Bitcoin Bulls Charge: Technicals Scream Buy as Wall Street Warms Up

Bitcoin’s chart paints a bullish masterpiece—ascending triangles, golden crosses, and institutional inflows stacking like unconfirmed transactions. Forget ’digital gold.’ This is a rocket strapped to a hedge fund’s balance sheet.

Wall Street’s latest love affair? A volatile, decentralized asset they spent a decade mocking. How’s that for irony?

One hedge fund manager puts it bluntly: ’We’re either early or wrong. But the tape doesn’t lie.’ Meanwhile, retail traders stare at leverage ratios like gamblers at a roulette wheel.

Closing thought: When banks start shilling BTC ETFs while quietly shorting futures, maybe—just maybe—we’re in the ’sell the news’ phase of this cycle.

On, Bitcoin reached a, closing atafter briefly touching an intraday peak of. Despite this milestone, market behavior suggests this may not be the euphoric top—capital is still flowing in at unprecedented levels.

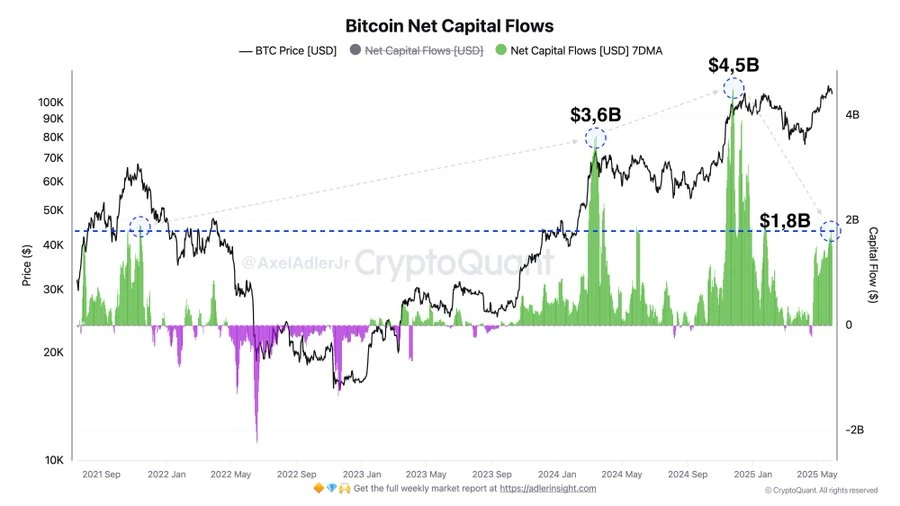

Investor Confidence Remains Unshaken: $1.8B Daily Inflows Match 2021 Peak

According to on-chain analyst, bitcoin is now averaging around, comparable to the peaks last seen in thebull market, when BTC hit $64,000. Adler, known for his data-driven insights shared on platforms like X (formerly Twitter), emphasizes that this volume of inflow is a strong indicator of, even after setting new all-time highs.

Axel Adler Jr. on X

“Daily net inflows remain historically high—even surpassing peak 2021 levels at current price points.”

Capital Flows Strongest at High Price Points—Not the Dip

Notably, Adler’s data reveals that capital surged most aggressively during price spikes—not dips. At, Bitcoin sawin daily inflows, while the figure jumped toper day when BTC was around.

This is a significant shift from past market behavior where buying typically intensified during pullbacks. The current cycle shows growing comfort among investors to buy at higher levels, possibly reflectingrather than short-term speculation.

Market Structure: A Breakout Followed by Consolidatio

At the beginning of May, Bitcoin hovered around, trading sideways in a narrow band. A sharpbroke that pattern, launching a new phase of bullish momentum.

From, Bitcoin spiked over, reaching its new high. However, a brief pullback followed: since, BTC has dropped approximately, now trading at. The retracement suggests a period ofrather than panic selling, especially considering broader macroeconomic stability and continued crypto ETF interest.

Technical Indicators Show Ongoing Strength

- RSI (Relative Strength Index): Currently at 53.58, suggesting neutral momentum. It has held between 50 and 70 since late May, indicating consolidation without immediate overbought conditions.

- Golden Cross: On May 22, the 50-day MA crossed above the 200-day MA—a bullish signal. The moving averages now stand at $97,776.48 and $94,668.91 respectively, with the gap widening, affirming strong trend momentum.

- ADX (Average Directional Index): At 25.88, it indicates a sustained trend strength. Since late April, the ADX has stayed above 25, further validating the current upward momentum.

Looking Ahead: Beyond the ATH

While themay seem alarming in isolation, zooming out reveals a. The volume of capital inflows, even at elevated price levels, underlines a shift in market psychology. Long-term investors appear increasingly comfortable entering the market at higher valuations, perhaps viewing Bitcoin as arather than a volatile asset.

Final Takeaway

The new all-time high for Bitcoin is notable—but what matters more is thebehind it. Historical levels of capital inflow, strong technical signals, and a maturing investor base all point to a market that is, not overheating.

In the words of analyst, this may be the “.”