ETH Outpaces BTC as Whale Activity Surges: Is the Altseason Rally Imminent?

Ethereum isn't just holding its ground—it's gaining on Bitcoin. A fresh wave of accumulation from deep-pocketed investors is fueling the shift, turning heads across crypto markets.

The Whale Signal Everyone's Watching

Large-scale Ethereum purchases have spiked, marking a clear divergence from Bitcoin's recent flow patterns. This isn't retail FOMO; it's strategic capital repositioning. When wallets that move millions start stacking ETH over BTC, the portfolio rebalancing speaks louder than any analyst report.

Beyond the Dominance Chart

The ETH/BTC pair breaking higher acts as a classic risk-on barometer for the broader digital asset space. It suggests confidence is trickling down from the blue-chip crypto—a potential precursor to the speculative frenzy that defines an altseason. Traders are now scrutinizing every major altcoin for similar momentum, hoping to catch the wave early.

The Multi-Trillion-Dollar Question

Does this signal a sustained rotation into altcoins, or is it just another fleeting pump before capital retreats to the perceived safety of Bitcoin? One cynical take: it's the same old cycle—whales accumulate quietly, the narrative shifts to 'fundamentals,' and everyone else gets a masterclass in buying high just in time for the smart money to exit. Whether this marks the true start of an altseason or merely a well-orchestrated preview remains the multi-trillion-dollar question.

Ethereum (ETH) price has strengthened against Bitcoin (BTC) in the past few days. The large-cap altcoin, with a fully diluted valuation of about $408 billion, surged over 3% on Wednesday, December 10, to trade above $3,427 at press time.

Ahead of the last FOMC meeting of 2025, BTC price hovered around $92.4k. As such, the ETH/BTC pair has edged over 7% in the past three days to hover about 0.0367 during the mid North American trading session.

ETH Price Eyes Parabolic Rally Fueled by Whale Investors

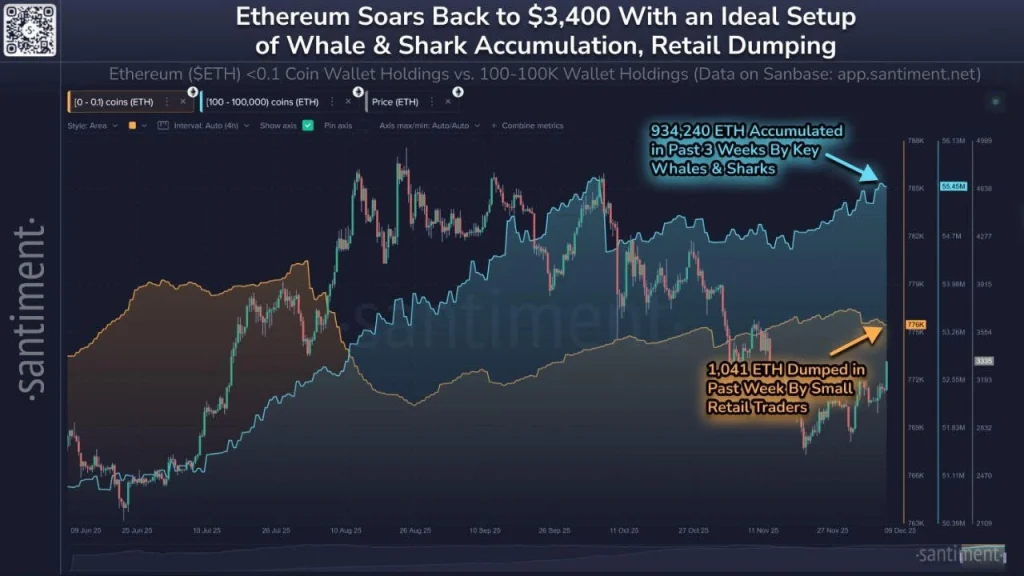

According to onchain data analysis from Santiment, the recent Ether price surge above $3,400 has been fueled by a renewed demand from whales amid retail dumping. During the past three weeks, Ethereum’s whales and sharks, with an account balance of between 100 and 100k coins, added 924,240 ETH, thus currently holding around 55.45 million coins.

On the other hand, retail investors, with an account balance of below 0.1 ETH, have sold 1,041 coins in the past week. Historically, Santiment has shown that a renewed demand from whales amid capitulation of retail investors has resulted in a bullish outlook.

Is Altseason Next?

The ongoing bullish thesis for ethereum has signaled a potential parabolic rally for altcoins in the near term. Moreover, capital rotation from Bitcoin to Ethereum and the wider altcoin market has surged fueled by a clearer regulatory outlook.

The ratio ETH/BTC is key to watch![]()

– this ratio has been rising the past few weeks, reflecting $ETH fundamentals strengthening

– assume fair value $BTC $200k

– if ratio recovers to 8-yr avg, implies $12k $ETH

– if ratio recovers to 2021 high, implies $22k $ETH

See the… pic.twitter.com/2yYTv6UkjI

According to Tom Lee, a major Ethereum believer and holder through BitMine, the ETH price is likely to reach $12k on average and $22k on the upside in the coming months. Such a scenario would trigger a parabolic rally for the wider altcoin market.