Whale Watch 2025: Are Bitcoin’s Big Players Dumping BTC for Altcoin Gold?

Whales are making waves—again. This time, the crypto elite might be shifting their billions from Bitcoin to altcoin plays. Here's why the smart money's rotating.

Signs point to capital flight from BTC as Ethereum, Solana, and even meme coins see unusual whale-sized inflows. On-chain data shows telltale wallet movements while exchanges report atypical altcoin accumulation.

The rotation game is risky. While some alts offer 10x potential, liquidity craters faster than a Terra stablecoin when whales exit. Remember: what pumps on whale money can dump twice as hard.

One hedge fund manager quipped, 'It's musical chairs—except the whales brought their own chairs and will yank them away mid-game.' Classic finance, just with more volatility and less regulation.

The crypto market today has taken a bullish turn, with total market capitalization climbing to $3.47 trillion and Bitcoin surging to a new all-time high. Altcoins, too, are not behind, as they are showing renewed strength, boosted by a 46.62% spike in daily trading volume. Yet, in the midst of all this green, one question remains in investor minds:

The question remains valid and vital, as Whale activity often signals where the next big rally or correction is headed. That being said, with the Fear & Greed Index at a neutral 58 and BTC dominance at a healthy 63.8%, signs suggest Bitcoin is still in charge. But beneath the surface, whale behavior tells a more nuanced story. Intrigued enough? I am sure you are. Join me as I give you a comprehensive overview of what Whales are buying now, is it Bitcoin or Altcoins?

What Does OnChain Speak?

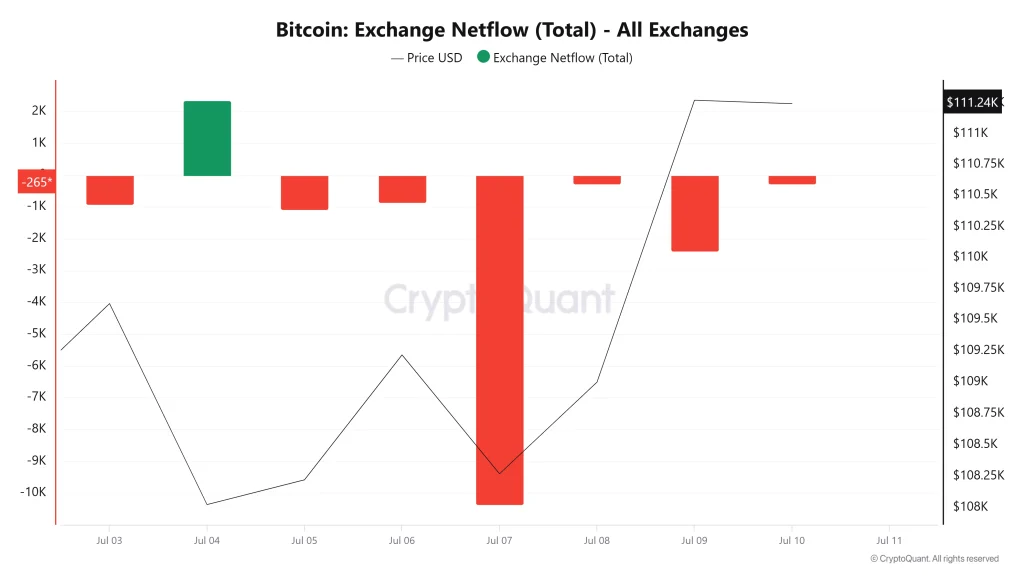

Exchange Netflows Show BTC Exits

The CryptoQuant exchange netflow chart highlights multiple days of negative netflows, with July 7 standing out. When over 10,000 BTC were withdrawn from exchanges, which has been the biggest single-day outflow in recent weeks. This suggests strong HODLing sentiment, often analyzed as bullish since whales are less likely to sell immediately.

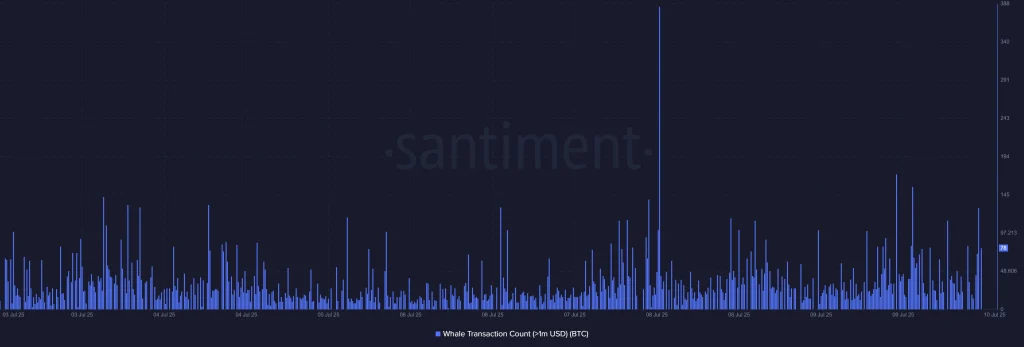

Whale Transaction Spike Big?

Santiment’s whale transaction count (>$1M) showed a massive surge on July 8, indicating significant whale activity. This could reflect both accumulation and distribution, but the timing is just before Bitcoin’s price breakout. This further hints at a possible rotation into high-risk, high-profit altcoins.

Altcoin Season Still a Distant Dream?

While there are numerous positive metrics, the Altcoin Season Index by CoinMarketCap sits at just 28/100, indicating we’re not yet in full rotation mode. However, that may change rapidly if BTC dominance drops and altcoins sustain breakouts.

BTC vs Alts

As evident from the chart, BTC faces a strong hurdle NEAR its ATH despite bullish netflows. Momentum indicators RSI and MACD suggest a temporary cool-off may be due. In contrast, top altcoins ETH, SOL, amongst others, are showing early signs of breakouts from consolidation, supported by increasing whale wallet activity and stablecoin inflows into alt-heavy exchanges.

Curious about Ethereum’s future? Read our ethereum (ETH) Price Prediction 2025, 2026-2030!

FAQs

Why do whales rotate from BTC to altcoins?Whales rotate to maximize profits. Once BTC rallies and shows signs of stalling, whales shift to altcoins.

What does a drop in BTC dominance mean?It often signals the beginning of an alt season, as capital flows from bitcoin into altcoins like ETH, SOL, or newer Layer-1s.