Crypto Primed for ’Rubber-Band’ Rebound Against Gold and S&P 500, Santiment Analysis Reveals

Crypto markets get crushed—but analysts spot the setup for a major snap-back rally.

The Great Divergence

Digital assets dramatically underperform traditional safe havens and equity indices. Gold glitters while crypto craters. S&P 500 climbs as Bitcoin stumbles. The performance gap stretches to extremes not seen in months.

Rubber Band Theory in Action

Santiment's metrics flash contrarian signals. Extreme underperformance creates coiled-spring conditions. Market sentiment hits levels that historically precede violent reversals. The analytics firm predicts the snap-back could be dramatic.

When Fundamentals Don't Matter

Traders watch technical indicators trump news flow. Oversold conditions reach fever pitch. Liquidations flush out weak hands while whales accumulate quietly. The stage sets for what could be one of crypto's signature whipsaw moves.

Because nothing says 'mature asset class' like predicting price movements based on metaphors from office supplies.

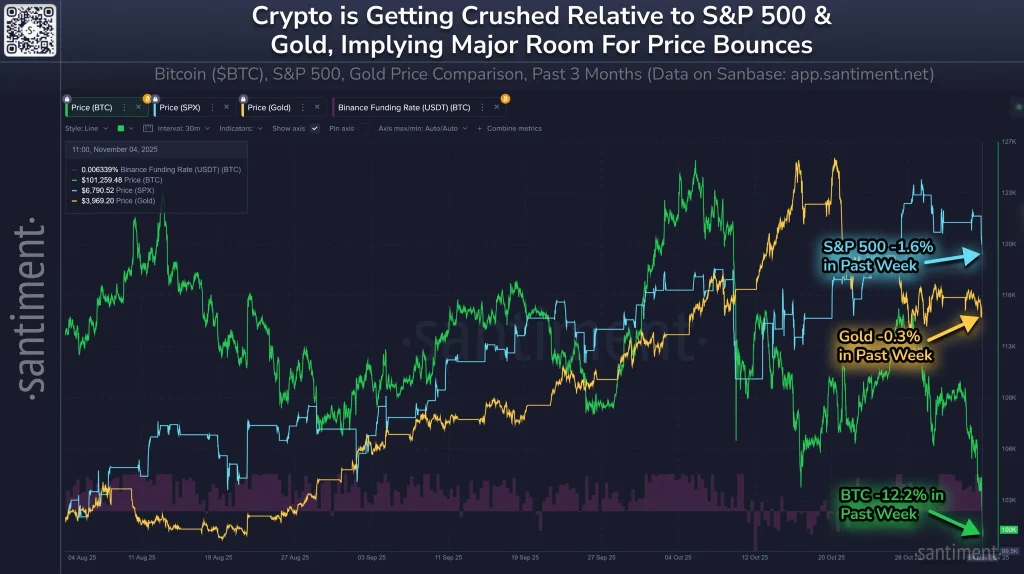

The multi-month correlation between the crypto market and the S&P 500 is fast slipping away. During the past week, the S&P 500 dropped approximately 1.6%, gold shed less than 1%, while the crypto market dumped over 12% during the same period.

The wider crypto market recorded significant losses during the last 24 hours led by Bitcoin, which teased below $100k on Tuesday.

Source: Santiment

What’s Next for Crypto Amid Significant Divergence from the S&P 500

According to Santiment, the crypto market is well-positioned to rebound after hitting oversold levels. A potential rebound for the S&P 500 is likely to influence the wider crypto market with a relief rally as traders bet on a midterm rebound.

Furthermore, the crypto market has accumulated significant positive fundamentals in the recent past including clear regulations in major jurisdictions amid high demand from institutional investors. Additionally, the upcoming Fed’s Quantitative Easing (QE) will build on the rising global liquidity, which is bullish for crypto.

“This sharp underperformance suggests that crypto markets may have become oversold. Extreme volatility in crypto often leads to a “rubber-band” effect, where traders’ capitulation can lead to a huge bounce-back once selling pressure subsides,” Santiment noted.

BTC price trends on ‘bear market’ levels; Here are Key Levels

From a technical analysis standpoint, the BTC/USD pair must rebound from its weekly 50 Simple Moving Average (SMA) to invalidate further capitulation.

Source: X

According to market analyst Aksel Kibar, BTC price, in the weekly timeframe, cannot fall below $98k as it will invalidate the midterm bullish sentiment.