🚀 Ethereum Soars 5% as $2B Shorts Sweat—Is This the Start of ETH’s Next Leg Up?

Ethereum just punched through resistance with a 5% surge—leaving $2 billion in short positions dangling by a thread. Traders are scrambling as ETH flexes its muscles, but can the rally hold?

The squeeze is on

Liquidations loom for over-leveraged bears as ETH's momentum builds. Market makers whisper about gamma traps while retail FOMO creeps in—classic ingredients for a melt-up.

What's fueling the fire?

Spot ETF flows? Layer-2 adoption? Or just good old-fashioned greed outpacing fear? (Wall Street analysts are, as always, 'monitoring the situation' from their Hamptons rentals.)

One thing's clear: Ethereum's proving it's more than just 'gas fee theater.' The network's actually being used—even if half those transactions are NFT degens flipping monkey JPEGs at a loss.

Next targets? Watch the $3,500 zone. Break that, and we're in price-discovery mode. Reject there? Enjoy your leveraged long funeral.

Ethereum price continues its bullish momentum with another 5% jump, pushing the price to new short-term highs and putting approximately $2 billion in short positions at risk of liquidation. Market Optimism is fueled by rising institutional interest, increased network activity, and growing anticipation around Ethereum’s upcoming upgrades. Traders are closely watching key resistance levels, while retail and institutional participants alike assess the potential for further upside. The question for traders now: how far can ETH surge before facing its next major correction?

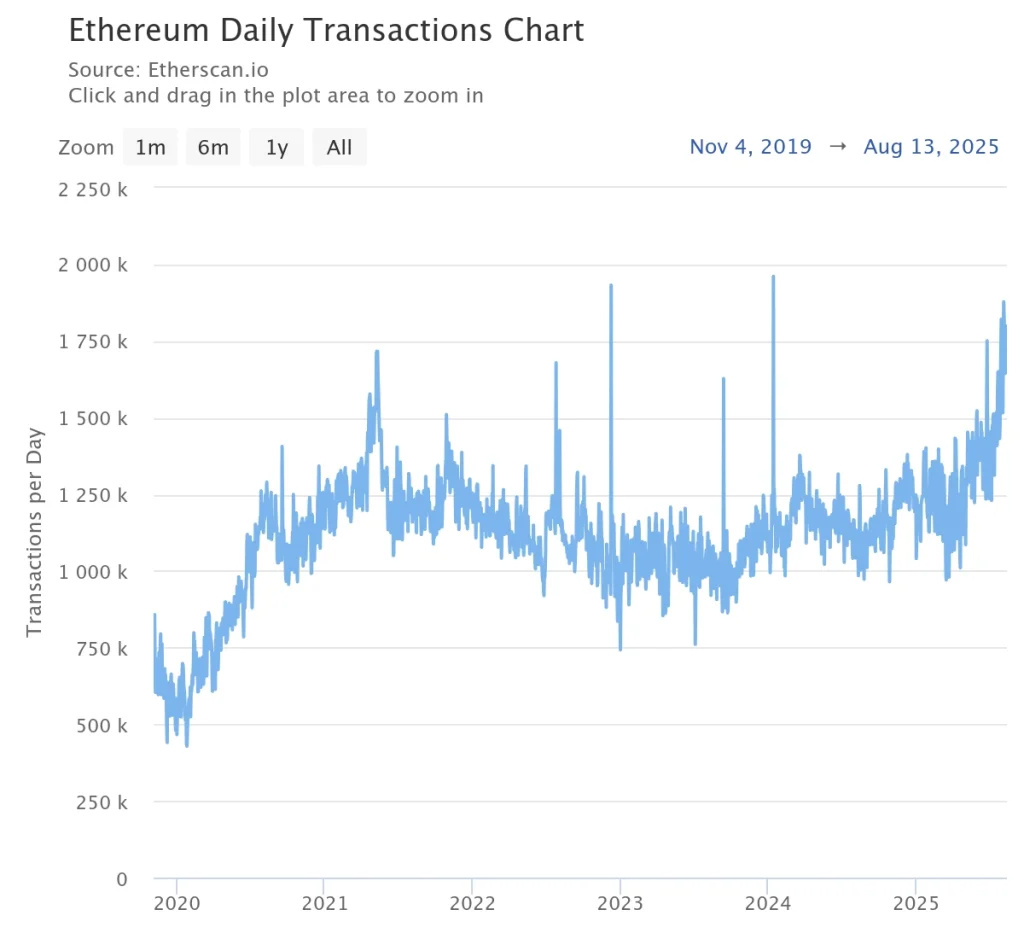

Ethereum Transactions Are Going Parabolic

Ethereum’s recent surge isn’t happening in isolation—several key market factors are driving investor optimism and fueling the rally. From institutional accumulation to rising network activity and upcoming protocol upgrades, these forces are shaping ETH’s short-term price action and setting the stage for potential further gains.

Ethereum’s daily transaction activity has shown a strong upward trajectory, reaching levels not seen since 2021. The recent spike in transactions indicates growing network usage and heightened market participation, reflecting increased retail and institutional engagement. Higher on-chain activity often correlates with bullish sentiment, as it signals strong demand for ETH across DeFi, NFTs, and smart contract applications. This surge in activity is likely contributing to the recent price rally, supporting Ethereum’s upward momentum and short-term bullish outlook.

Will Ethereum Price Reach $5000 This Week?

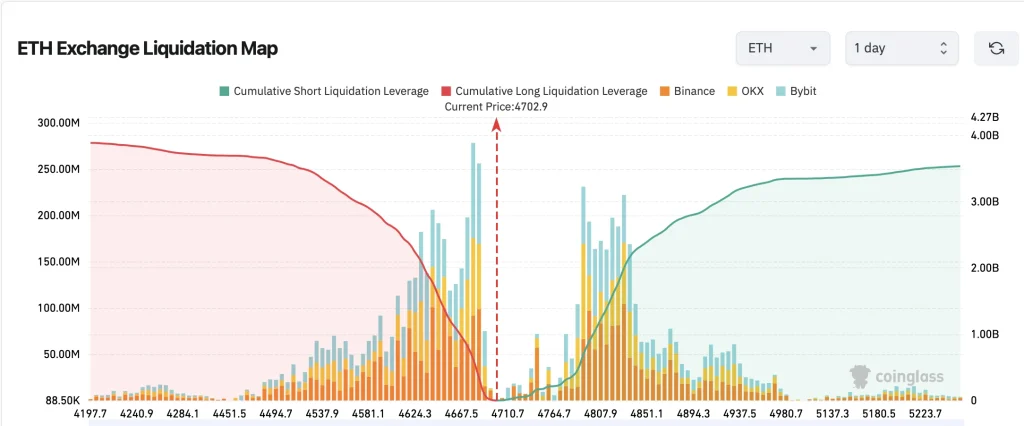

Ethereum’s latest exchange liquidation map reveals critical leverage pressure points as the price hovers NEAR $4,702. The data highlights clusters of both long and short liquidation levels across major exchanges like Binance, OKX, and Bybit. With substantial short liquidations above current levels and notable long liquidations below, the market is at a pivotal juncture. Traders are closely watching for potential liquidity sweeps that could trigger sharp volatility in either direction, depending on which side’s stops get hunted first.

The map shows heavy cumulative short liquidation leverage building above $4,710, meaning a breakout could trigger rapid short covering toward higher price zones. The map shows a significant short liquidation cluster near $4,870 — Ethereum’s all-time high—where over $2 billion in shorts are positioned. A breakout to this level could unleash a massive short squeeze, rapidly pushing ETH into price discovery. Based on Fibonacci extensions from the previous ATH-to-low cycle:

- 1.272 extension → ~$5,250

- 1.414 extension → ~$5,480

- 1.618 extension → ~$5,800

Price Target: A realistic initial target after liquidation for the ethereum (ETH) price rally is $5,250–$5,300, with momentum potentially stretching to $5,800 if FOMO buying accelerates.