SOL Price at a Crossroads: Overbought or Primed for Breakout? Expert Takes

Solana's SOL is flashing conflicting signals—technical indicators scream overbought, while momentum traders eye a potential breakout. Here's what the charts (and the skeptics) won't tell you.

The Bull Case: When FOMO Overrides Fundamentals

Network upgrades and meme coin mania pushed SOL past key resistance levels. Analysts whisper 'new ATH incoming'—if it holds above $150.

The Bear Trap: Liquidity Hunters Lurk

RSI hovering near 80? That's hedge fund territory. Watch for 'sell-the-news' action post-Rally—because nothing makes bankers happier than retail buying the top.

One thing's certain: SOL's volatility cuts both ways. Trade accordingly—or just enjoy the circus from the sidelines.

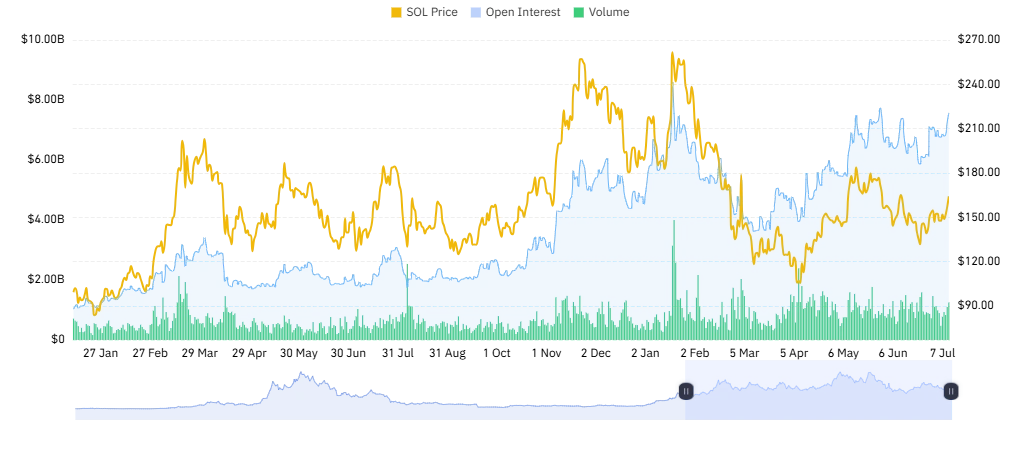

Solana (SOL) price rallied 3 percent in the past 24 hours to trade at about $164 on Friday, July 11, during the mid-North American session. The large-cap altcoin, with a fully diluted valuation of about $99 billion, recorded a 62 percent surge in its daily average traded volume to hover around $7.9 billion at the time of this writing.

As a result of the heightened volatility, more than $23 million was liquidated from Solana’s Leveraged market, with short traders involving $16.7 million. Meanwhile, Solana’s Open Interest (OI) has surged in tandem with its volume to around $7.5 billion and $16 billion respectively, according to market data analysis provided by Coinglass.

Solana Network Records High Supply vs Demand Shock

The solana network has recorded a significant increase in its on-chain activity, fueled by rising demand from retail traders, whale investors, and corporations. It is safe to say that Solana’s bullish sentiment is largely bolstered by the supply vs. demand shock fueled by the rising adoption from institutional investors.

Earlier on Friday, Upexi Inc. (NASDAQ: UPXI) announced that it had raised $200 million through private placement of common stock and convertible notes to purchase more Solana for its treasury. According to Allan Marshall, the company’s CEO, Upexi expects to hold 1.65 million SOL coins, worth $273 million by July 16.

Upexi joins a growing list of companies that have adopted Solana for treasury management including SOL Strategies.

Midterm Expectations for SOL Price

SOL price has gradually gained bullish momentum in the daily and weekly timeframe, especially after the Bitcoin price surged above $119k for the first time in history. According to crypto analyst Ali Martinez, the SOL price is aiming for $180 in the coming days after breaking out of a resistance level around $158 in the last 48 hours.