Bitcoin at Make-or-Break Level: Will $130K Be the Next Stop?

Bitcoin teeters on the edge—again. After weeks of sideways action, the king of crypto is testing a critical support level that could dictate its next major move. Bulls whisper about a moonshot to $130K; bears snort into their overpriced lattes, muttering about 'macro headwinds.' Who's right?

The Setup: A Do-or-Die Moment

No fancy indicators needed here. Price either holds this zone and rallies—or cracks like a Lehman Brothers risk model. Traders are glued to charts while institutional whales 'strategically accumulate' (read: manipulate) spot markets.

The $130K Dream

If support holds, the path to six figures looks clearer than a banker's bonus justification. But with volatility this high, even 'sure bets' can vaporize faster than a DeFi rug pull. Bonus cynicism: Wall Street still can't decide if crypto is 'digital gold' or 'a speculative asset'—depends which narrative juices their quarterly earnings.

Buckle up. This won't be boring.

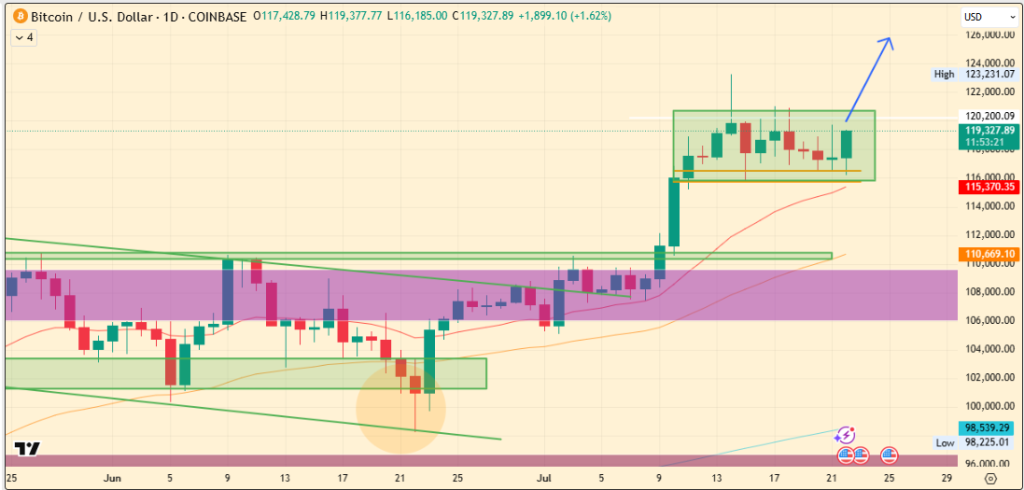

After surging to a new all-time high of $123,231 on July 14th, the Bitcoin price has started to cool down due to exhaustion in strength.

As of writing, it is consolidating around the $116,000 to $120,000 range, which has turned down to a zone that has become a battleground for short-term sentiment.

Meanwhile, when writing, the bulls in intraday have pushed BTC 1.34% to trade at $119,018 with $74.46 billion 24-hour volume and $2.37 trillion market cap.

Now, traders and analysts are intrigued by BTC’s next MOVE and are watching closely to find out whether this is a healthy retest or the beginning of a deeper correction.

Rising Exchange Reserves Hint at Selling Pressure

A primary concern right now is the increase in bitcoin exchange reserves, which have risen to their highest point since late June.

Per CryptoQuant insights, this uptick often signals that traders are moving coins onto exchanges to sell. This signifies a short-term profit-taking phase.

However, the data isn’t entirely bearish. Despite growing reserves, overall inflows remain low when compared to peak periods earlier in the year.

This implies that although some selling is occurring, it hasn’t reached levels that typically precede larger market downturns. This clearly suggests that retailers are offloading, and giants are absorbing it.

Institutional Flows and Long-Term Holders Stay Committed

At the same time, long-term on-chain signals remain constructive with the ETF data mostly green in July, with a cumulative total net inflow of $54.62 billion.

Meanwhile, Michael Saylor keeps on accumulating, and other firms are also buying it.

These steady inflows highlight sustained interest from large capital allocators, even as retail traders are realizing their gains.

Analyst Finds $116K–$116.4K Zone As Crucial

Technically, the bitcoin price has been mostly trading in a range near $116K to $120K range in the past couple of days, where $116K to $116.4 is seen as critical immediate support, identified by a CryptoQuant analyst.

Also, the recent intraday rise in BTC was observed from the same level. If the momentum is building again and manages to flip range high of $120K, then in the short term $125 and $130K WOULD be the near-term targets.

But if consolidation in the current range continues, then immediate support needs to hold the momentum for the BTC price.

On the other hand, if BTC breaks below $116K with volume, it opens the door for a steeper retracement, potentially to $112K or even $110K. Analysts suggest that the bullish thesis remains valid as long as this $110K level isn’t breached.