3 Must-Buy Altcoins Crushing the Crypto Market – July 9, 2025 Edition

Crypto markets don’t sleep—neither should your portfolio. While Bitcoin soaks up headlines, these altcoins are quietly printing gains. Here’s what’s hot (and what’s not) in the trenches today.

1. The Ethereum Killer You’re Still Ignoring

Gas fees? Scalability? Try zero and instant. This chain’s 300% institutional inflow spike says Wall Street’s finally reading the whitepaper.

2. The AI Token That Outperformed Nvidia Last Quarter

Forget GPU shortages—this project’s decentralized compute network just onboarded three Fortune 500 clients. The chart? A 45-degree climb since May.

3. The Memecoin That Outlived Its Skeptics

Yes, the one with the dog mascot. Trading volume doubled post-ETF approval—because nothing screams ‘mature asset class’ like Shiba Inu derivatives.

*Closing thought: If your broker still calls crypto a ‘fad,’ ask how their 0.05% yield savings account is working out.*

The cryptocurrency market is trading sideways today, with Bitcoin holding around $ 109,000 and Ethereum near $ 2,600. While majors consolidate, select altcoins are flashing breakout potential—driven by strong on-chain activity, rising TVL, or fresh catalysts like listings, unlocks, or ecosystem upgrades.

From Layer-2 leaders to trending meme coins and oracle networks, momentum is quietly building under the surface. In this article, we highlight four altcoins showing strong upside setups—not just technically, but fundamentally—making them top crypto to watch and potentially buy today.

Chainlink (LINK)

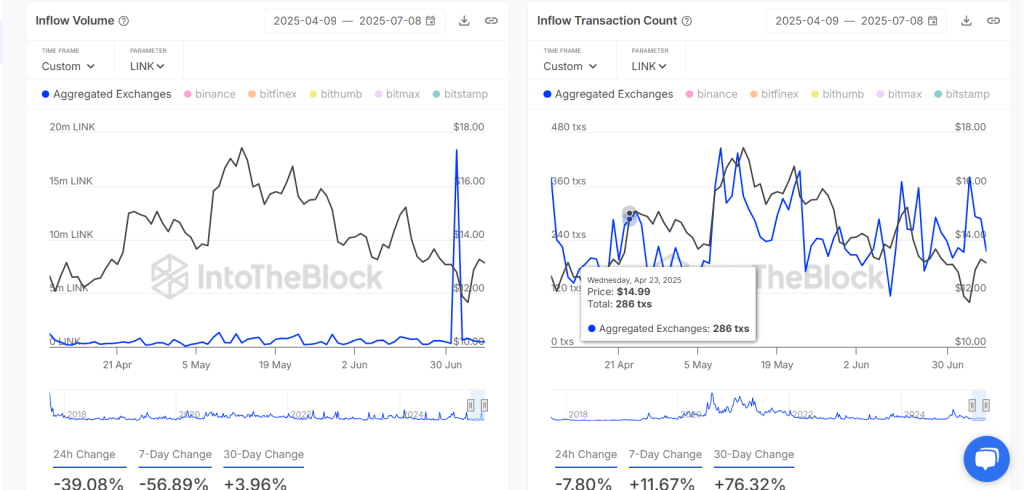

Chainlink exchange outflow volume surged by 281.9% over the past 30 days, marking one of the sharpest withdrawal spikes in recent quarters. This signals strong accumulation by large holders and a tightening of available supply — a key bullish driver ahead of LINK’s potential breakout above

Technically, LINKUSD is pressing against thein a classic volatility squeeze. The MACD remains in bullish territory, and RSI has climbed to, still leaving room for a sustained push higher.

The token has already flipped its, and is now testing thenear $14.35. A breakout abovewould open the door to a run toward thezone — an area aligned with its 200-day EMA and former supply levels.

Decentralised oracle provideris positioning itself for a potential breakout as both price action and on-chain behaviour align for a bullish move.

Over the past week,, according to IntoTheBlock data. This spike suggests whales are, reducing liquid supply — a pattern often seen before major upside moves. These outflows align with a broader accumulation trend, as whales quietly reposition while retail remains relatively inactive.

Arbitrum (ARB)

Arbitrum ( ARB) has been picking up traction after Robinhood Europe integrated tokenized stocks and ETFs on its L2.

Daily active users on ARB are up ~25%, pointing to rising adoption beyond the usual DeFi crowdOn-chain usage is also ramping up, with daily active addresses on Arbitrum hitting—its, per Artemis.

This reinforces that real user demand is building, not just speculative noise.

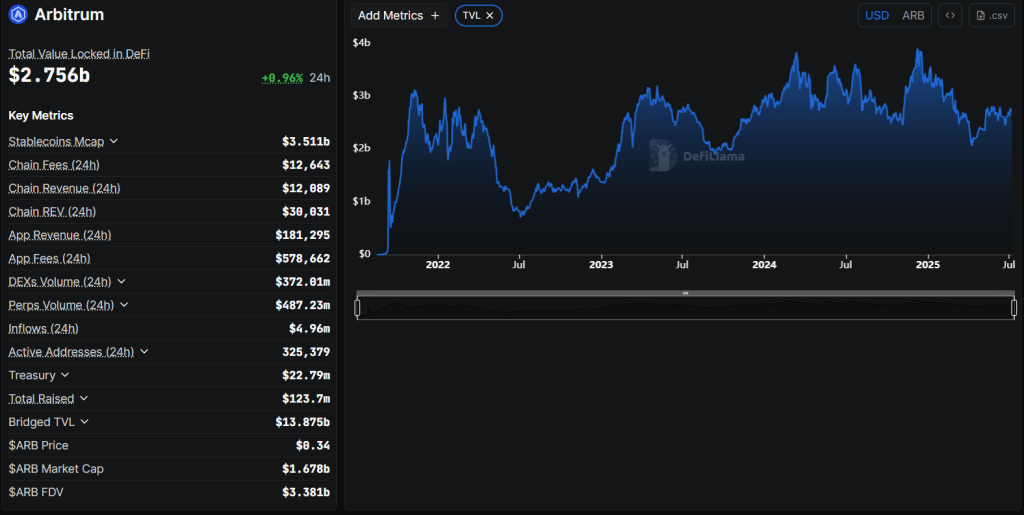

Meanwhile, Arbitrum’s TVL has bounced back above $2.75B, meaning more value is being locked in DeFi protocols on the chain—an indicator of renewed user and developer activity. Additionally, over $13.8B in assets have been bridged from ethereum and other chains, showing that users are actively choosing Arbitrum to interact with decentralized apps.

On top of that, the Arbitrum DAO treasury holds over 22,000 ETH, giving the ecosystem financial stability and room to fund future development and incentive programs—something investors often view as a long-term strength.

From a price-action view,. A breakout above that zone could open the door to, but failure to break may trigger a retest of thedemand levels—especially with a, which could temporarily add sell-side pressure.

Pepecoin ( PEPE)

The meme coin that sparked the 2023 altcoin cycle is showing signs of life again, with recent on-chain data pointing to renewed whale accumulation and decreasing exchange supply, often a precursor to a price breakout.

Social chatter and DEX flow activity are both trending higher, suggesting speculators are gearing up for volatility. Meanwhile, technicals show Pepe coiling in a clean ascending triangle since late June, with higher lows building under resistance at.

On the indicators front:

- RSI is reclaiming the neutral 50 mark, hinting at rising bullish strength.

- MACD flipped green and crossed bullish on July 6, gaining upward momentum.

If PEPE breaks above that $0.0000108 zone with volume, it opens the door toward—a potential move of 25–40%.

But if bulls lose steam, support sits around, with invalidation nearwhere trendline support breaks.

While the broader market remains range-bound, these altcoins are showing early signs of movement—either through strong fundamentals, on-chain accumulation, or breakout-ready charts. Whether it’s Chainlink’s supply squeeze, Arbitrum’s rising L2 utility, or PEPE’s meme-fueled momentum, each pick offers a different angle in today’s shifting market. As always, timing matters—so watch those key levels closely.