SOL Primed for October Surge as ETF Frenzy Reaches Fever Pitch

Solana's moment is here—ETF whispers are turning into market shouts as institutional interest builds momentum.

The Catalyst Everyone's Watching

Speculation around a potential SOL ETF has traders positioning for what could be the biggest October rally in recent crypto history. Market makers are accumulating positions while retail FOMO starts building—classic pre-breakout behavior that seasoned investors recognize immediately.

Technical indicators align with fundamental momentum, creating that rare convergence where charts and narrative fuel each other. Liquidity patterns suggest big money isn't just watching—they're building exposure ahead of any formal announcement.

Because nothing gets Wall Street's attention faster than another fee-generating product they can sell to clients—even if half of them still can't explain how blockchain works beyond 'digital magic beans.' The financialization train keeps rolling, whether the underlying technology gets understood or not.

SOL price is at a crucial inflection point as ETF speculation builds ahead of October deadlines. With institutional products already showing momentum and ecosystem upgrades underway, investors are closely watching solana crypto as it defends key support levels and prepares for a potential rally.

ETF Momentum Builds Case for SOL Upside

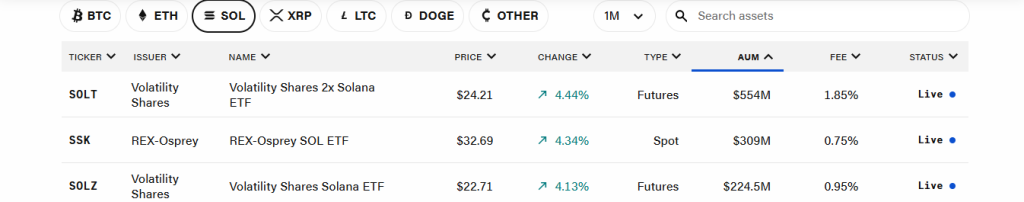

The ETF-related optimism is quickly becoming the key driver for SOL price in October. Live tracking shows that Volatility Shares’ products, SOLT and SOLZ, are both up by more than 4% on a monthly basis.

Meanwhile, Rex-Osprey’s SSK staking product is also above 4%, signaling steady inflows. Such performance suggests that further ETF approvals could boost confidence in Solana crypto and drive new demand.

Experts suggest that October stands out as a pivotal month. Regulatory deadlines for Solana, along with other altcoin ETF applications such as XRP, LTC, and DOGE, are scheduled mid-month.

![]() MASSIVE:

MASSIVE:

OCTOBER IS ETF MONTH

Final deadlines are here for $SOL, $XRP, $LTC & $DOGE ETFs.

Mid-October could be historic for altcoins.

THE APPROVAL SEASON IS COMING. pic.twitter.com/ZdOTErvL5r

Decisions here could set a precedent for altcoin markets, potentially validating SOL price USD as an institutional-grade investment and sparking a wave of buying pressure.

Firedancer Upgrade Fuels Bullish Sentiment

Beyond ETFs, Solana’s ecosystem itself is laying bullish groundwork. Jump Crypto’s Firedancer team has introduced proposal SIMD-0370, which recommends removing the fixed compute unit block limit and allowing validator performance to set capacity.

If approved, this change could significantly enhance throughput and scalability, providing a boost to Solana’s fundamentals with a new growth engine.

![]() JUST IN: @jump_firedancer team has introduced SIMD-0370, a proposal to remove Solana’s fixed compute unit block limit after Alpenglow. Instead of static caps, validators WOULD skip blocks they can’t process in time. pic.twitter.com/0JcBiLVvpt

JUST IN: @jump_firedancer team has introduced SIMD-0370, a proposal to remove Solana’s fixed compute unit block limit after Alpenglow. Instead of static caps, validators WOULD skip blocks they can’t process in time. pic.twitter.com/0JcBiLVvpt

With Firedancer already positioned as a next-generation validator client, and backed by Jump Crypto’s DEEP involvement in the network, such upgrades strengthen the long-term SOL price forecast and further differentiate Solana from other layer-1 projects.

Technical View: Solana Price Prediction

From a technical perspective, SOL price is sitting at the base of its ascending channel, finding support just under $200.

Buyers have consistently defended this zone, and if strength continues, a rebound toward $230-$255 appears possible. Should momentum persist, the next resistance cluster is expected to be around $330-$350, marking the upper boundary for a potential breakout.

On the other hand, failure to hold above $200 could weaken the bullish setup. Key supports then lie at $190 and $175, levels that would need to hold to avoid a deeper correction in Solana crypto.