Pi Network Teeters on the Edge: Can It Defend the $0.60 Lifeline as Bulls Lose Steam?

Pi Network''s price action is flashing warning signs—its once-bullish momentum now looks as shaky as a crypto influencer''s ''100x guaranteed'' call.

The $0.60 support level has become a make-or-break zone. If it cracks, expect panic selling from moonbag holders who still think ''mainnet launch'' is an actual catalyst.

Meanwhile, traders eyeing the charts are getting déjà vu—another altcoin bleeding out while Bitcoin eats everyone''s lunch. Some things never change in crypto''s zero-sum casino.

- Pi Coin (PI) is consolidating below $0.65 and nearing a critical support level at $0.60.

- Technical indicators, including RSI, MACD, and the Ichimoku Cloud, are signaling increasing downside pressure.

- Daily trading volume has dropped by over 90% since May, with on-chain engagement stalling.

- Scalping opportunities may still exist on the 4-hour timeframe, though broader sentiment remains cautious.

- All eyes are on Pi Day 2 (June 28), which is expected to determine the token’s short-term trajectory.

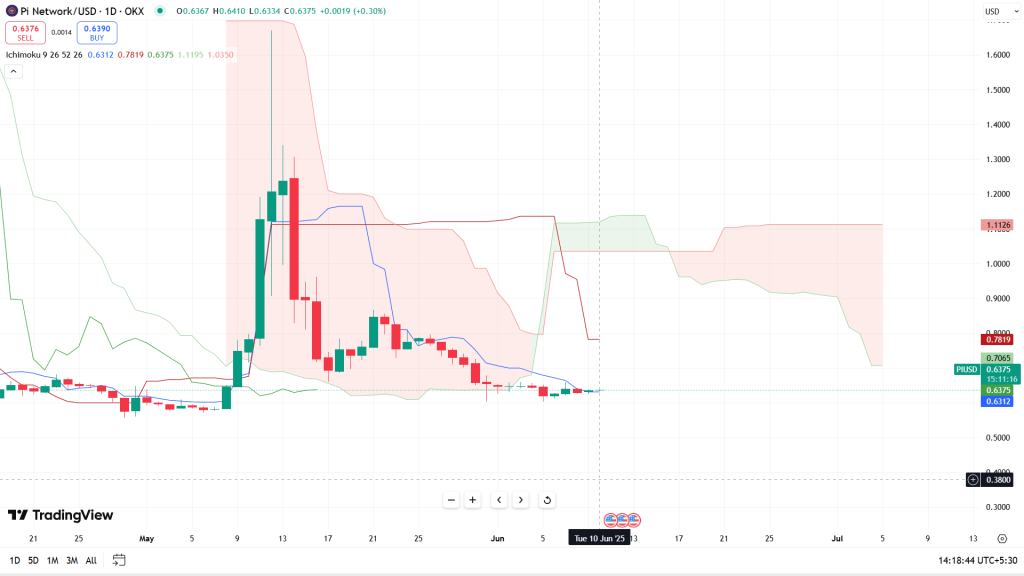

Technical Indicators Suggest Weakness

Pi Coin is trading just above a key support level at $0.60, with price action forming a classic descending triangle on the daily chart—a bearish continuation pattern.

The Relative Strength Index (RSI) remains below 45 and is trending downward, indicating a lack of bullish strength. Meanwhile, MACD continues to print red histogram bars, highlighting prevailing bearish momentum.

The Ichimoku Cloud analysis confirms this trend, with the price positioned below the Kumo, and the Chikou span lagging, both suggesting continued downward pressure.

Unless Pi breaks decisively above the descending trendline NEAR $0.75, the technical setup favors a move below $0.60, with the next key support level at $0.38.

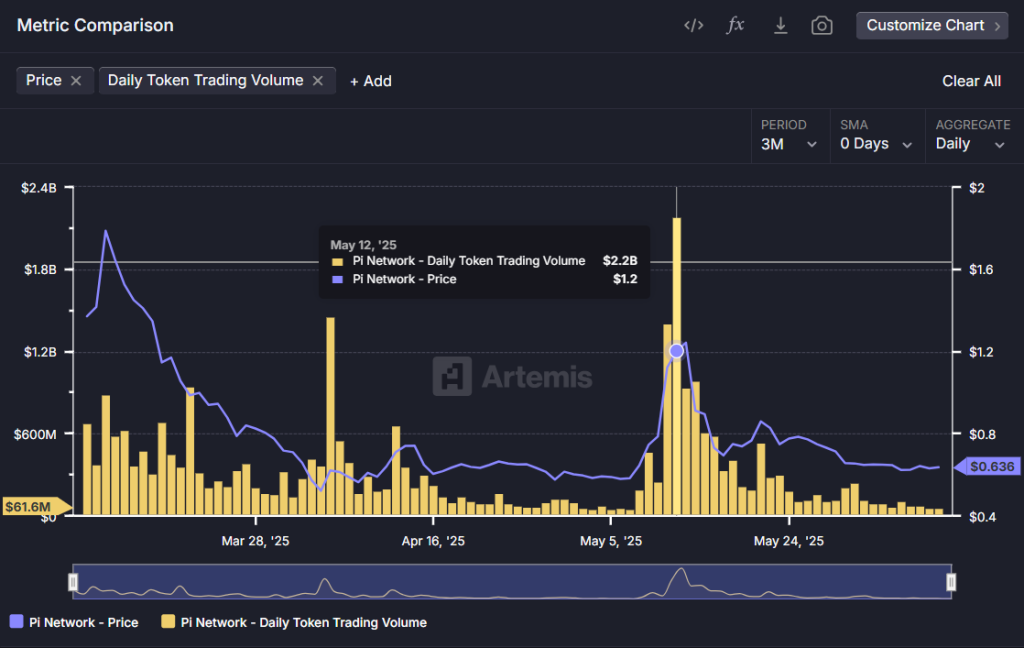

On-Chain Data Underscores Demand Drop

On-chain metrics reinforce the bearish outlook. According to Artemis data:

- Daily trading volume has plunged from over $2.2 billion in mid-May to under $62 million by June 10—a decline of more than 97 percent.

- The 24-hour trading volume to fully diluted market cap (FDMC) ratio has fallen to just 0.09 percent, reflecting low liquidity and waning speculative interest.

While a slowdown in supply release may be constructive in the long term, in the current environment it has not been enough to offset the lack of demand or improve price action.

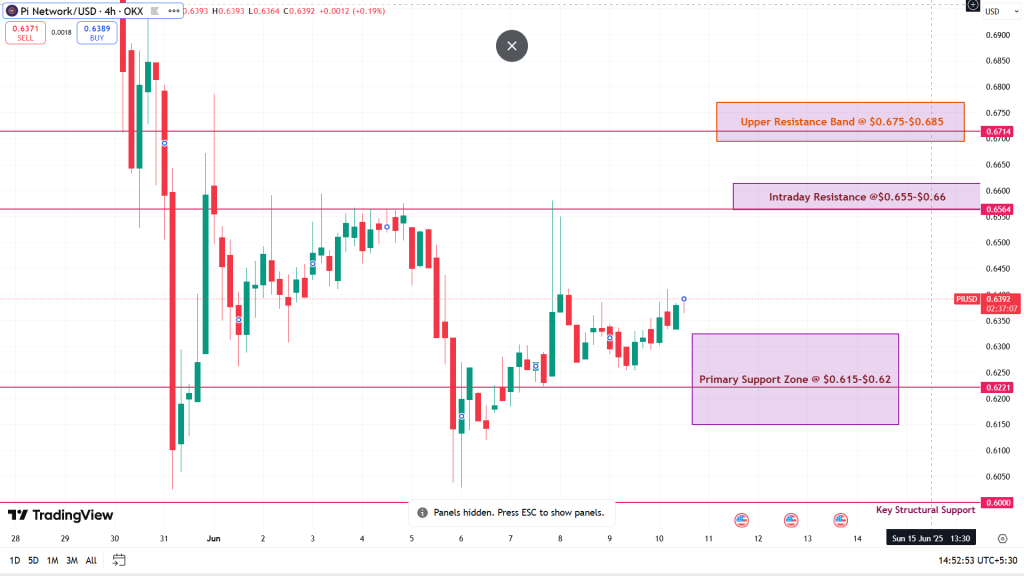

Scalping Strategy on the 4-Hour PIUSDT Chart

As of June 10, 2025, Pi Coin (PI/USDT) is trading aroundin a tight consolidation range betweenon the 4-hour chart. Short-term indicators suggest mild bullish momentum building, though the broader trend remains uncertain.

Theis currently at, showing mid-level strength, while thehas formed a marginal bullish crossover (MACD: 0.0015, Signal: 0.0014). These indicators point to a potential setup for intraday scalping, particularly within well-defined price levels.

become favorable if RSI dips to theand reverses upward, with a confirming MACD histogram flip to green and volume exceeding the 4-bar average. A recent example occurred on, when price rallied from(+9%) after similar conditions.

can be considered if RSI approachesand rolls over, accompanied by a MACD bearish crossover and high-volume rejection. This setup played out on, resulting in a drop from(-6%).

Scalpers should maintain tightand aim for quick exits at nearby resistance/support zones, focusing trades within theuntil a breakout confirms a broader move

Pi Day 2: A Defining Event

The upcoming PI Day 2 event on June 28 is expected to serve as a turning point for the project. The community is anticipating three key developments:

If these deliverables are met with substance, Pi could see a strong recovery, potentially testing $1.00 or higher. Conversely, if the event lacks clarity or results in vague promises, the price may lose its $0.60 footing, leading to a deeper correction.

Analyst Outlook: Short-Term Speculation

In the near term, Pi Coin stands at a pivotal level. With technical momentum fading and on-chain activity drying up, the most likely scenario is a period of sideways consolidation between $0.55 and $0.80 while the market awaits direction from the Pi Day 2 event.

A bullish breakout remains possible but is contingent on a strong, actionable roadmap, especially regarding mainnet deployment and exchange readiness. In that case, Pi could rally toward the $1.00 to $2.50 range. However, if expectations are not met or sentiment weakens further, a breakdown below $0.60 could send the token spiraling toward $0.50 or even $0.30.

At present, the evidence is bearish. The market is likely to remain in a holding pattern until clarity emerges from the Core Team.

Pi Coin Prediction: Short-Term Uncertainty Persist

Pi Network’s underlying architecture and mobile-first consensus model offer long-term potential, particularly with its large user base and community engagement. However, short-term challenges persist. Technical breakdown risks, a sharp fall in volume, and absence of listing momentum in top Exchnges like Binance place Pi Coin in a vulnerable position.

Until the Pi CORE Team delivers tangible progress—especially on Open Mainnet timelines and ecosystem development—$0.60 remains the critical line separating recovery from rejectionhttps://markets.coinpedia.org/pi/