AAVE Primed for 2x Surge as On-Chain Metrics Shatter All-Time Highs

DeFi's sleeping giant wakes up swinging.

AAVE isn't just ticking up—it's rewriting the playbook. On-chain growth just punched through record levels, signaling what could be the start of a parabolic move. We've seen this story before in crypto: when network activity detonates, price usually follows.

The 2x breakout thesis isn't hopium—it's simple math. More users, more transactions, more value locked. The numbers don't lie (though Wall Street analysts might).

This isn't 2021's reckless bull run. Today's surge comes with actual fundamentals—the kind that make traditional finance bros clutch their Excel sheets. AAVE's protocol isn't just surviving the bear market; it's evolved into a lean, yield-generating machine.

Will the breakout hold? If history's any guide—and in crypto, it's the only guide that matters—we're watching the birth of a new uptrend. Just try telling that to your financial advisor still waiting for 'the blockchain fad' to die.

The Aave Price continues to lag behind its on-chain strength despite record-breaking fundamentals. With Aave’s network registering all-time highs in revenue and deposits, momentum is quietly building beneath the surface. As indicators flip bullish and real-world asset (RWA) growth surges, traders are watching closely for a potential breakout in AAVE/USD.

AAVE Fundamentals Reach New Heights

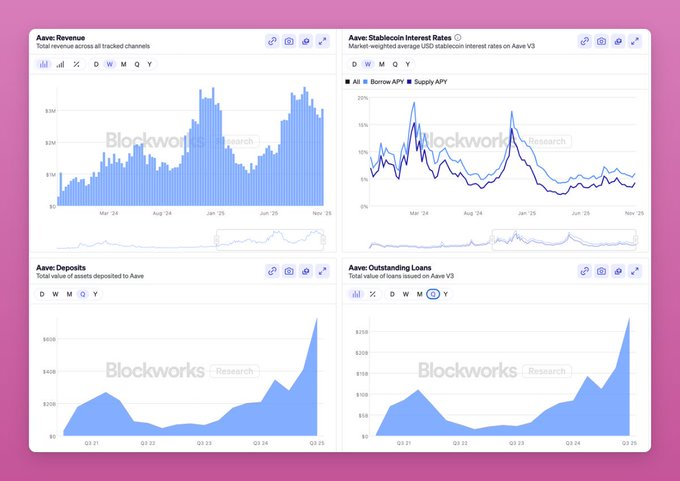

On every major on-chain metric, Aave crypto is hitting fresh highs. Weekly revenue has surged past $3 million, while total deposits crossed an impressive $56 billion, reflecting strong ecosystem confidence and DeFi liquidity inflows. Yet, despite these record figures, the AAVE price chart shows the token still trading 66% below its 2021 all-time high and nearly 40% down since December 2024.

This disconnect between network growth and token performance has drawn attention from long-term investors. Historically, such divergences often precede sharp recoveries, especially when underlying fundamentals continue to strengthen.

RWA Expansion Sparks Institutional Momentum

The fastest-growing segment of Aave’s ecosystem is its Horizon RWA market, which skyrocketed 268% in just 30 days, adding $347 million in new deposits. This rapid expansion signals the growing institutional interest in tokenized real-world assets within decentralized finance. As AAVE continues to scale its RWA integrations, the platform is positioning itself as a leading bridge between TradFi and DeFi.

Horizon, @aave's RWA market, grew by 268% in the last 30 days.![]()

That's $347M worth of deposits in 30 days.

Unarguably the fastest-growing RWA product in the market.

Trillions. pic.twitter.com/5By3WVUWpz

The surge in RWA activity could be a catalyst for broader market repricing, particularly if the platform sustains its current growth trajectory into the next quarter.

Technical Structure Points to Major Upside

From a technical standpoint, the Aave price chart reveals a strong setup for a potential rally. The token is currently retesting the lower boundary of a long-term parallel channel, which has historically marked key reversal zones.

If the current support holds, the AAVE price prediction targets a rise toward $450, representing over 100% upside from the current level of $218.

Additionally, momentum indicators such as the TD Sequential buy signal on the weekly timeframe add confluence to the bullish case.

TD Sequential has flashed a buy signal for $AAVE! pic.twitter.com/yNnz1AUg8Y

— Ali (@ali_charts) November 12, 2025These signals, coupled with the on-chain growth, suggest that AAVE crypto could be on the verge of a breakout rally if broader market sentiment remains supportive.

Market Outlook and Current Performance

As of mid-November 2025, AAVE price today hovers NEAR $218, maintaining stability despite broader market volatility. With DeFi activity climbing, and new liquidity entering RWA products, traders are closely watching for confirmation of a reversal pattern.

Should buying pressure increase, a sustained MOVE above $250 could ignite a powerful bullish leg, setting the stage for a renewed uptrend in AAVE/USD.

The growing gap between on-chain success and market valuation reinforces the notion that the AAVE price forecast 2025 might soon turn decisively upward.