Crypto Fear Index Plunges to Extreme Lows: Is Bitcoin’s Bull Run Over?

Panic's grip tightens across digital asset markets as the Crypto Fear & Greed Index hits rock bottom—a psychological indicator flashing red while traders scramble for answers.

Decoding the Dread

That sinking feeling isn't just indigestion from late-night chart-watching. The Fear Index, a composite of volatility, market momentum, social media sentiment, and surveys, has cratered into 'extreme fear' territory. Historically, these depths have signaled capitulation—the point where weak hands fold and assets get dumped at fire-sale prices.

Beyond the Bitcoin Headline

While all eyes fixate on Bitcoin potentially entering bear market territory, the real story unfolds in the derivatives markets. Funding rates are turning negative, open interest is shrinking, and the put/call ratio is skewing heavily toward protection. It's the sophisticated money preparing for stormy weather, not just retail panic.

The Contrarian Playbook

Seasoned crypto veterans are whispering a different tune. They've seen this movie before: maximum fear often coincides with long-term opportunity. The same metrics screaming 'sell' to the crowd are being parsed as potential accumulation signals by institutions with longer time horizons and colder blood. After all, Wall Street's old adage—'be fearful when others are greedy, and greedy when others are fearful'—was practically invented for crypto's manic cycles.

Regulatory Shadows & Macro Winds

External pressures aren't helping. Hawkish central bank chatter about rate hikes makes high-risk assets less appealing, while regulatory bodies globally are sharpening their pencils—and their enforcement actions. It's a classic risk-off environment, and crypto, still painted as the speculative frontier, takes the first hit. Nothing like a potential regulatory crackdown to make leveraged longs sweat.

So, is this the end of the bull market, or just another brutal shakeout? The charts will decide. But one thing's certain: when the Fear Index hits these extremes, the next big move is rarely boring. Just ask the hedge fund managers currently revising their quarterly projections downward over very expensive coffee.

The crypto market is very scared right now. The Fear and Greed Index is at 21, and it was even lower at 10 before. Fewer people are searching for Bitcoin on Google, and many investors have become careful after the big crash on October 10.

With interest dropping and ETF flows reversing, everyone is asking, is this just a correction or the start of a real bear market?

Crypto Market Index Hits Extreme Fear

According to recent market data, the October 10 crash was the main reason sentiment fell to record lows of 10, triggered by surprise U.S.–China tariff war news.

Following the announced Bitcoin price fall from $126,000 to $98,000, wiping out over $19 billion in leveraged trades. Meanwhile, the major altcoins like SOL, XRP, etc, fell more than 40% within hours.

Due to this crash, crypto order books became very thin. Market makers removed liquidity to avoid more losses, ETF inflows turned into outflows, and global demand for digital assets weakened.

With most investors staying cautious, fear has dominated the market for several weeks.

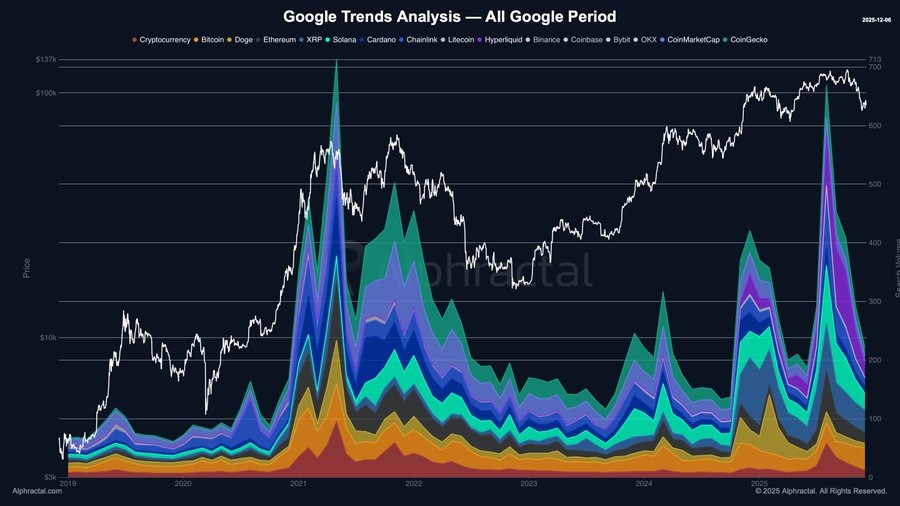

Investors Show Declining Interest as Google Searches Drop

Though markets have stabilized somewhat as the crypto greed & fear index has climbed slightly to 21, but the market is still DEEP inside the fear zone.

Meanwhile, retail interest around crypto, tracked via global Google Trends for “crypto,” “Bitcoin,” and related searches, has dropped back to levels seen during previous mid-cycle corrections.

According to market traders, such periods of low interest and high fear often mark an accumulation zone, times when savvy investors quietly build positions while the crowd remains pessimistic.

Is This a Bear Market or Mid-Cycle Reset?

Even with growing panic, analysts are divided. Crypto trader KillaXBT says Bitcoin is still repeating the same pattern it shows after every recent FOMC week. This time, Bitcoin briefly moved above $95,000, then dropped about 5% and is now near $90,000.

He expects the next key MOVE to happen around December 10–11 based on the latest FOMC data.

Despite all the Nasdaq, silver, and S&P 500 all moving higher, bitcoin is heading in the opposite direction, down 3% today, marking the first time since 2014 that the market has dropped while traditional assets climbed.