Ethereum at a Crossroads: Will It Surge to $4,096 or Retreat to $3,525?

Ethereum's price teeters on a knife-edge—bulls eye a breakout past $4,096, while bears whisper about a pullback to $3,525. The smart money's watching the charts, but let's be real: in crypto, even the 'smart money' is just guessing with better PowerPoints.

Technical Tug-of-War

Key resistance at $4,096 isn't just a number—it's the line in the sand between FOMO and 'thanks, I'll wait for the dip.' Meanwhile, $3,525 lurks as the safety net for traders who think 'risk management' means selling before their UberEats arrives.

Volatility Is the Only Guarantee

Whether ETH punches through or pulls back, one thing's certain: the 20-something TA 'experts' on Crypto Twitter will claim they predicted it all along. Place your bets—just don't mortgage your dog for leverage this time.

Ethereum has seen an explosive price rally over the past week, gaining over 22% to touch a high near $3,856. However, the recent 24-hour dip of 4.18% has raised questions about short-term momentum. While there are jitters, spurred by regulatory uncertainty and ETF outflows, Ethereum’s fundamentals and onchain data suggest this could be a healthy cooldown rather than a trend reversal. Curious about ETH’s next milestone? Read this short-term ETH price analysis for targets.

Strategic Holding Amid Sell Pressure

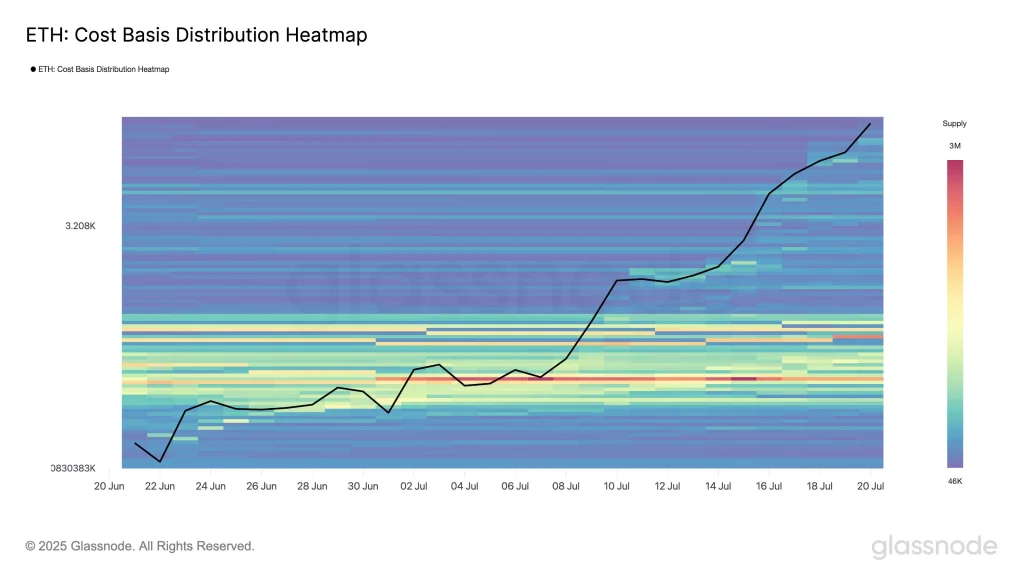

According to Glassnode’s Cost Basis Distribution Heatmap, a large cohort of ETH investors who accumulated around the $2,520 level have begun booking profits. This is evidenced by the fading red bands from early July. Despite this, nearly 2 million ETH from this group remains unmoved. The platform reveals three critical insights:

This distribution behavior underlines a maturing investor base using rallies to rebalance, while also trusting ETH’s medium-term outlook.

Ethereum Price Analysis

Ethereum price is currently changing hands at $3,635, with a -4.18% pullback in the last 24 hours. The RSI has dipped from the overbought zone of 70 to 51, indicating waning momentum. The price has also broken below the 20-period EMA on the 4-hour chart, a sign of short-term bearish pressure.

Key support is seen at $3,550, a potential bounce zone. A failure here may expose ETH to further downside toward the $3,525 level. On the upside, the ethereum price needs to reclaim the resistance at $3,870 for any hopes of retesting the $4,096 mark.

FAQs

Why is Ethereum price down today?Bitcoin ETF outflows, profit-taking after a sharp ETH rally, and regulatory uncertainty have led to the ETH price going down today.

Is Ethereum still bullish in the medium term?Yes, onchain data shows large holders retaining positions, suggesting confidence in long-term upside despite near-term corrections.

Where is the ETH price heading next?While the support for ETH is at $3,550 and $3,525, the resistance is at $3,870 and the critical breakout level is at $4,096.