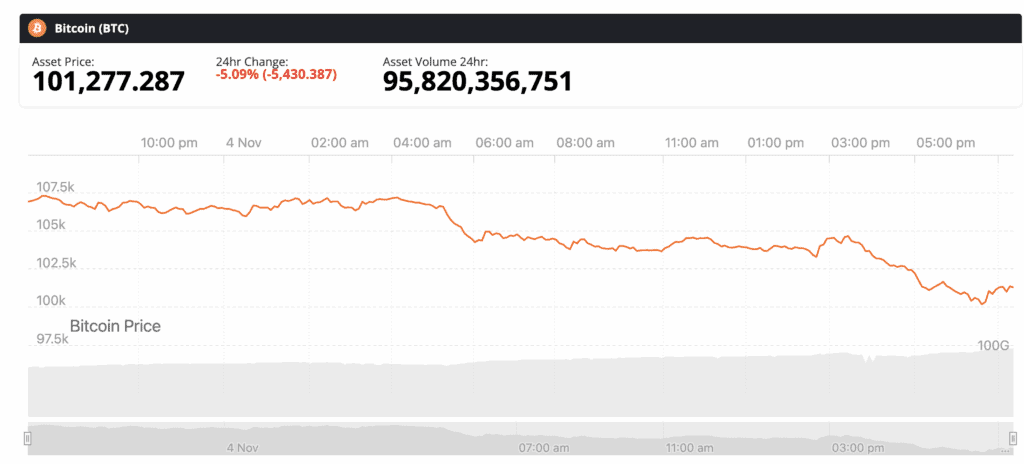

Bitcoin Plunges Below $100K — Time to Buy the Dip or Brace for More Pain?

Bitcoin's brutal correction continues as it slices through the psychological $100K barrier—a level not seen since the 2024 halving rally. Traders scramble as the king crypto tests key support levels, leaving the market to wonder: capitulation or consolidation?

Blood in the streets—or just another shakeout?

With leveraged longs getting liquidated at a pace not seen since the 2022 bear market, derivatives traders are getting a masterclass in volatility. Meanwhile, Bitcoin maximalists point to the 200-week moving average holding strong at $92K—because this time it's 'different,' obviously.

The real question isn't whether this is the bottom—it's whether Wall Street's latest 'digital gold' narrative survives another 20% drawdown. After all, nothing builds conviction like watching your portfolio turn the same shade of red as a traditional bank's balance sheet.

That’s a nearly 6% daily dip, 12% weekly dump, and 18% slide over the last month, which is a fancy way of saying Uptober turned into “Honey, where’s the cold storage?” season. All this after printing fresh ATHs above $126K in early October.

Big round numbers are emotional landmines in Bitcoin. $100K? That’s the psychological equivalent of the “Are we there yet?” moment on a family road trip — and when it snapped, the outflows and liquidations came hard and ugly. Just in the past 24 hours? $1.3 billion in liquidations, with ~$470M from Bitcoin longs alone.

Bitcoin is currently sitting at $101,000, Source: BNC

Where’s the Bottom? Traders Betting on $88K–$95K Zone

If $100K doesn’t hold, the liquidity desert below is real. If $100K was a trap door instead of a trampoline, prepare yourself emotionally for a slide toward the $88K–$95K neighborhood. And yes, there’s a liquidation heatmap backing that thesis — Hyblock data shows Leveraged longs lined up like sitting ducks down to around $88K, with not much liquidity cushioning the ride.

Analyst Dave the Wave wrote that “there’s the dip to 100K and the retest of the 1-year moving average. This is a crucial juncture – bulls wanting to see a MOVE up from here, otherwise likely to go into extended consolidation.” Source: X

The Melker Doom Model: Lose the 50-MA → Say Hello to 200-MA

Scott Melker dropped a historical gut-check: bitcoin has lost its weekly 50-MA as support four times. Each time? We eventually kissed the 200-MA like it owed us money. And guess where that long-term MA currently sits?

“Price is currently $700 above the 50MA. The 200 MA is sitting around $55,000 (and rising).”

Look, nobody wants to hear “$55K Bitcoin” after we were popping champagne above $120K just weeks ago. But markets don’t ask for your feelings. They eat them for breakfast.

Who Pulled the Trigger? Institutional Pain Everywhere

One circulating theory: someone big blew up during the October 10 washout, where ~$20B in BTC positions were liquidated. Think hedge funds, market-neutral geniuses, structured product chads — whoever they are, they’re vomiting inventory into the market as we speak.

Altcoins? Worse. Much Worse.

If Bitcoin got slapped, the alts got straight-up punched in the teeth.

- ETH: −10%, now sub-$3,300

- XRP: −7.5% to ~$2.17

- SOL: −8% to ~$154

- DOGE: −7% to ~$0.157

Macro Blame Game: TGA, Repo Stress, Government Weirdness

Macro folks are pointing fingers at the U.S. government’s Treasury General Account refill — which quietly hoovered ~$700B of liquidity from markets during the shutdown mess. Combine that with record repo facility use and you’ve got a slow drain turning into a sudden plunge.

So… Is the Party Over?

Short answer: no. Longer answer: this is Bitcoin — volatility is not a bug, it’s the product.

Yes, we could see $95K. Maybe even a heart-stopping wick into the high-80s. And yes, the market may need to finish washing out whoever just got margin-baptized in gasoline.

But capitulation is how bottoms form. That’s the dirty secret. As long as retail is panic-selling and institutions are stress-sweating, the long-term thesis hasn’t changed one atom.

If anything, this is the market removing leverage tourists and TikTok “crypto strategist” influencers. Brutal? Sure. Necessary? Definitely. Bull markets don’t die with a bang — they sag, shake, and clean house.