Crypto Market Shakeout: Bitcoin Plunges to $86K Amid $637M Liquidation Storm

Digital asset markets just got a brutal reality check. A massive wave of liquidations swept through cryptocurrency exchanges, wiping out leveraged positions and sending Bitcoin tumbling to $86,000.

The Domino Effect of Forced Selling

When prices drop sharply, over-leveraged traders get margin calls. Their positions are automatically closed—or liquidated—to cover losses. This forced selling creates a cascade, pushing prices down further and triggering more liquidations. That's the vicious cycle that just erased $637 million from the market in a matter of hours.

Anatomy of a Flash Crash

This wasn't a slow bleed. It was a high-velocity flush. The $637 million figure represents the total value of positions that were automatically unwound by exchanges. The majority were long bets—traders betting on prices going up—who got caught on the wrong side of a sudden downturn. It's a stark reminder that in crypto, the market can giveth, and the market can violently taketh away.

Navigating the Volatility

For seasoned players, these events are part of the landscape—painful, but not unexpected. They highlight the critical importance of risk management in an asset class known for its breathtaking swings. Using excessive leverage is like building on sand during a hurricane; it might work until the storm hits. Meanwhile, traditional finance pundits will likely use this as another excuse to tout the 'stability' of their 2% yielding bonds.

The dust hasn't settled. While the immediate liquidation frenzy has subsided, the psychological impact lingers. This shakeout weakens weak hands, tests conviction, and sets the stage for the market's next move. One thing's certain: complacency just got a $637 million dollar bill.

The market witnessed a sudden crypto crash in the last 24 hours, with Bitcoin plunging from $92,000 to $86,000. The sharp drop triggered more than $637 million in liquidations across major cryptocurrencies. While the fall looked dramatic, analysts say the sell-off was largely caused by global macro turbulence, not internal crypto weakness.

Why the Crypto Crash Happened

Japan’s Rate Shift Sparked Global Panic

Today’s crypto crash began after the Bank of Japan signaled a 76% chance of raising interest rates on December 19, pushing Japan’s 2-year bond yield to 1.84%, the highest since 2008. This move threatens the long-running yen carry trade, where traders borrowed cheap yen to invest in higher-yielding global assets. As borrowing costs rise, traders unwind positions and pull money out of risk assets like Bitcoin, fueling the crypto crash.

Trading Algorithms Accelerated the Sell-Off

The crash intensified as the new day, week, and month began. Resetting trading algorithms fired simultaneously, causing instant selling across the market. This wasn’t emotional behavior; it was automated portfolio rebalancing and risk reduction, adding fuel to the ongoing crypto crash.

Capital Returning to Japan and China Tightened Liquidity

As Japanese yields rise, money naturally flows back home. At the same time, Japan and China are purchasing less U.S. debt. This reduces global liquidity, creating pressure on all risk assets, including crypto, and contributing to the sharp market downturn.

Technical Volatility Made the Crypto Crash Worse

Monthly and weekly candle closes added another LAYER of volatility. There was no major negative news within crypto today. Instead, several global and technical factors aligned, turning a normal pullback into a full crypto crash.

$637M Liquidated as the Crypto Crash Deepens

The ongoing crypto crash resulted in more than $637.57 million in liquidations over the past 24 hours. Long positions took the biggest hit, losing $567.96 million, while short positions lost $69.61 million.

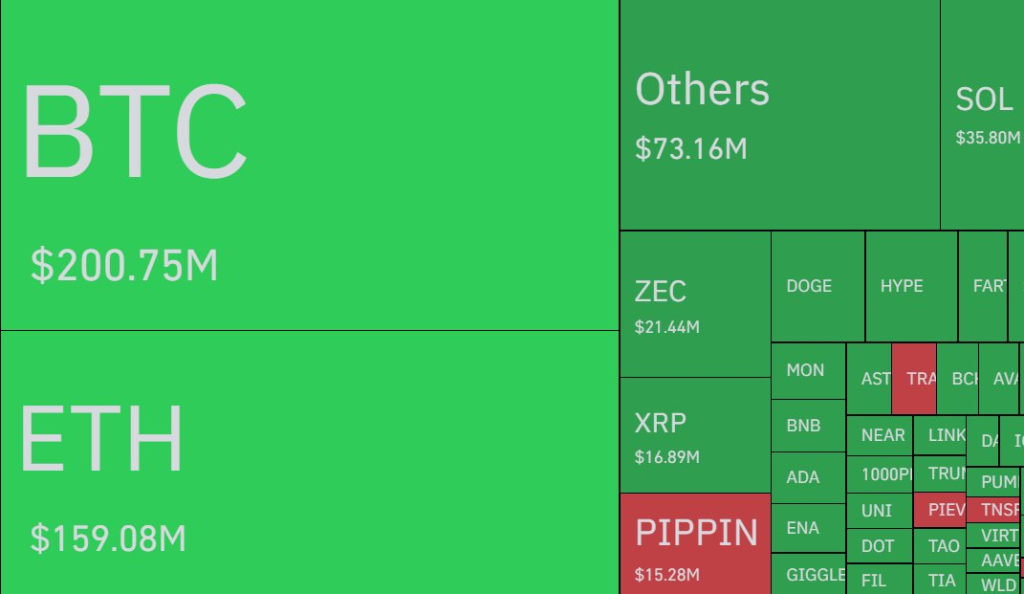

Bitcoin saw more than $200 million in liquidations. ethereum faced losses of around $159 million, while Solana recorded about $35 million in liquidations. XRP and other altcoins also came under pressure, with ZEC and PIPPIN witnessing notable liquidation spikes.

Liquidations surged sharply between the 4-hour and 12-hour windows, jumping from $15 million to over $578 million, showing how quickly the crypto crash intensified once selling momentum began.