Institutional Bitcoin Holdings Explode 924% in 10 Years – Gemini & Glassnode Reveal Stunning Growth

Wall Street''s crypto flip-flop reaches new heights as institutional Bitcoin holdings rocket nearly 10x since 2015. Who said ''just a fad'' again?

The whales are here – and they''re not leaving

Forget retail traders mooning on leverage. The real story? Pension funds and hedge funds now hold more BTC than ever before. That 924% surge didn''t happen by accident.

Why institutions finally stopped pretending

From ''too risky'' to ''must-have'' in a decade – turns out even suits need inflation hedges when central banks print money like confetti. The real shock? How long it took them to figure it out.

What happens when the big money arrives

Volatility gets tamed. Liquidity deepens. And suddenly, the asset class everyone mocked becomes... respectable. Just in time for the next halving cycle.

The irony? Institutions spent years dismissing crypto – now they''re the ones pumping the market. Somewhere, a Goldman Sachs VP is explaining to his boomer clients why they need ''digital gold'' in their portfolios. Progress hurts.

A new joint report by Gemini and Glassnode reveals a dramatic shift in Bitcoin ownership, highlighting the cryptocurrency’s growing maturity and institutional adoption. According to the report, centralized treasuries—including governments, ETFs, public companies, and centralized exchanges—now hold nearly, totaling overworth approximately.

Government Bitcoin Holdings Surge Through Seizures

Governments around the world collectively hold, valued at over. Theleads with, followed bywithand thewith.

The report highlights that these holdings are not from open market purchases but have mostly come from.

ETFs Take the Lead in Bitcoin Accumulation

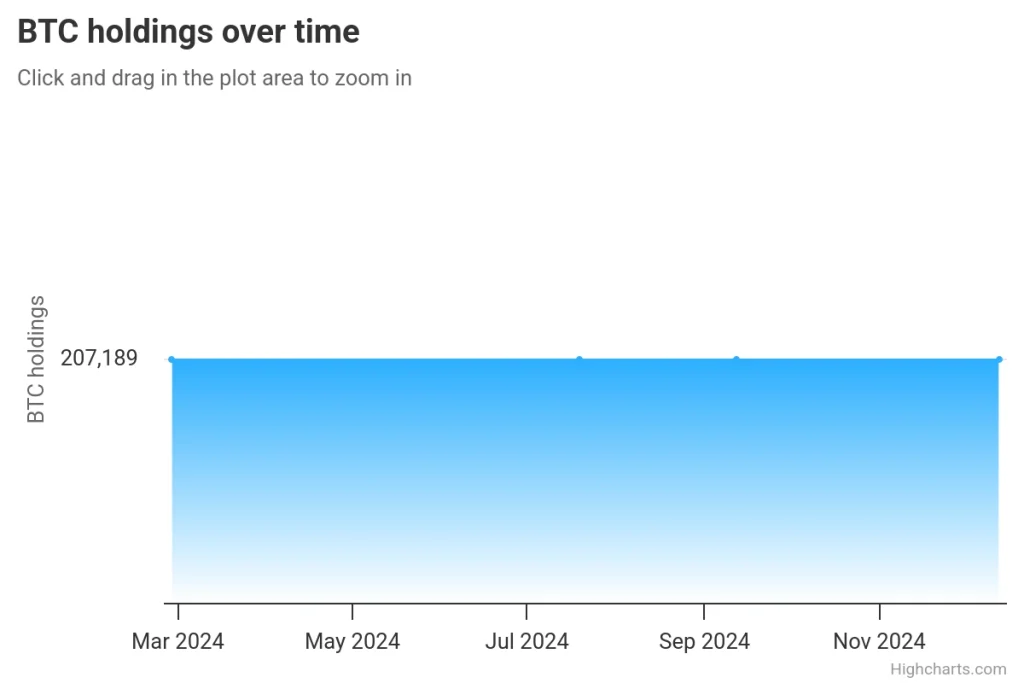

Bitcoin ETFs are rapidly growing as dominant holders. They now control, worth about. The largest holder is, which owns.andfollow withand, respectively.

These numbers reflect rising institutional confidence in bitcoin as a long-term financial asset.

Public Companies Double Down on BTC

Public companies have become aggressive buyers, collectively holding, valued at.continues to lead this category with a staggeringin reserves. Other key players includewithandwith.

This further signals Bitcoin’s growing role as a strategic asset for corporations seeking to protect against inflation and economic uncertainty.

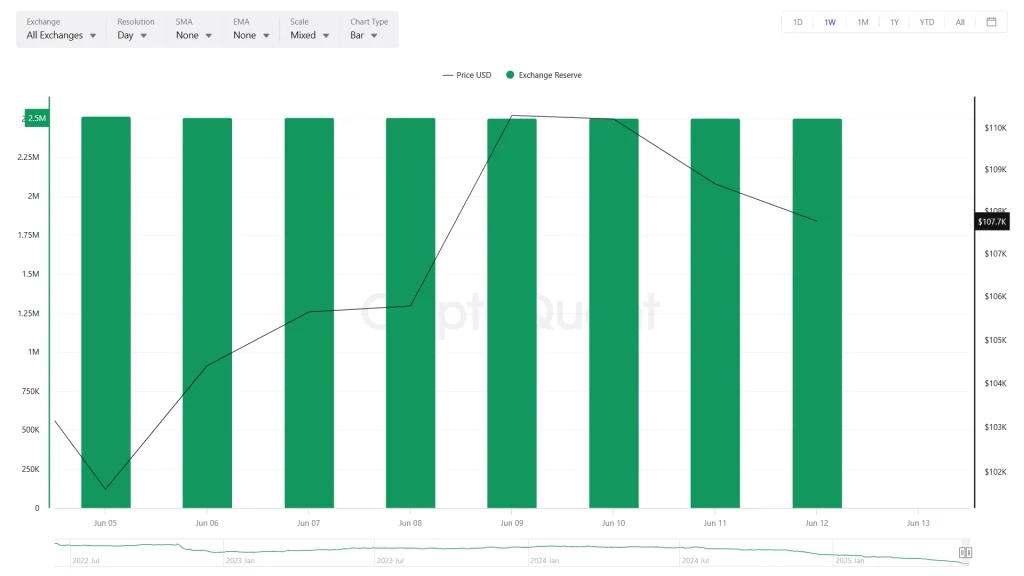

The report also confirms that centralized exchanges make up a significant portion of the 6.1 million BTC controlled by centralized entities. Currentstand at.

However, analysts believe much of this Bitcoin, not the exchanges themselves. Still, the inclusion of exchanges highlights the role of custodial platforms in Bitcoin’s ecosystem.

Private Companies Show Distributed Ownership

In contrast to public firms, private companies collectively hold, valued at around. The distribution is more spread out in this segment.

holds, whileowns. Other notable holders includewithandwith.

Bitcoin’s Price Mirrors Institutional Growth

The report highlights that institutional Bitcoin holdings have surged. During the same period,. In just the past year, the price has climbed, showing increased stability and mainstream acceptance.

This price performance is closely tied to growing institutional interest, which has created a stronger foundation for Bitcoin as an asset class.

Conclusion: Bitcoin Matures, but Risks Remain

The data reflects ain Bitcoin’s ownership landscape. With governments, ETFs, public companies, and exchanges holding a large share of circulating BTC, Bitcoin is now entering a phase of.However, despite this evolution, Bitcoin still remains a, subject to macroeconomic forces and market sentiment. Its volatility may have reduced, but it has not disappeared.