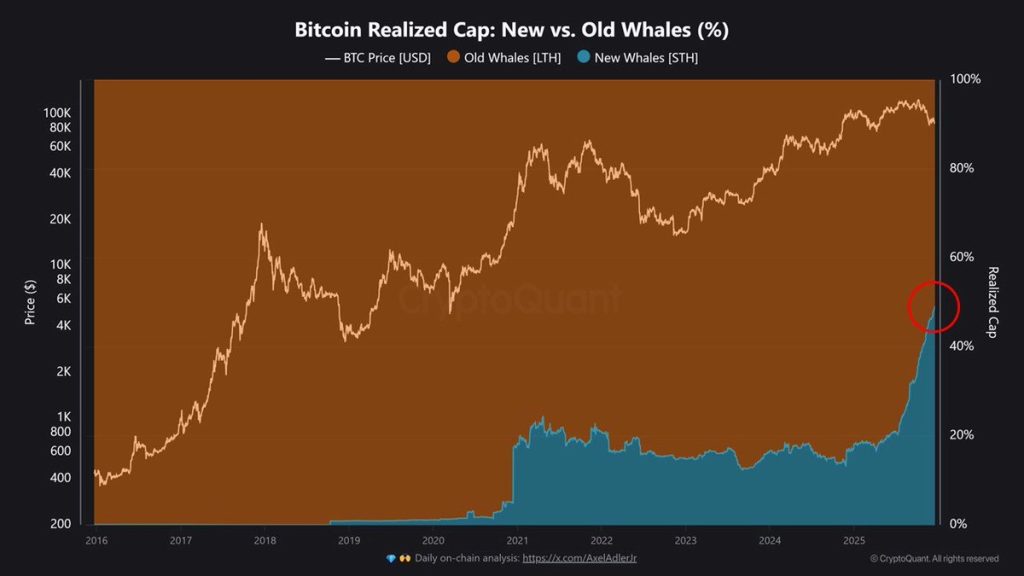

New Whale Buyers Now Drive 50% of Bitcoin’s Realized Cap – Is This a Historic Shift From Old Cycles?

Forget the old guard. Fresh capital from new institutional whales now accounts for half of Bitcoin's realized market cap—a tectonic shift in the asset's foundational ownership structure.

The Whale Migration

Market veterans are watching a fundamental power transfer. Where previous cycles were dominated by long-term holders and early adopters, the current landscape shows a stark 50% of realized value coming from recent, large-scale entrants. These aren't retail investors dipping a toe in; they're sovereign wealth funds, corporate treasuries, and asset managers moving billions.

What Realized Cap Reveals

Realized capitalization cuts through the noise of pure price speculation. It values each coin at its last transaction price, painting a clearer picture of the actual capital invested. When that metric swings so decisively toward new buyers, it signals a profound change in the asset's economic bedrock. The old hodler narrative is getting a multi-billion-dollar rewrite.

A Cycle Unlike Any Other?

This isn't a repeat of 2017's retail frenzy or 2021's leverage-fueled euphoria. The scale and profile of these buyers suggest a maturation phase—one where Bitcoin is being treated less like a speculative tech stock and more like a strategic reserve asset. They're not trading it; they're vaulting it. Of course, on Wall Street, a 'strategic reserve' is just a fancy term for something you hope goes up before the next quarterly report.

The New Foundation

This influx of patient, high-conviction capital builds a higher floor. It dampens volatility from the sell-side and creates a more resilient price structure. The market's center of gravity has officially shifted. The question is no longer if institutions are coming, but what they do now that they're here—and what happens when their notoriously short-term performance reviews clash with crypto's long-term thesis.

Bitcoin’s price has been volatile, but the bigger story right now isn’t the chart. It’s who’s buying and at what levels.

New on-chain data shows that, a sharp break from how past Bitcoin cycles played out.

Realized cap tracks the value of bitcoin at the price each coin last moved on-chain. So when new whales approach a 50% share, it means, not during early low-cost accumulation phases.

New Whales Are Playing a Different Game

According to the data, these new whales are mainly institutions and ETFs buying Bitcoin at higher prices and in larger volumes. That alone sets them apart from long-term holders who accumulated cheaply and sold into strength during previous bull runs.

More importantly, their behavior during pullbacks looks different.

“Even during corrections, the Realized Cap share of new whales has continued to rise,” the analysis notes.

This should not be interpreted as a short-term bullish or bearish signal, but as evidence that the structure of the Bitcoin market itself is changing, the report adds.

Demand Is Rising, Not Rotating

Short-term holder data backs this up. Supply held by coins younger than 155 days grew by roughly, reaching an all-time high. That suggests fresh demand is still coming in, even as prices fluctuate.

At the same time, long-term holders remain mostly inactive. Exchange flows show that selling pressure came largely from smaller participants, while large wallets stepped in to absorb supply.

Cumulative volume delta data reinforces this split. Whale wallets posted a, while retail and mid-sized traders showed negative flows.

What This Shift Really Signals

This data points to something deeper.

Bitcoin is entering a transition toward a more mature asset shaped by sustained institutional accumulation.

For a market long defined by boom-and-bust cycles, that change matters. And it may explain why Bitcoin’s behavior is starting to look less familiar and more structural with each passing month.