Crypto Bloodbath: How DJT, S&P 500 & NASDAQ Plunge Sparked a Panic Sell-Off

Markets just got slapped—hard. Crypto tanks as traditional finance tremors send shockwaves through digital assets. Here’s the damage.

The Domino Effect Hits Crypto

When the S&P 500 and NASDAQ tripped, crypto didn’t just stumble—it face-planted. DJT’s nosedive added fuel to the fire, turning cautious dips into full-blown panic sells. Classic herd mentality—Wall Street sneezes, and crypto catches pneumonia.

Liquidity Ghost Town

Traders bolted for exits faster than a DeFi rug pull. Volume evaporated, spreads widened, and suddenly everyone remembered crypto’s ‘uncorrelated assets’ narrative was built on quicksand. Thanks for nothing, macro.

Silver Linings for Degens

Blood in the streets? For diamond hands, this is Black Friday with extra volatility. Meanwhile, institutional ‘experts’ who swore BTC was inflation-proof are quietly editing their PowerPoints.

Markets move fast—but crypto moves faster. Today’s panic could be tomorrow’s buying opportunity. Or just another Tuesday in the casino.

The global cryptocurrency market witnessed a broad downturn today, with total market capitalization falling by 1.68% to $3.39 trillion. Daily trading volume also dipped 5.27% to $133.81 billion, signaling cautious investor sentiment. The Fear & Greed Index currently sits at 61, still in the “Greed” zone, though edging downward as uncertainty clouds the outlook.

The decline follows a sequence of macroeconomic and political events that have rattled both crypto and traditional markets. Talking about Wall Street, the S&P 500 is down 0.27% at 6,022.24, DJT fell 1.87% to 20.52, NASDAQ dropped 0.50% to 19,615.88, and the Dow Jones slipped marginally by 0.0026% to 42,865.77.

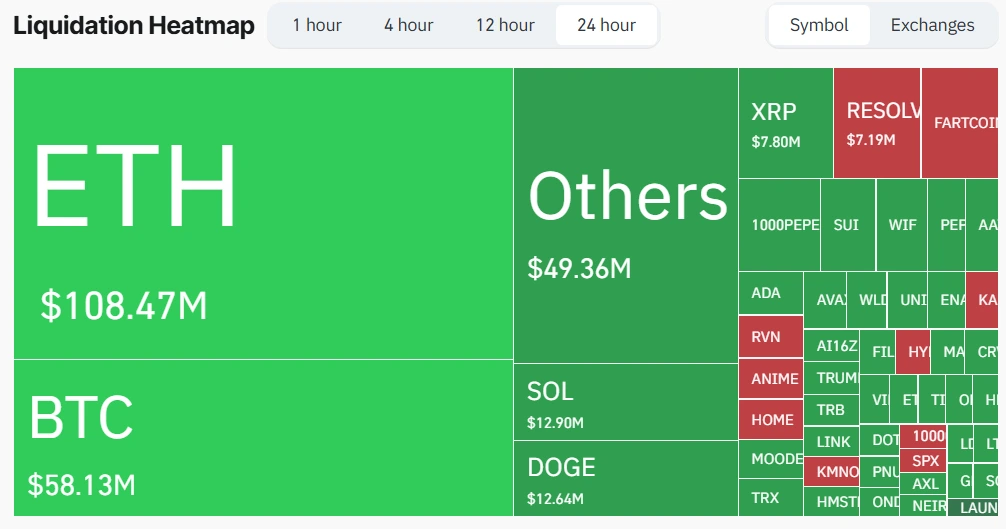

Liquidations Surge as Traders Get Caught Off Guard?

As price action turned against the bulls, liquidations began to mount. In the past 24 hours, 112,143 traders were liquidated, amounting to a total of $327.94 million wiped out across exchanges. The single-largest liquidation occurred on Binance’s BTCUSD perpetual pair, totaling $2.15 million.

The scale of the liquidations suggests that many traders were caught off guard by the rapid reversal in sentiment, especially those betting on a bullish continuation after the CPI dip. With Leveraged positions wiped out across both long and short sides, volatility is expected to be present in the short term.

BTC & ETH in Red, Altcoins Hit Harder?

Bitcoin price is down 1.68% in the last 24 hours, now trading at $107,740.76. Its market cap stands at $2.14 trillion, with $53.99 billion in daily trading volume. ethereum followed suit, dipping 1.11% to $2,760.10. Among the top altcoins, XRP dropped 1.87%, while Solana took a heavier bash with a 3.97% decline.

Top Gainers

- SPX6900: $1.68 (+6.63%)

- KAIA: $0.1695 (+3.14%)

- AB: $0.01167 (+2.64%)

Top Losers

- CRV: $0.6394 (-9.98%)

- JUP: $0.4553 (-9.39%)

- RAY: $2.26 (-9.38%)

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

How are Bitcoin and Ethereum performing during the downturn?Bitcoin fell 1.68% to around $107,740, while Ethereum dipped 1.11% to about $2,760

What caused the surge in liquidations?The sudden market reversal caught many leveraged traders off guard, resulting in over 112,000 liquidations and $327.94 million lost across exchanges.

What is the S&P 500?The S&P 500 is a stock market index tracking the performance of 500 of the largest publicly traded U.S. companies. It’s widely considered a benchmark for overall U.S. stock market health.

How is DJT stock performing today(12,2025)?DJT fell 1.87% and is trading at 20.52 amid broader market declines.