XRP Price Plummets: Unpacking Today’s Market Downturn

XRP tanks 15% as regulatory shadows lengthen across crypto markets. The digital asset's slide mirrors broader sector weakness—but specific headwinds hammer Ripple's token harder than most.

SEC Overhang Bites Again

Fresh legal uncertainties surrounding Ripple Labs' ongoing battle with regulators spook investors. Every court document drop triggers algorithmic sell-offs that human traders amplify.

Whale Wallet Exodus

Blockchain trackers flag massive XRP movements from dormant wallets to exchanges. When whales dump, retail gets soaked—classic crypto volatility playing out in real-time.

Liquidity Evaporates

Market makers pull bids as volatility spikes. Thin order books magnify price swings, creating a self-reinforcing cycle of panic selling. Even 'stable' pairs show abnormal spreads.

Broader Crypto Bloodbath

Bitcoin's failure to hold $60K drags entire altcoin complex downward. XRP's correlation with BTC hits 0.89—when Bitcoin sneezes, Ripple catches pneumonia.

Traders pivot to 'safer' assets like Treasury bonds yielding 5%. Because nothing says digital revolution like grandma's investment vehicle paying inflation-adjusted negative returns.

The crypto market is flashing red once again. As of September 26, global market cap sits at $3.74 trillion, down 2.27% in 24 hours. The Fear & Greed Index has slipped to 32 (Fear), showing clear risk-off sentiment. Altcoins are particularly hit, with the average RSI at 35.85 indicating oversold conditions. XRP is no exception, falling to $2.76, down 3.3% in a day and over 9% in a week. So why exactly is XRP under pressure today? Let’s break it down.

Factors Behind XRP Price Fall

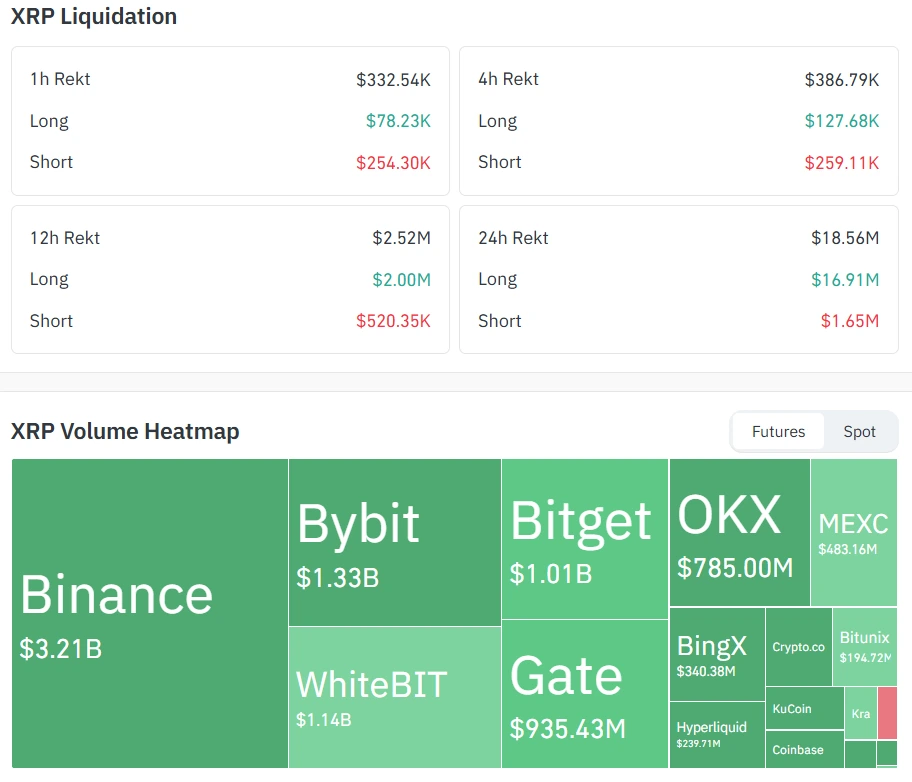

The broader crypto market just faced a $1.5 billion liquidation wave after Ethereum dropped below $4,000. With XRP closely tied to market sentiment, it suffered sharp outflows as Leveraged positions unwound. XRP’s 24-hour volume spiked 30.7% to $8.73B, signaling panic-driven selling. Adding to the pain, open interest rose 7.92% to $1.11T, suggesting traders were caught on the wrong side of the move.

On charts, XRP broke down below the $2.81 Fibonacci retracement and its 100-hour moving average. This invalidated a bullish setup that had defended the $2.71 floor since July 2025. The RSI dipped to 29.24 (oversold) while the MACD flipped negative, showing clear bearish momentum. Analysts now warn that a decisive close below $2.71 could drag XRP toward the $2.50–$2.55 zone.

Ironically, positive news also played a role in the drop. The SEC approved a Hashdex ETF holding XRP/SOL/XLM on September 25, but instead of a rally, XRP saw heavy selling. Traders had already priced in the event after an 8% run-up earlier in the week and rushed to “sell the news.” While the ETF drew $37.75M in spot volume on its launch day, it was modest compared to BTC and ETH products, muting optimism.

XRP Price Analysis

At the time of writing, xrp price is at $2.76, with a market cap of $165.21B. It has posted a daily low of $2.74 and a high of $2.87. Trading volumes remain elevated, which highlights both panic selling and speculative positioning.

The $2.71 level is now the key short-term support. A bounce here could stabilize XRP, especially if broader market sentiment recovers. However, a clean break below $2.71 opens the door to $2.55, a level last tested in June. On the upside, reclaiming $2.81 on a daily close WOULD be an early sign of strength, while a move above $2.99 could neutralize bearish momentum.

FAQs

Why is XRP dropping despite ETF approval?Because traders used the approval as an opportunity to lock in profits after a pre-announcement rally.

What key level should XRP investors watch?$2.71 is the make-or-break level. Holding it signals accumulation, but losing it may lead to $2.55.

Is XRP oversold right now?Yes, RSI readings are NEAR oversold territory, but bearish momentum remains strong until $2.81 is reclaimed.