Swedish MP Champions Bitcoin Tax Exemption for Everyday Transactions

Stockholm's political arena heats up as lawmakers push to remove tax barriers from daily Bitcoin spending.

The Regulatory Revolution

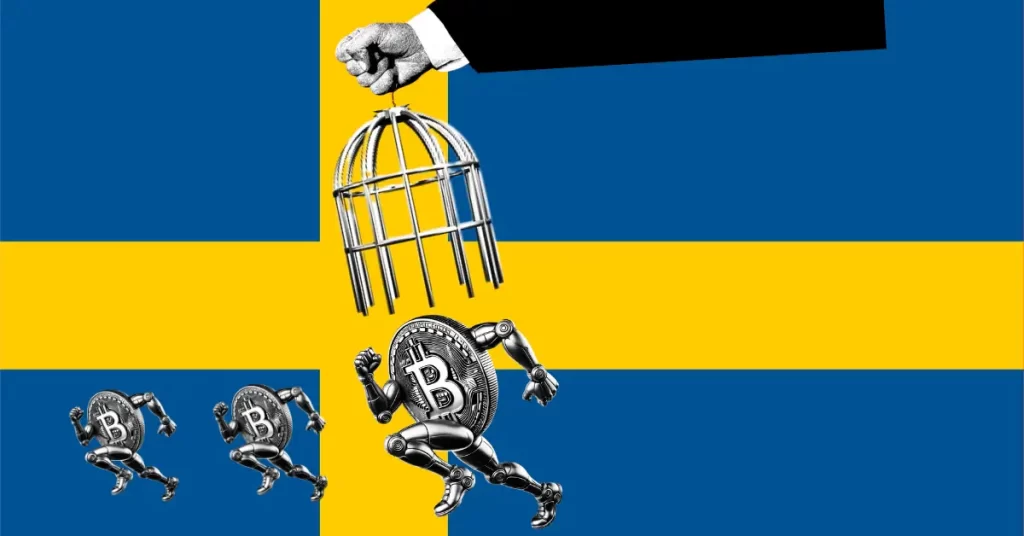

A Swedish parliamentarian is spearheading legislation that would exempt Bitcoin from taxation when used for routine purchases—from coffee to groceries. The move challenges traditional financial frameworks and positions Sweden at the forefront of crypto adoption.

Breaking Tax Barriers

The proposal eliminates capital gains calculations on small-scale Bitcoin transactions, cutting bureaucratic red tape that currently discourages practical cryptocurrency use. Supporters argue this could accelerate mainstream adoption while critics warn about potential revenue losses—though let's be honest, traditional finance hasn't exactly been winning any efficiency awards lately.

Nordic nations continue outpacing global counterparts in digital currency integration, proving sometimes the best regulatory approach involves getting out of the way.

Swedish MP Rickard Nordin has officially proposed removing capital gains taxes on Bitcoin to promote everyday use. His suggestion aims to encourage more people to pay with Bitcoin for regular transactions. The proposal emphasizes the benefits of using Bitcoin as a store of value and a medium of exchange. If accepted, it could mark a significant step toward integrating digital currency into Sweden’s economy, making Bitcoin more accessible for daily payments.