🚀 Bitcoin Shatters Records: Soars Past $124,457 ATH – $125K Next Stop Today?

Bitcoin just bulldozed through another milestone—$124,457—and the market's screaming: 'What's next?'

### The FOMO Engine Is Running Hot

Traders are piling in like it's a Black Friday sale on digital gold. Liquidity? Thin. Sentiment? Greedy. The $125K psychological barrier? Suddenly looking flimsy.

### Wall Street's Late to the Party (Again)

While institutional analysts dust off their 'Bitcoin 101' notes, retail traders are already front-running the next leg up. Cue the inevitable 'correction' warnings from suits who missed the boat.

### The Cynic's Corner

Let’s be real—if Bitcoin actually *does* tap $125K today, CNBC will still find some economist to call it a 'bubble.' Meanwhile, the rest of us will be busy counting satoshis.

The Bitcoin price has surged to a fresh ATH of $124,457 today, fueled by a surge in spot Bitcoin ETF inflows, heightened whale accumulation, and a notable rise in on-chain activity. Trading volume across major exchanges has spiked, reflecting growing investor confidence and renewed institutional interest. Active Bitcoin addresses have also hit multi-month highs, signaling increased network participation. The bullish momentum is further supported by robust liquidity and expanding market capitalization, pushing Bitcoin’s dominance higher. With market sentiment firmly optimistic and adoption trends accelerating, traders are eyeing the $125,000 milestone as the next key target for the world’s leading crypto.

Bitcoin Price Action Today: Testing the Next Milestone

Following its surge to ATH at $124,457, Bitcoin is trading within a narrow but volatile range as bulls push to secure a daily close above $124,000. The upward move has been accompanied by a sharp increase in global BTC trading volumes, indicating strong buyer interest at current levels.

Over the past 24 hours, liquidity has concentrated NEAR key resistance zones, with market depth improving across major exchanges. This steady demand, coupled with favorable macro sentiment, has kept selling pressure limited. Keeping the path to $125,000 within reach if momentum holds through the U.S. trading session today.

Institutional Inflows and Spot Bitcoin ETF Momentum

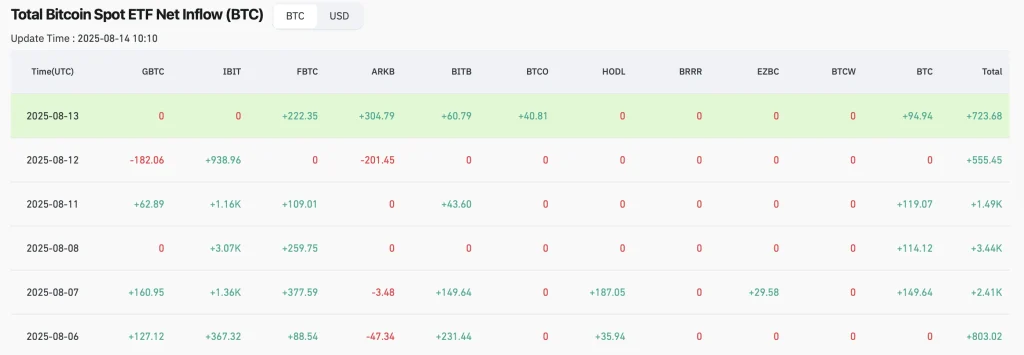

A major driver of today’s rally has been the robust inflows into spot bitcoin ETFs, with institutions like BlackRock’s iShares Bitcoin Trust (IBIT) and Fidelity’s Wise Origin Bitcoin Fund leading the charge. In just the past 48 hours, ETF products have collectively added thousands of BTC to their holdings. This has pushed total institutional reserves to new record levels.

This accumulation underscores growing confidence among asset managers, as Bitcoin’s status as a digital store of value gains further legitimacy. The strong demand from ETFs has also tightened available supply, amplifying price momentum and setting the stage for a potential breakout above $125,000 today.

On-Chain Data Signals Strong Whale Accumulation

Bitcoin’s latest rally is backed by compelling on-chain metrics, highlighting significant whale wallet activity. Over the past 24 hours, addresses holding over 1,000 BTC have added substantial positions, signaling long-term conviction. Data shows a rise in large transaction volumes, with several transfers exceeding $100 million in value recorded on the blockchain today.

Active Bitcoin addresses have also reached their highest point in three months, reflecting a surge in network participation. This combination of whale accumulation, increased transaction sizes, and heightened network usage indicates that the current uptrend is not purely speculative but supported by strong capital inflows from high-value investors.

Market Sentiment and Global Adoption Trends

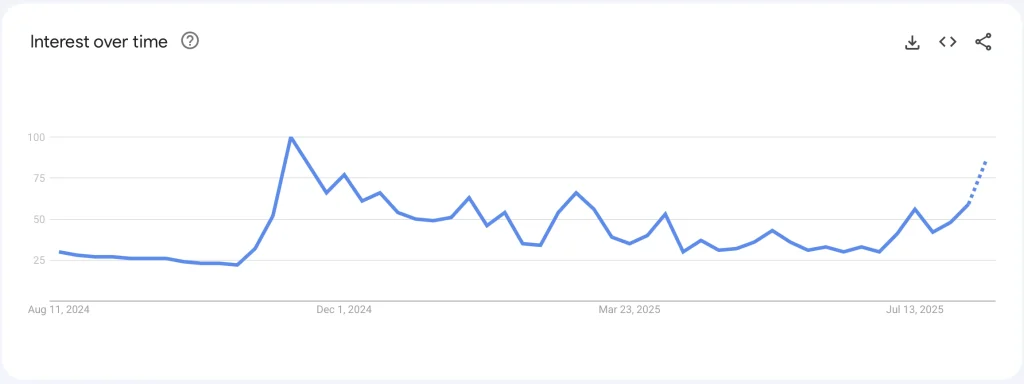

Market sentiment around Bitcoin remains overwhelmingly bullish today, with social media buzz and Google search interest for “Bitcoin price” and “BTC ATH” spiking sharply. Crypto Fear & Greed Index readings remain deep in the “Extreme Greed” zone, reflecting strong investor appetite.

On the adoption front, major developments are reinforcing long-term confidence—a leading global payment processor announced expanded BTC payment support, while reports suggest multiple publicly listed companies are considering adding Bitcoin to their balance sheets. Combined with growing ETF participation, these adoption milestones are enhancing Bitcoin’s legitimacy and fueling Optimism for a sustained rally beyond the $125,000 mark.

Conclusion: Eyes on $125K and Beyond

Bitcoin’s surge to $124,457 today reflects a perfect storm of bullish catalysts—from surging spot ETF inflows and whale accumulation to rising network activity and adoption milestones. If current momentum holds, a clean breakout above $125,000 could open the door to the next psychological targets at $127,500 and $130,000 in the near term.