Fed Rate Cuts Ahead: 50% of Policymakers Project Two Additional Reductions by End-2025

Monetary Policy Shift Signals Bullish Environment for Risk Assets

The Federal Reserve's internal projections reveal a significant pivot—half of all voting members now anticipate implementing two extra interest rate cuts before 2025 concludes. This dovish turn marks the most substantial policy shift since the post-pandemic tightening cycle began.

Market Implications: Liquidity Floodgates Prepare to Open

Traditional finance braces for impact as cheaper capital prepares to flow through the system. The coming liquidity injection could fuel the next leg of the digital asset rally—because nothing says 'responsible monetary policy' like printing your way out of trouble.

Digital Assets Positioned for Capital Inflows

With institutional money seeking yield in alternative markets, cryptocurrencies stand to benefit disproportionately from the Fed's accommodative stance. The timing couldn't be better for blockchain networks demonstrating real utility beyond speculative trading.

The countdown begins—twenty-seven months until the financial landscape transforms completely.

Today’s all eyes are on the Fed Chair Jerome Powell who will speak today at 8:30 a.m. EST. Meanwhile crypto traders are watching closely for hints about future rate cuts.

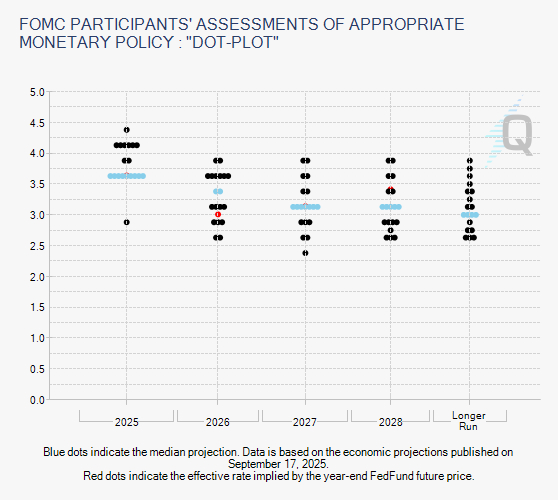

As recent Fed minutes show that 50% of the policymakers expect two more cuts by the end of 2025, a sign of a possible policy shift that could boost the next crypto rally.

Fed Split Over Forward Rate CutsFor the first time Fed reduced interest rates by 25 basis points last month, lowering the federal funds rate to a range of 4.00% to 4.25%, committee remains split on the pace and extent of further easing.

The September FOMC “dot plot” shows a clear split. 50% of the policymakers expect two small rate cuts to bring interest rates closer to normal. The others remain cautious, worried that inflation could return if Trump’s tariff plans push prices higher.

Right now, rates sit between 4.00% and 4.25%, with markets already pricing in cuts for October and December. That means investors aren’t entirely surprised, but the official confirmation of dovish leaning still matters.

On top of it, Coinpedia news reported that Governor Stephen Miran advocated for a more aggressive 50bps (0.50%) cut, citing softening job market data and underlying inflation nearing the Fed’s 2% target

Shutdown and Labor Market Concerns

Adding to the Fed’s tilt is the ongoing government shutdown, which started on October 1, 2025, has completely sidelined nearly 750,000 workers daily, and disrupted economic data reporting.

This “data vacuum” creates uncertainty about the real strength of the labor market and overall economy, making it harder for the Fed to make confident decisions.

Why This Matters for Crypto

Low rates typically weaken the U.S. dollar and push investors toward higher-yielding assets. In past cycles, Bitcoin and ethereum have benefitted from similar outcomes, with BTC gaining over 5% in short windows when rate cuts were expected.

As of now, Bitcoin is trading around $123, slightly up in the last 24 hours, while Ethereum, currently hovering around $4383 it continues to attract institutional interest.