PEPE Coin Soars 20% Overnight—Here’s What’s Fueling the Memecoin Frenzy

Frogs are flying today as PEPE defies crypto gravity with a double-digit surge. Traders are piling in—but is this just another speculative bubble waiting to pop?

The whale effect: On-chain data shows three fresh wallets scooped up $2.3M worth of PEPE in under an hour. Classic pump tactics or genuine conviction? The blockchain never lies—but it doesn’t explain motives either.

Binance boost: The world’s largest crypto exchange just added PEPE margin trading, giving degens 5x leverage to amplify both gains and losses. Because what’s a memecoin rally without reckless overexposure?

Market madness: With Bitcoin flatlining at $62K, bored traders are rotating into high-risk alts. PEPE’s 24h volume just hit $800M—proof that when the crypto casino gets quiet, the degens start shouting.

As always in crypto land: the bigger the green candle, the harder the eventual reckoning. Enjoy the ride—just remember someone’s always left holding the bag when the music stops.

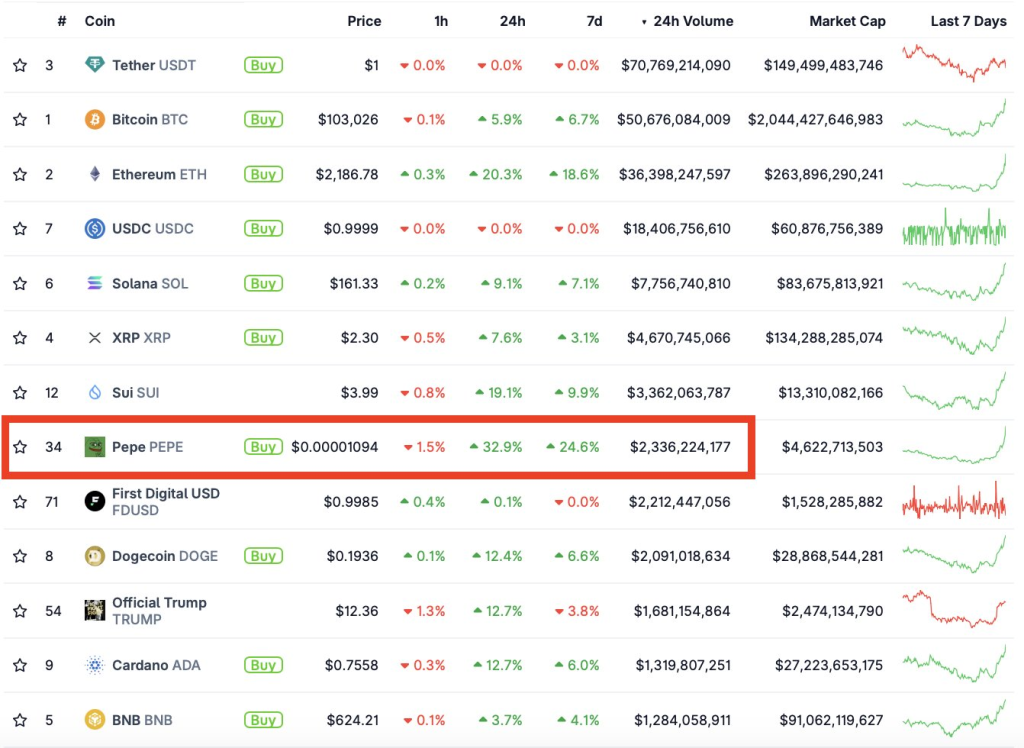

PEPE coin is trending today in the memecoin market With a stunning 30% price surge in just 24 hours. PEPE has overtaken Dogecoin in daily trading volume, becoming the most traded memecoin and the sixth most traded cryptocurrency globally (excluding stablecoins).

Why is PEPE Surging?

The Pepe coin price surge is fueled by a combination of whale accumulation, technical breakouts, and increasing open interest in the derivatives market.

Whale Accumulation

According to lookonchain Data, over the past week, a prominent crypto whale has been actively buying PEPE on the open market. On April 30, this whale—who holds $147 million in crypto assets—, and earlier today, they added another, bringing their total holdings to. This accumulation, totaling roughly, signals strong long-term confidence in PEPE.

Derivatives Market Heating Up

According to data from CoinGlass,. The amount of money locked into PEPE futures — known as open interest — has gone up by. That means more traders are betting on PEPE’s next move.

In the past 24 hours alone, around, and. In simple terms, a lot of traders who expected the price to fall got caught off guard — a classic sign of a.

What Next For PEPE Price?

According to analyst, PEPE recently broke out of apattern—a bullish signal—confirming a shift in momentum with a strong daily close. This could lead to a. If the market remian bullish and Pepe Price maintain the uptrend we can see, with a price target of(a 10x from current levels) within the next bullish cycle.