🚀 Bitcoin Primed for $140K Surge as Analysts Flag Unstoppable Momentum

Bitcoin's bull run isn't asking for permission—it's rewriting the rules. With institutional FOMO hitting overdrive, analysts now see a clear path to $140K. Here's why the smart money (and the reckless gamblers) are piling in.

The Halving Effect: Rocket Fuel for BTC

Supply shocks don't care about your portfolio diversification strategy. Post-halving scarcity is clashing with ETF demand, creating a perfect storm for price discovery. Traders who waited for a 'dip' now stare at green candles.

Institutions vs. Meme Coin Degens: Strange Bedfellows

BlackRock's Bitcoin wallet and crypto Twitter's shitcoin bets somehow agree on one thing: this train's leaving the station. Even gold bugs are quietly reallocating—though they'll never admit it at country club brunches.

The Cynic's Corner

Wall Street spent years dismissing crypto... until their clients demanded exposure. Now every bank's blockchain 'expert' suddenly has a 10-year HODL thesis. How convenient.

One thing's certain: when Bitcoin gets this heated, it doesn't do halfway measures. Buckle up—or get left watching from the fiat sidelines.

Bitcoin price is currently trading at $109,500, reflecting a 4% increase this week and a 2% rise intraday, despite the resurfacing of major dormant wallets. Recently, two wallets that had been inactive for over six years transferred a total of 8,000 BTC into a custody wallet controlled by Coinbase Prime.

Additionally, data from Glassnode revealed that over 80,000 BTC, untouched for five years or more, moved last Friday. The revival of these long-dormant coins has sparked speculation about a potential market dump as Bitcoin hovers near its all-time highs. However, the market has shown little reaction, indicating strong accumulation beneath the surface.

On another note, the US Dollar Index (DXY) has reached its lowest level in 21 years compared to its 200-day moving average. This weakness in the DXY is typically seen as bullish for risk assets like Bitcoin. With this increased bullish sentiment, experts are now predicting a near-term target of $140,000 for Bitcoin.

Analyst Says BTC To Hit $140K

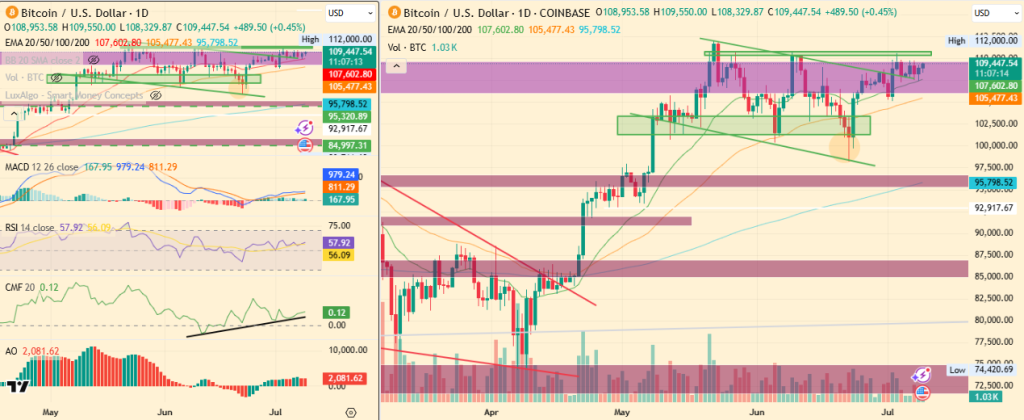

Bitcoin has recently broken out of a flag pattern and is now consolidating NEAR its upper boundary. If it clears the swing high from June, a rise to $120K appears likely in the short term.

Technical indicators are also signaling bullish momentum for Bitcoin. The MACD has formed a golden cross, accompanied by a rising histogram, while the Awesome Oscillator (AO) confirms that momentum is picking up.

Similarly, the Chaikin Money FLOW (CMF) indicates strong and increasing money flow, reflecting positive sentiment in the market. The Relative Strength Index (RSI) is currently above the median line at 58, suggesting that Bitcoin’s strength remains intact, with ample room to grow before entering overbought territory.

Additionally, Experts are eyeing even higher short-term targets, with some suggesting a potential climb to $140K. Notably, analyst Mister crypto has identified a bullish cup and handle pattern forming in the price action. The “cup” took shape from January to early May, while the “handle” has been developing from late May to early July. Once this pattern breaks out, Mister Crypto is targeting a parabolic move to $140K.