🚀 Bitcoin Blasts Past $110K as ETF Demand Explodes—Next Stop: ATH? Predicting BTC’s Price Ceiling

Bitcoin just punched through $110,000 like a bull through a china shop—ETF inflows are fueling the frenzy, and traders are scrambling to call the top. Could this be the run that finally smashes the old records?

Wall Street’s latecomers are dumping cash into crypto ETFs like it’s 2021 all over again—just in time to maybe, possibly, catch the tail end of the rally. Meanwhile, OGs are side-eyeing the charts and whispering: 'How high is stupid high?'

Technical signals scream overbought, fundamentals whisper 'institutional FOMO,' and that one guy on Crypto Twitter is already mortgaging his house. Buckle up—we’re either hitting $150K or watching the mother of all corrections. Place your bets.

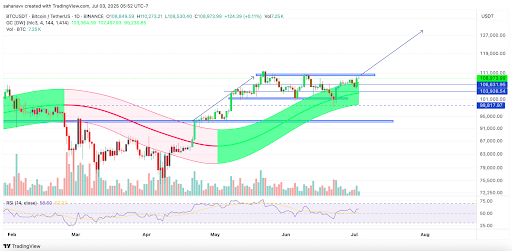

Bitcoin has reclaimed the $110,000 mark, posting a 3-week high after a sharp recovery from its June low near $58,000. The leading cryptocurrency has surged nearly 90% from that bottom, fueled by consistent ETF inflows and a broader risk-on shift in global markets. On the technical front, BTC has broken above key resistance at $108K, with bullish momentum supported by rising RSI and MACD crossover. Analysts now eye $115K as the next major target, provided macro tailwinds persist.

ETF Inflows, Macroeconomic Tailwinds, etc., Add Momentum

One of the primary drivers behind Bitcoin’s price spike is the continued inflow into the spot Bitcoin ETFs. BlackRock’s iShares Bitcoin Trust (IBIT) remains a major contributor, consistently attracting large institutional investments. These steady inflows indicate growing confidence among traditional finance players, further legitimizing Bitcoin as a store of value and investment vehicle.

Besides, the Macroeconomic factors are also playing a key role in boosting Bitcoin’s performance. Softer-than-expected ADP employment in the US has fueled expectations of potential Federal Reserve interest rate cuts. This prospect has encouraged a broader shift toward risk-on assets, with bitcoin benefiting as a high-beta alternative investment.

After $110K, Where Will Bitcoin Price Head Next?

The BTC price surged past the $110K mark, reaching its highest level in the past three weeks. This bullish move comes amid a correction of strong institutional inflows and favorable macroeconomic developments that are reigniting risk appetite across financial markets. Now that the price is an inch close to its ATH, the investors continue to hold but not spend, which suggests they are confident of the upcoming price action.

The daily chart of Bitcoin suggests the price has risen above the bearish influence as it surges above the resistance of the Gaussian Channel. It displayed a similar MOVE during mid-April that resulted in a 20% upswing. Besides, the price is attempting to break above the pivotal resistance zone as it did and a successful breach could result in a new ATH for the Bitcoin (BTC) price rally. Moreover, the rising RSI from the average range hints towards the growing strength of the rally.

Therefore, considering the current chart patterns and market conditions, the peak of the current Bitcoin (BTC) price rally could be somewhere around $125,000, which may be achieved during Q4, 2025.