Bitcoin & Ethereum Volatility Squeeze Tightens—Here’s What This Critical Setup Signals for the Next Major Crypto Price Move

The crypto market is holding its breath. Bitcoin and Ethereum, the twin titans of digital assets, have entered a period of dramatically tightening volatility—a classic coiling-spring setup that historically precedes explosive price movements.

The Calm Before the Storm

For weeks, the trading ranges for both assets have been compressing. This isn't just low volume; it's a textbook consolidation pattern where price action gets squeezed into an ever-tighter band. Market makers and algos are battling it out, absorbing sell orders and propping up bids, creating an equilibrium that feels increasingly fragile. It’s the financial equivalent of atmospheric pressure building before a hurricane—everything gets quiet, right up until it doesn't.

Reading the Tape for Direction

So which way does it break? The symmetrical nature of the squeeze means the market itself hasn't decided. The key will be which level fails first. A sustained hold above the upper consolidation boundary could trigger a cascade of short covering and FOMO buying. Conversely, a breakdown below support might see a swift retest of lower levels as leveraged longs get liquidated. Watch the derivatives data—funding rates and open interest often tip the market's hand before price itself moves.

Implications Beyond BTC and ETH

When these two move, everything else follows. A decisive breakout will dictate sentiment across the entire digital asset spectrum. Altcoins, which have been trading in sympathy, will see amplified moves. It’s a reminder that for all the talk of decentralization, crypto still dances to the tune of its two largest players—a dynamic that would make any traditional finance cartel blush with its efficiency.

The squeeze is on. This tightening volatility isn't a sign of a dead market; it's the market gathering energy. The next major move is being set up right now in the quiet, narrow ranges. All that's left is for someone to light the fuse.

The final quarter has historically been a constructive phase for crypto markets, with December often marking the start of renewed upside momentum. In past cycles, the Bitcoin price has used this period to break prolonged consolidations and reverse bearish trends, while the ethereum price follows. This year, however, that seasonal playbook is failing. Despite multiple attempts, bulls have struggled to force a decisive breakout, keeping volatility compressed and traders alert for what comes next.

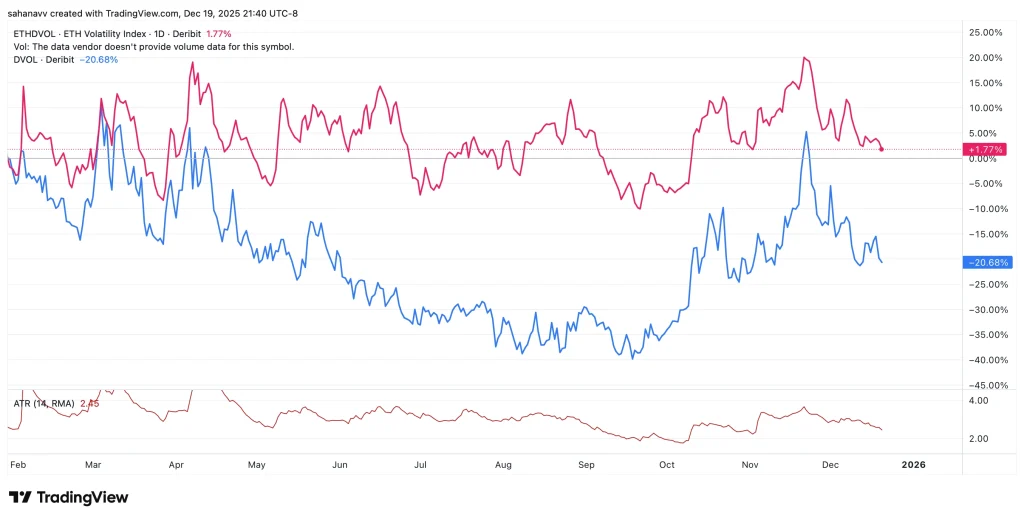

Volatility Is Compressing Across BTC & ETH

The chart shows that the expected price movement in both Bitcoin and ethereum is falling. In simple terms, traders are expecting smaller moves, and the market has become unusually quiet. This is also visible on price charts, where daily candles have become smaller, and the price keeps moving inside the same range. Prices move each day—they have also dropped, confirming that daily swings are getting smaller.

This slowdown is confirmed by the Average True Range (ATR), which measures how much the price moves each day. As ATR drops, it tells us that daily swings are shrinking. When both expected movement and actual movement fall together, it usually means the market is pausing rather than trending.

Historically, these quiet phases do not last long. Positions start building up on both sides, stopping the cluster NEAR critical levels, and liquidity slowly accumulates. Once the price breaks out of the range and holds, movement tends to return quickly. For traders, this is a period to stay patient, mark key levels, and wait for the market to show its next direction.

Key Price Ranges That Will Decide the Next Move

With volatility compressed across both Bitcoin and Ethereum, price is being contained within well-defined ranges. These levels matter because volatility usually returns after price breaks out and holds beyond them.

Bitcoin (BTC)

- Upper resistance zone: $87,800–$88,500

- Lower support zone: $84,200 – $83,500

As long as bitcoin trades within this band, choppy and slow price action is likely. A sustained move and hold above resistance would signal renewed upside momentum. A clean break and acceptance below support would likely lead to faster downside moves as volatility expands.

Ethereum (ETH)

- Upper resistance zone: $3,000–$3,050

- Key support zone: $2,880 – $2,830

Ethereum continues to mirror Bitcoin’s behaviour, trading inside a tight range. Acceptance above the resistance zone WOULD suggest buyers are regaining control, while a failure to defend support would indicate that selling pressure is increasing rather than stabilising.

The Bottom Line!

Bitcoin and Ethereum have entered a phase where price is moving less, but importance is increasing. With volatility and daily ranges compressed, the market is no longer rewarding anticipation or aggressive positioning. Instead, it is quietly setting the stage for a shift in behaviour.

For traders, the focus now should be on how the BTC & ETH price reacts around key levels, not on predicting direction. Once Bitcoin or Ethereum breaks out of their current ranges and holds, volatility is likely to return quickly. Until then, patience, risk control, and preparation matter more than conviction.

Quiet markets do not stay quiet forever—but they often punish those who MOVE too early.