Ethereum Primed for 10X Explosion by 2026 – Here’s Why Traders Are Loading Up

Ethereum's price action is setting up for a historic breakout—and institutional money is starting to notice.

Why 2026 could be ETH's year

With key upgrades finally complete and institutional ETFs likely approved by then, analysts see a perfect storm brewing. That 10x prediction isn't just hopium—it's math based on previous cycle multiples. Though let's be honest, Wall Street will still find a way to take 30% in fees before retail sees a dime.

The smart money's already positioning

Futures open interest is creeping up while staking yields remain juicy. Even the SEC's usual foot-dragging can't stop this freight train. Just don't expect your traditional finance buddies to admit they missed the boat... again.

While most traders are chasing short-term market pumps, a quiet structural shift is taking place behind the scenes, and it’s forming around Ethereum. According to 10x Research, stablecoin inflows and staking activity are showing signs of a major structural setup that could shape Ethereum’s next big MOVE heading into 2026.

Liquidity Is Returning to Ethereum

Despite Ethereum’s slow price performance in recent months, on-chain liquidity tells a very different story.

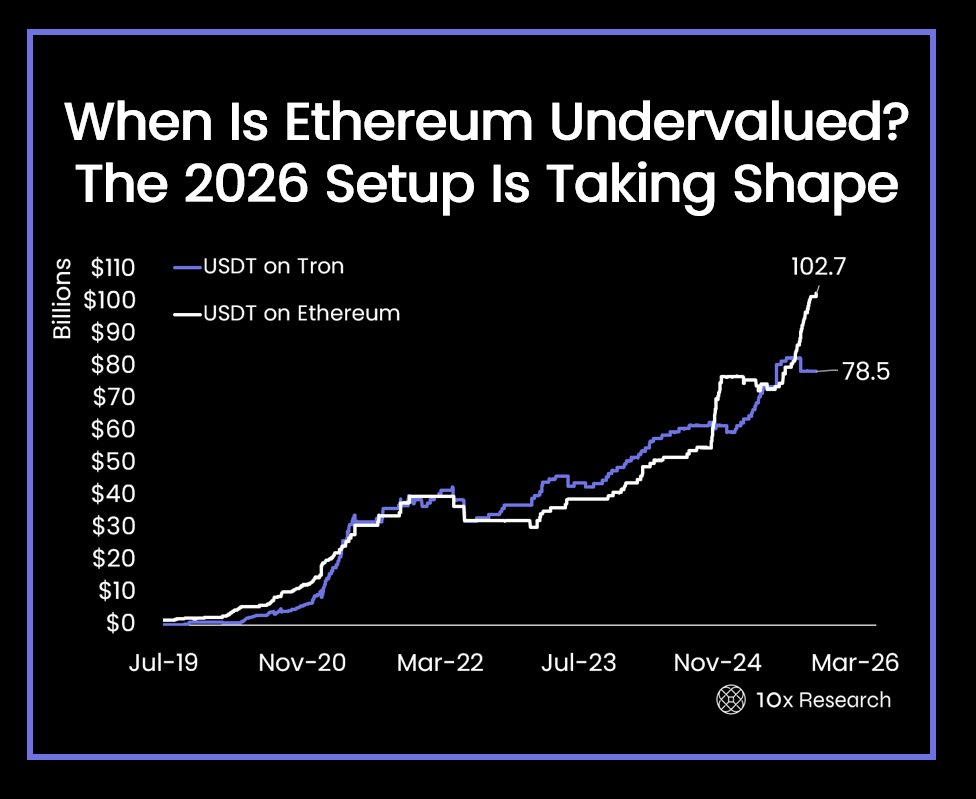

Data from 10x Research shows that USDT (Tether) supply on ethereum has surged from $54 billion to over $102 billion since President Trump’s election. That’s almost a doubling of liquidity, quietly flowing into Ethereum’s ecosystem while market attention remains elsewhere.

Meanwhile, Tron, which had long dominated stablecoin activity due to lower fees, is now falling behind. The steady rise in Ethereum-based USDT suggests that capital is shifting back to the Ethereum ecosystem, potentially laying the groundwork for a major recovery phase.

Institutional Eyeing For Ethereum

Behind this liquidity shift is a broader regulatory and institutional trend. U.S. crypto policy under the new administration has started to favor transparent, on-chain activity, a development that plays directly into Ethereum’s strengths.

At the same time, major staking providers like P2P Validator, which oversees more than $10 billion in assets, are making staking easier and more secure for institutional investors.

This is helping Ethereum become the hub for both liquidity and yield, a combination that could strengthen price momentum once market confidence grows.

The 2026 Setup Is Forming

While price charts may still look dull, the network’s fundamentals, liquidity, staking, and policy support are aligning for what could be a massive breakout phase by 2026.

Ethereum might look quiet for now, but history shows that the biggest moves often begin in silence.

As of now, ETH is trading around $3,580, holding well above the $3200 resistance level. If the recovery continues, resistance levels to watch are $3,650, $3,710, and potentially $3,920.