BREAKING: Nasdaq-Listed Bitmine Drops $201M on ETH—Ethereum Soars to $4,400 Today

Institutional money floods Ethereum as publicly-traded firms bet big on crypto's blue-chip asset.

Massive Whale Move Shakes Markets

Bitmine just deployed a staggering $201 million into Ethereum—pushing ETH prices to a blistering $4,400. This isn't some crypto fund playing with pocket change; it's a Nasdaq-listed company making a definitive statement about where smart money flows.

Mainstream Adoption Accelerates

Forget the cautious dips—Bitmine went all-in, signaling that corporations now view Ethereum as a core treasury asset. Traditional finance jaws drop as crypto-native strategies outperform their legacy portfolios yet again.

Market Momentum Builds

This purchase fuels Ethereum's relentless climb toward new all-time highs. While Wall Street still debates 'digital gold,' forward-thinking firms stack ETH—because yield beats outdated theories every time.

Institutional validation meets decentralized power—while traditional banks still try to figure out their blockchain strategies.

Ethereum is getting more powerful backers day by day. Nasdaq-listed Bitmine Immersion Technologies announced a massive addition to its corporate treasury, 446,255 ETH worth around $201 million. It was a bold MOVE that cemented Bitmine’s place as the single largest corporate holder of Ethereum.

Following the purchase news, the ETH token price jumped nearly 3% in a day, trading above $4410.

Bitmine Acquired 446,255 ETH To Its Treasury

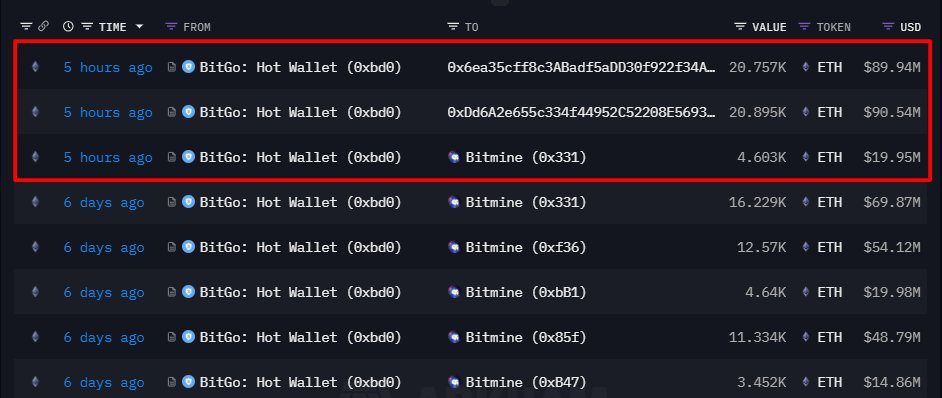

According to data from Onchain Lens, Bitmine acquired 446,255 ETH worth $201 million to its corporate treasury. Meanwhile, the purchase was completed on September 10 through custodian BitGo, pushing the company to the top spot as the largest corporate holder of ethereum globally.

This isn’t just a routine buy. It’s a carefully calculated step led by Chairman Thomas Lee, whose vision is clearly to position Bitmine at the center of Ethereum’s long-term growth story.

And judging by the size of the purchase, the company isn’t just dipping its toes, it’s diving headfirst.

Bitmining Goal to Own 5% of ETH Supply

With this latest buy, Bitmine now controls 2,126,018 ETH, valued at nearly $9.3 billion. To put it into perspective, the company is on track to own around 5% of Ethereum’s total supply. That’s no small ambition.

It echoes the kind of dominance MicroStrategy built in Bitcoin, but this time, it’s all about ETH.

Such heavy accumulation could also have broader market implications. By locking away large chunks of Ethereum, Bitmine is effectively reducing the circulating supply. Less liquidity in the market often translates into stronger upward price pressure, especially at a time when institutional interest in Ethereum is already heating up.

Ethereum Price Outlook

Ethereum’s recent accumulation trend has created strong price support. The token is now trading NEAR $4,412, up an impressive 90% over the past year.

Just days ago, ETH broke above the upper boundary of a descending triangle and briefly touched $4,480 before facing a mild rejection. If Ethereum manages to stay above this breakout zone, it could test resistance again, with a potential rally toward $4,800.

However, the downside risks remain. A drop below the 50-day Simple Moving Average (SMA), along with the $4,000–$4,200 support zone, could push ETH back toward $3,800.