Massive Bitcoin Transfers Signal Market Shift—Profit Taking or Strategic Capital Rotation Ahead?

Whale movements shake crypto markets as billions in Bitcoin change hands

The Great Migration

Massive Bitcoin transfers are triggering alarm bells and excitement simultaneously across trading desks. While some see classic profit-taking behavior after recent gains, others detect sophisticated capital rotation strategies unfolding in real-time.Follow the Money

These aren't your average retail transactions—we're talking institutional-scale movements that could redefine market structure. The timing suggests either smart money positioning for the next leg up or whales cashing out at what they perceive as local tops.Market Mechanics Exposed

When Bitcoin moves in these quantities, it's never just about buying or selling. It's about collateral repositioning, yield optimization, and strategic portfolio rebalancing—the kind of moves that make traditional finance look like it's playing checkers while crypto plays 4D chess. Because nothing says 'sophisticated investment strategy' like moving digital assets between wallets while hoping the music doesn't stop.

Bitcoin’s on-chain activity has sparked fresh debate as a surge in large wallet movements suggests a potential shift in market positioning. Over the past 24 hours, several high-value Bitcoin transactions have been recorded. This indicates that whales may be either locking in profits or redistributing capital in anticipation of a broader market rotation. This sudden uptick in BTC transfers often precedes volatility phases, as traders assess whether the move signals institutional profit realization or strategic positioning for the next bullish leg.

With liquidity tightening across major exchanges, the coming days could reveal if these movements mark the start of a consolidation phase—or a setup for renewed upside momentum.

More Than $4B Worth of Bitcoin Moved

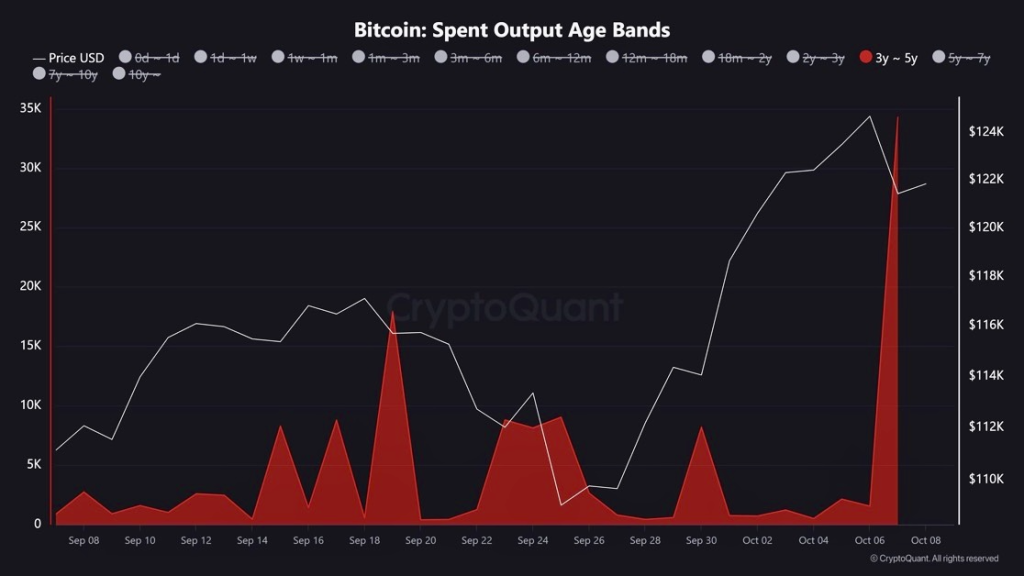

The latest on-chain data from CryptoQuant highlights a sharp rise in Bitcoin’s Spent Output Age Bands (3–5 years), revealing that long-term holders are increasingly moving their dormant coins. Such movements often occur during key market phases, signalling shifts in investor sentiment. With bitcoin recently hovering near local highs, this spike in aged coin activity suggests that early investors might be preparing for either profit realization or a strategic reallocation as the market braces for its next directional move.

The chart shows a significant increase in 3–5-year-old Bitcoin being spent, coinciding with a price pullback from the $124K region. This pattern indicates that long-term holders—who accumulated during earlier cycles—are becoming active, often a precursor to rising short-term volatility. If these transactions represent selling, a short-term correction could follow as profit-taking intensifies. However, if the coins are being moved for repositioning or custodial shifts, it may instead mark capital rotation, setting up for the next market accumulation phase.

What’s Next? Will This Drag the Bitcoin Price Lower?

Just before the monthly close, Bitcoin bulls triggered a strong rebound and lifted the levels above the bearish influence. This further led the rally towards a new ATH of around $126,199, followed by a period of consolidation. Unfortunately, this consolidation resulted in a significant pullback, marking an intraday low of around $120,574. However, the bulls appear to have initiated a rebound, but the question arises whether the token is in a state of recovery or whether it is a short-term rise.

As seen in the daily chart, the Bitcoin price continues to remain within a rising parallel channel. Therefore, the current pullback could be another opportunity for the bulls to enter at the lows and push the rally higher. Considering the Accumulation/Distribution, it suggests that the price has again entered an accumulation phase as the indicator has displayed a bullish divergence. Meanwhile, the RSI has also displayed a similar action, validating the bullish claim.

Now that the volatility is set to rise, the average range of the channel at $118,600 may act as a strong support for the Bitcoin (BTC) price to reach the interim target at $128,000.