XRP Primed for Explosive Move as Exchange Balances Crash 45%

XRP is coiled for a major price swing. The catalyst? A massive 45% exodus from centralized exchanges.

What the Exodus Means

When tokens flood off exchanges, it signals a shift from selling pressure to holding conviction. It's a classic supply squeeze setup—fewer coins available for quick sale often precede significant price movements. This isn't just shuffling; it's strategic positioning.

The Mechanics of a Squeeze

Liquidity dries up. Buy orders meet thinner order books. The result? Volatility spikes and price discovery accelerates. For XRP, a token with a history of dramatic rallies, these conditions are a powder keg. The market's moving assets to cold storage and private wallets, betting the next move is up, not down.

Timing the Tension

Markets hate uncertainty, but they profit from anticipation. The current drain creates a tangible imbalance. While traditional finance fiddles with spreadsheets, crypto markets move on pure supply and demand mechanics—sometimes it's refreshingly simple, even if the suits don't get it.

Watch the charts. When supply gets scarce, anything can happen.

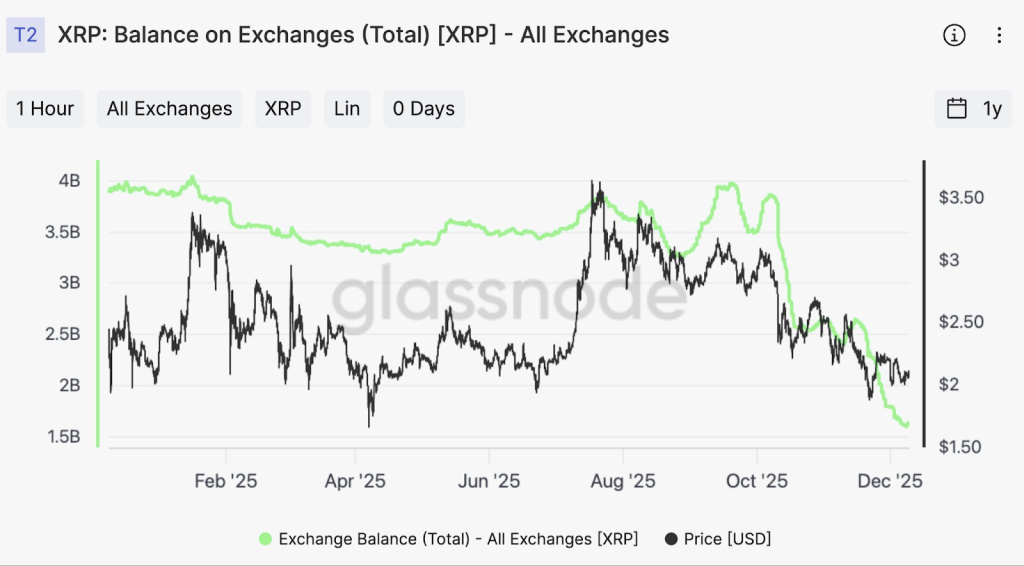

XRP is undergoing a major shift as over 1 billion tokens have moved off exchanges in just three weeks, according to Glassnode. Despite this large supply drop, the xrp price has stayed mostly flat, showing a clear gap between what’s happening with available supply and how the market is pricing XRP.

XRP’s total balance on exchanges has dropped sharply, falling from 3.95 billion tokens to around 1.6 billion. This represents a 45% decline in less than 60 days, with roughly 1.35 billion XRP removed from public exchange order books.

Historically, exchange balances show how much traders are buying and selling in the short term. When tokens leave exchanges in large amounts, it usually means they are being moved for long-term holding or private custody.

This kind of activity is rarely driven by retail traders and instead suggests liquidity is shifting away from public exchanges toward OTC desks, custody platforms, and institutional systems.

Institutional Adoption Reduces XRP Exchange Supply

Several recent developments back this view. In a short period, XRP has been included in multiple institutional filings and investment products. crypto index funds now carry meaningful XRP weightings, and new ETF-related filings explicitly mention the token.

At the same time, regulators have relaxed rules for banks engaging in crypto, while payment platforms have added easier ways to buy XRP. Together, these steps point to growing institutional integration, not short-term price speculation.

This kind of setup can change how prices move. When there is less XRP available on exchanges, even small buying pressure can push prices higher. With limited supply for sale, price moves tend to be quicker and more volatile once demand picks up.

XRP Price Predictions For Next 3 Weeks

XRP price is currently trading NEAR $2.05, consolidating within a symmetrical triangle pattern. According to Alicharts, this formation reflects a tightening range, with buyers stepping in at higher levels and sellers capping price advances at lower highs.

These patterns usually lead to a strong MOVE once the price breaks out. If XRP rises above $2.12–$2.15, it could trigger an upward rally, while a drop below $2.00 may cause short-term weakness.

For now, XRP is still moving sideways. However, with exchange liquidity falling, institutional activity increasing, and price tightening into a narrow range, the data suggests a major move is coming. The direction will depend on which side the price breaks out next.