ETHFI Shatters Resistance – Is $1.54 the Next Stop?

ETHFI just bulldozed through a critical price barrier—traders are now eyeing $1.54 as the next battleground.

The breakout play:

After weeks of consolidation, ETHFI's surge past resistance signals bullish momentum. No fancy indicators needed—price action tells the story.

Targets in sight:

The $1.54 level looms as liquidity pools get reshuffled. Watch for either a swift rejection or a grind higher as latecomers FOMO in (as they do).

Reality check:

While the charts look promising, remember this is crypto—where 'technical analysis' often just means 'educated guessing'. One whale dump could send this thesis back to the drawing board.

Ether.fi is gaining traction after a strong 7-day rally, fueled by whale buying and Ethereum’s broader ecosystem growth. The ETHFI price ROSE 6.23% in the past 24 hours to $1.29, with its market cap chugging up to $544.91 million. Trading volume surged 23.54% to $268.88 million, showing rising retail participation alongside institutional activity. Curious about the next big pitstop? Read this analysis for all details.

Why ETHFI Price Is Going Up?

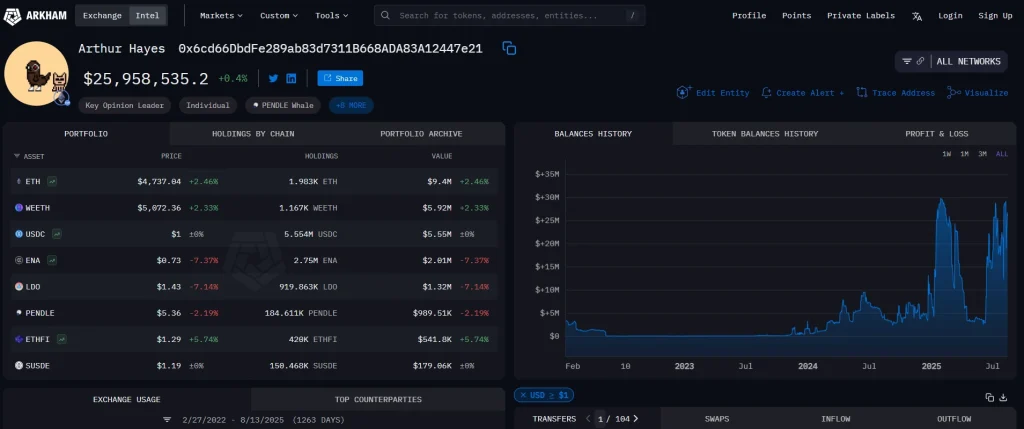

On August 11, BitMEX co-founder Arthur Hayes acquired 420,000 ETHFI worth about $517,000 as part of an $8.4 million DeFi buying spree. Which also included LDO and PENDLE. Such high-profile purchases often trigger copycat trades. With on-chain data showing whales now control around 42% of ETHFI’s supply. This accumulation, while bullish in the short term, raises centralization concerns if profit-taking occurs NEAR resistance levels.

Ethereum’s price rally to $4,300 is driving capital into liquid restaking protocols. ETHFI’s TVL has rebounded to $6.7 billion, with revenue up 58% month-over-month. A new partnership with Superstate to use weETH as collateral for yield funds reinforces ETHFI’s utility in RWA strategies. That being said, sustained ethereum strength above $4,200 remains critical for ETHFI’s staking demand.

ETHFI Price Analysis

ETHFI price broke above its 7-day SMA at $1.21 and the Fibonacci 23.6% retracement level at $1.29, signaling a trend shift. The RSI-14 reading at 64 is neutral-bullish, while the MACD histogram turning positive suggests strong momentum.

Traders are eyeing $1.54, the 127.2% Fibonacci extension, as the next upside target. However, the 24-hour pivot point at $1.31 could act as immediate resistance. If ETHFI fails to hold above $1.25, profit-taking could drag prices toward $1.09 support. Conversely, a clean breakout above $1.30 may accelerate gains toward the $1.50–$1.60 zone.

FAQs

1. Why is ETHFI price rising?Whale accumulation led by Arthur Hayes and Ethereum’s broader rally have boosted demand.

2. What is ETHFI’s short-term price target?If momentum holds, traders are watching $1.50–$1.60, with $1.54 as a key Fibonacci level.

3. What are the risks for ETHFI now?Failure to hold $1.25 or whale profit-taking near $1.54 could trigger a pullback.