The Graph (GRT) & Arkham (ARKM): The Analytics Tokens Outperforming the Market in 2025

Blockchain's data detectives are having a moment—and these two tokens are leading the charge.

Why Analytics Tokens Are the New Oil

Forget crude—the real black gold is now on-chain data. The Graph (GRT) and Arkham (ARKM) are turning raw blockchain transactions into actionable intelligence, and traders are paying attention.

The Graph: Web3's Google

GRT keeps dominating as the go-to indexing protocol. Its decentralized query network processes more API calls than some small countries have people—without the middlemen taking their usual pound of flesh.

Arkham: Chainalysis for Degens

ARKM's Intel Exchange lets users buy/sell crypto intel like a dark pool for blockchain sleuths. Because nothing says 'decentralization' like paying anonymous sources for wallet leaks (with 30% going to the house, naturally).

The Bottom Line

While VCs pour millions into 'AI-powered analytics,' these tokens actually deliver—proving once again that in crypto, the real money isn't in the tech, but in selling the shovels.

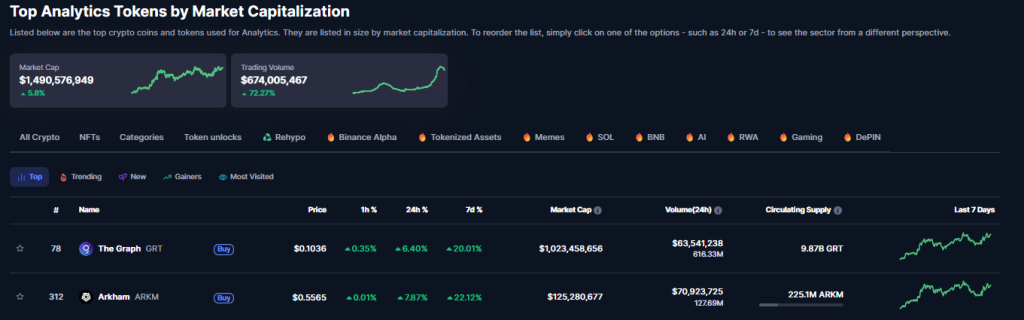

The financial crypto realm isn’t limited to speculative tokens, in fact, extends far beyond that, to power critical infrastructure. Among these are analytics tokens, which hold a market cap of $1.49 billion and saw a 5.8% intraday rise. It includes tokens like Arkham (ARKM) and The Graph (GRT), which are carving out an underrated but extremely essential niche by enabling on-chain data analysis and accessibility.

Their performance and utility are becoming increasingly vital as the crypto ecosystem matures and demands more sophisticated insights.

The Graph (GRT): The Decentralized Data Indexer

The Graph (GRT) is a project that is very essential for dApps to query information efficiently, This analytics token mostly used by developers and data consumers who pay to query data.

Recently, a report from Messari showed that query volume shot upto 6.1 billion in Q1 2025, and the updated Q2 2025 query volume per its official website highlights that it has reached 11.0 billion, reflecting robust developer adoption.

Its token, GRT, incentivizes Indexers, Curators, and Delegators who secure and provide data to the network. Future predictions for GRT are directly linked proportional to the expansion of the Web3 ecosystem; as a result, the demand for the indexing services is expected to rise.

Technically, the GRT price has not displayed much growth yet but in July 2025, the GRT token has jumped from an important support near $0.08 to $0.103, if the GRT token can break the $0.133 resistance in July it might retest $0.20 supply level in before July ends, and under extreme bullish conditions the GRT could even close the year by hitting $0.330.

Similarly, the MACD showed a bullish cross with the histogram rising at 0.0023, the AO histogram ROSE to 0.0129, the CMF is also increasing to 0.13 from a 30-day low of -0.19, and the RSI is at 66.42, meaning a rise in the short term is imminent. But, if the breakout does not occur in GRT price, the $0.08 support will be revisited.

Arkham (ARKM): On-Chain Intelligence Pioneer

Arkham (ARKM) has rapidly gained prominence for its focus on on-chain intelligence, allowing users to de-anonymize blockchain data and track significant entities like whales, institutions, and hackers.

Its utility token, ARKM, is central to its “Intel-to-Earn” marketplace, where users can buy and sell on-chain data and analysis. Future predictions for ARKM are heavily tied to the increasing demand for transparency and actionable intelligence in the crypto space, especially as regulatory scrutiny and market sophistication grow.

Its unique value proposition in revealing “who owns what” on the blockchain positions it for potential growth as this demand intensifies.

Technically, on the daily chart, it has been consolidating in a range in the first half of 2025 after declining from a high of $2.86 and falling to $0.365. But, in July, with major bullish sentiment increasing, the ARKM price showed Optimism as it made higher lows from the Bollinger bands’ lower band to the upper band in the past 30 days with more than 45% gains.

The MACD, AO, RSI, and CMF are all showing bullish strength, where CMF is at 0.08, histograms rising at 0.074 in AO and MACD at 0.012. Also, the RSI has spiked to 60, and shows that bullishness has enough space to rise, and the Bollinger bands are expanding upwards.

In July, if ARKM price spikes, then by July end it could hit $0.80 or $1.231, and could hit $2.70 before the year ends.