ETF Flows Reveal Critical Divergence: XRP, ETH, and DOGE Send Conflicting Market Signals

Money talks—and right now, the exchange-traded fund data is shouting a complicated story. While the broader crypto market pushes toward new milestones, the capital flows for three major assets are painting a decidedly mixed picture. Forget the hype; the institutional tape tells a more nuanced tale.

The Flow Fracture

Institutional investment vehicles, those multi-billion-dollar gatekeepers of traditional capital, aren't moving in lockstep. The data reveals a clear split in sentiment. One segment is seeing consistent accumulation, a quiet bet on long-term infrastructure. Another faces persistent outflows, as short-term traders take profits or rotate positions. The third? It's trapped in a state of volatile indecision, flipping between inflows and outflows on a weekly basis. This isn't uniform bullishness; it's a strategic battlefield.

Decoding the Institutional Mindset

So, what's driving the divide? It boils down to narrative and utility. Assets with clear regulatory pathways and tangible use-case development are attracting steady, 'smart money' interest. The ones perceived as purely speculative or mired in legal uncertainty are watching capital flee at the first sign of turbulence. It's a brutal efficiency—Wall Street's version of 'show me the roadmap, or show me the door.'

The underlying message from the ETF desks is one of selective conviction. They're not just buying 'crypto'; they're funding specific theses on blockchain's future. Some bets are being doubled down on, while others are being quietly trimmed. This creates powerful tailwinds for some and invisible headwinds for others, all while the public focuses on price alone—a classic case of watching the ticker, not the ledger.

Ultimately, these flows are a leading indicator, often preceding major price moves by weeks. The current divergence suggests a coming shakeout. When the music stops, the assets with strong institutional backing will likely have a chair. The rest? They might be left standing—a sobering reminder that in modern finance, even revolutions get a quarterly performance review.

This week’s Top crypto analysis reveals a shifting dynamic across XRP, Ethereum, and Dogecoin as ETF inflows and outflows reflect market-wide bearish sentiment. Although XRP ETF products continue to see positive momentum throughout the week, ETH and DOGE ETFs remain under pressure. Many are watching this data, having expectations that it will be reflected in price action, so let’s examine which ETF is stronger and how it influences the price movements of its respective assets.

ETF Inflows Show Divergence Across Leading Assets

In the latest ETF data, XRP stands out as the only asset among the three to register consistent inflows, even while the broader crypto market experiences sustained declines. Despite these positive movements into XRP ETF products, the XRP price chart continues to slide because the overall market trend remains firmly bearish.

Top Alts #ETF data this week DEC1-DEC5

US spot #ETH ETF

US spot #XRP ETF

US spot #SOL ETF

US spot #DOGE ETF

Refer screenshots From SoSoValue to understand.#crypto #altcoins pic.twitter.com/QrMjz50Qps

XRP ETF holdings represent only 0.71% of the total market cap, with net assets near $861 million and cumulative inflows of $897 million. Though they are strong numbers, but not yet large enough to influence xrp price USD in isolation.

Similarly, DOGE ETF inflows remain too small to generate meaningful impact. Total net assets account for just 0.02% of the dogecoin market cap, amounting to roughly $5.51 million.

Although the week recorded inflows, but this contribution is minimal, keeping the Doge price aligned with broader market direction rather than ETF-driven momentum.

Both XRP and Doge are therefore moving with market sentiment, not against it highlighting that positive inflows alone are insufficient unless supported by deeper liquidity and stronger capital rotation.

Ethereum ETF Trends Reflect Strong Market Influence

In contrast, the ETH ETF landscape paints a very different picture. With nearly two years of history, Ethereum’s ETF ecosystem holds a much larger footprint, representing 5.19% of Ethereum’s market cap and totaling $18.94 billion in net assets. The cumulative total net inflow of $12.88 billion is significantly multifold times higher than XRP and DOGE combined, meaning movements in ETF flows materially influence the ETH price USD and overall altcoin market strength.

This week, however, the ETH ETF market reflected persistent bearish control. Most days recorded outflows, except December 3rd. This was the only session showing inflows tied to Ethereum’s Fusaka (Fulu-Osaka) upgrade aimed at improving scalability. This single green day stands out amid otherwise negative ETF activity, contributing to notable pressure on the Ethereum price chart and weakening the short-term ETH price prediction outlook.

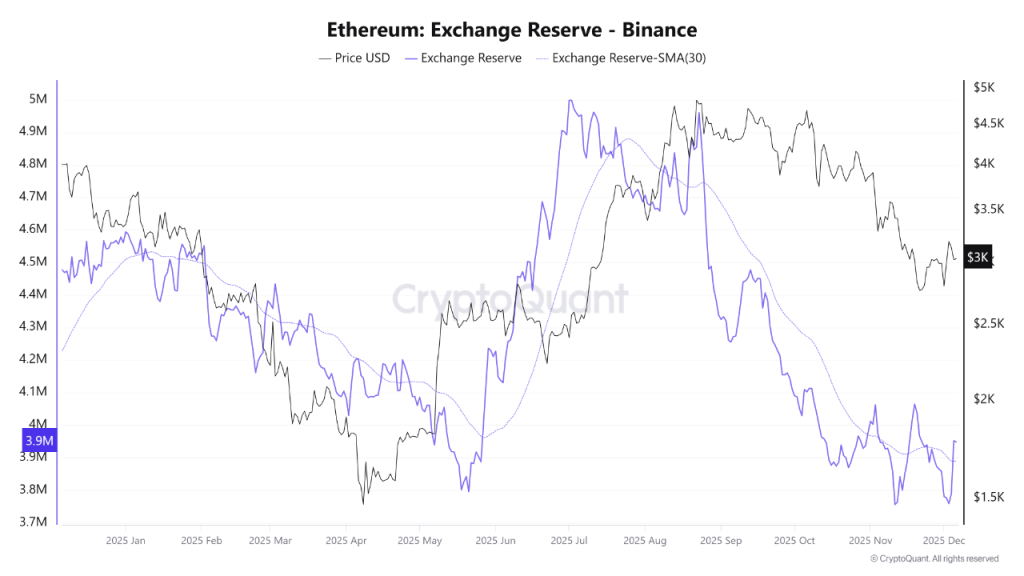

With ethereum Binance reserves rising, additional selling pressure appears to be leaning toward the downside.

Critical Support Levels Define Next Moves

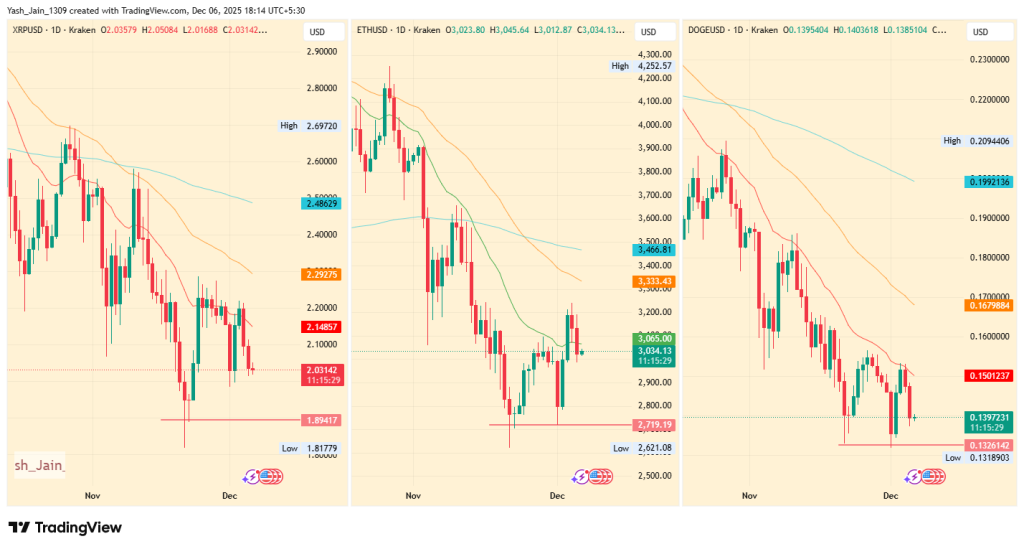

Technical structure across all three assets underscores the market’s fragility. Each of ETH, XRP, and DOGE is now trading below the 20-day EMA, signaling short-term bearish continuation.

For XRP/USD, $1.89 remains the key demand zone losing it could accelerate declines.

Meanwhile, the DOGE price USD must hold support at $0.1326 to avoid a deeper correction. As for Ethereum, maintaining levels above $2719 is crucial; a breakdown here could trigger significant weakness across the broader altcoin market.

These converging technical and ETF indicators reinforce the cautious sentiment highlighted in this week’s Top crypto analysis, especially as market momentum still favors the downside.

Altogether, ETF behavior, market-wide sentiment, and key support structures continue to define this week’s Top crypto analysis, giving traders a clearer view of how ETH, XRP, and DOGE may react in the sessions ahead.