Bitcoin at Critical Juncture: Bulls Battle for Control Ahead of Pivotal FOMC Decision

Bitcoin''s price action tightens like a coiled spring as it retests a crucial support level—just hours before the Fed drops its latest policy bomb. Will crypto''s alpha asset shake off the macro shackles?

Key levels in play

The BTC chart prints a textbook make-or-break moment at $65K, with liquidity pools clustering around this psychological threshold. Market makers appear to be playing both sides—loading bids at support while stacking sell walls every $500 north of current price.

FOMC wildcard looms

Traders are bracing for the classic ''buy rumor, sell news'' circus as Powell takes the mic. The options market shows skewed put protection through Friday—smart money hedging against another ''transitory'' policy speech that somehow always translates to market turbulence.

Institutional chess moves

Whispers of a hidden bullish catalyst: two mega-corp treasuries quietly onboarding cold storage solutions this week. Nothing like some good old-fashioned ''adoption theater'' to juice the narrative machine.

The bottom line? Bitcoin''s plumbing looks solid, but the Fed holds the plunger. Watch for a classic ''sell the hike, buy the pivot'' play—assuming Jerome remembers which script they''re using this quarter.

Bitcoin (BTC) price has experienced heightened volatility as the Middle East crisis signals further escalation. The flagship coin dropped as much as $103,396 on Tuesday, which resulted in a similar MOVE for the wider altcoin market.

As a result of the heightened volatility, more than $513 million was liquidated from the crypto-leveraged market, with the long traders accounting for $421 million. Nevertheless, crypto traders remain optimistic for a bullish rally soon as shown by the BTC fear and greed index, which hovered around 68 percent.

Bitcoin Demand Remains Strong

As Coinpedia has pointed out severally in the recent past, the overall demand for Bitcoin by institutional investors remains highly elevated. Amid the ongoing short-term bearish outlook, the Bitcoin balance on centralized exchanges continued to drop to about 2.08 million at the time of this writing from 2.26 million on April 24, 2025.

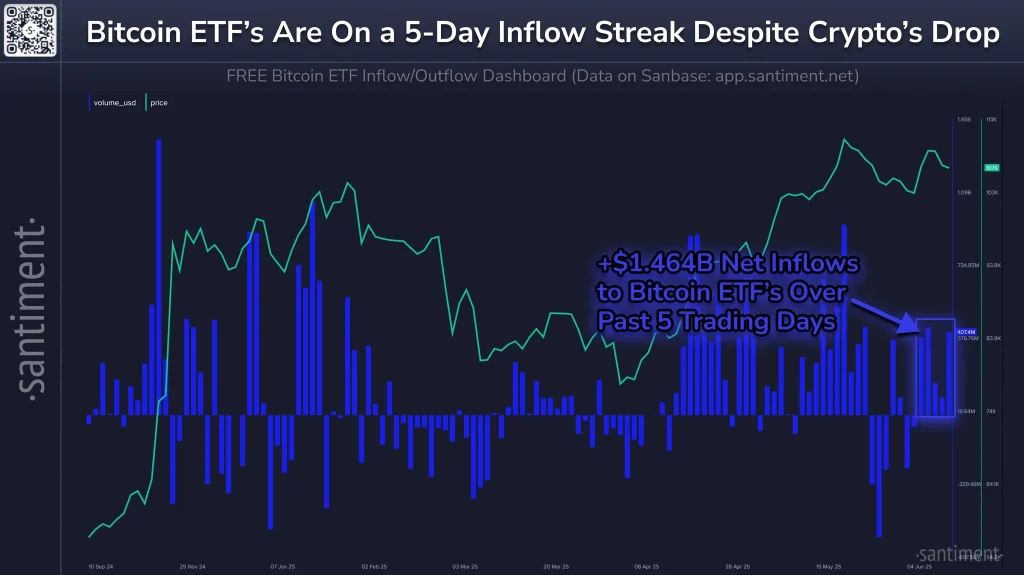

The U.S. spot bitcoin ETFs and institutional investors, led by Strategy and Metaplanet, remain a major contributor to the declining supply of BTC on centralized exchanges (CEXs). Over the past five days, U.S. spot BTC ETFs have recorded a net cash inflow of approximately $1.46 billion, led by BlackRock’s IBIT.

What Next for BTC Price?

BTC price has been forming a bullish continuation pattern despite the seemingly choppy market. Following a 5 percent drop in the past 24 hours to retest a crucial support level around $103k, BTC price has rebounded over 1 percent to trade around $105k on Tuesday, during the mid-North American trading session.

In the two-hour timeframe, BTC price retested a bullish breakout from a falling logarithmic trendline. Within the 2-hour timeframe, BTC’s Relative Strength Index (RSI) hovered around oversold levels, suggesting a rebound in the NEAR future.

However, a consistent close below the support range between $103k and $101k will trigger further bearish sentiment in the subsequent weeks.