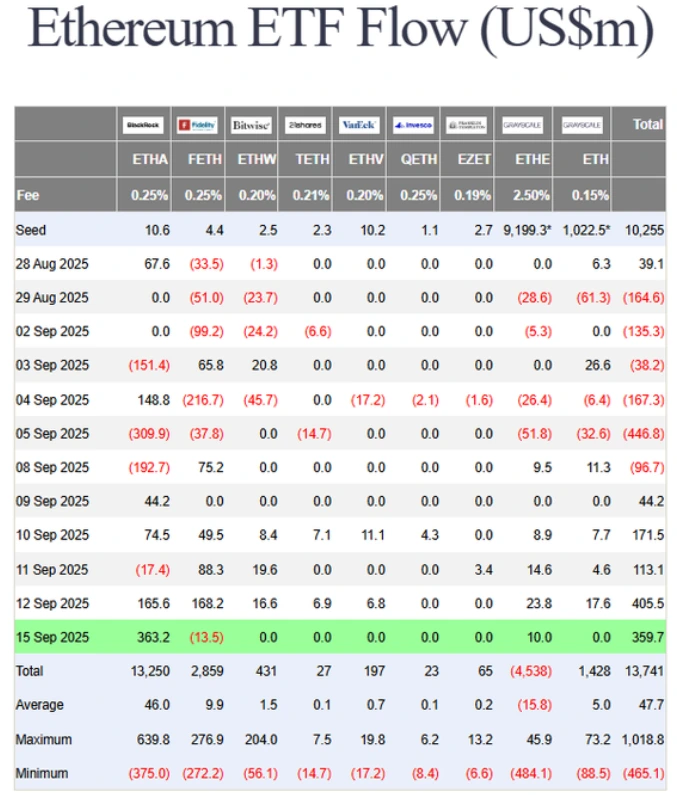

Markets are often full of contrasts. On one hand, retail traders anxiously refresh their charts, waiting for the ethereum price to dip a little further. On the other hand, BlackRock, the world’s largest asset manager, just poured $363 million into its Ethereum ETF. This divergence between cautious retail sentiment and confident institutional buying paints a fascinating picture of where the ETH price might be headed next.

At the time of writing, ETH trades at $4,507.71, down 0.49% in the last 24 hours, but still up 3.33% over the past week. With a market cap of $544.17 billion and 24-hour trading volume of $31.18 billion, ethereum continues to sit firmly at the heart of the crypto ecosystem.

Institutional Flows and Treasury Holdings

ETF flows add another layer of insight. Despite choppy activity earlier in September, BlackRock’s $363 million inflow on September 15th stands out as a vote of confidence from institutions. Meanwhile, Grayscale products continued to bleed, showing that investors prefer lower-fee alternatives. This dynamic could favor long-term ETH price stability.

Adding to the bullish case, BitMine Immersion revealed $10.8 billion in crypto and cash reserves, positioning itself as the largest ETH treasury holder worldwide. Such treasury accumulation signals that corporates and institutions increasingly view ETH as a strategic reserve asset.

Overall, Ethereum seems to be in a waiting game: institutional inflows and treasury holdings are building a strong foundation, but retail sentiment remains cautious. If ETH holds above $4,155 and breaks past $4,577, momentum could accelerate.

Ethereum Price Analysis

Ethereum’s price chart shows consolidation after a failed attempt to sustain above the $4,577 resistance zone. The next major resistance for the Ethereum price lies at $4,774, which also aligns with the upper Bollinger Band. A clean breakout above this level could push ETH closer to its all-time high of $4,953.73.

Contrarily, immediate support rests at $4,155, with a stronger cushion at $3,967. The RSI at 44 suggests ETH is currently neutral, leaving room for either a rebound or further correction.

FAQs

What is the Ethereum price today?The price of 1 ETH at the time of press is at $4507.71 with an intraday change of -0.41%.

Is Ethereum close to its all-time high?Yes, at $4,507, ETH is less than 10% away from its ATH of $4,953.73.

What levels should traders watch?Support is seen at $4,155 and $3,967, while resistance stands at $4,577 and $4,774