Bitcoin and Ether ETFs Bleed Millions as Markets Brace for Powell’s Pivotal Speech Today

Crypto markets hold their breath as ETF outflows accelerate ahead of Fed chair's address.

THE LIQUIDITY DRAIN

Digital asset investment vehicles hemorrhage millions in pre-speech jitters. Bitcoin and Ether ETFs see substantial outflows as institutional players reposition before Powell's macroeconomic guidance.

TIMING THE VOLATILITY

Traders dump exposure ahead of what could be market-moving commentary. The classic 'sell the rumor, buy the news' playbook gets another workout—because why trust fundamentals when you can gamble on central bank theater?

THE POWELL EFFECT

All eyes turn to the Fed chair whose every syllable gets parsed like ancient prophecy. Markets hang on interest rate signals that could make or break crypto's short-term momentum.

Another day, another million-dollar bet on whether the money printer goes brrr or not.

![FOMC Meeting Today [Live] Updates FED Decision Time Today, Jerome Powell Speech Today](https://image.coinpedia.org/wp-content/uploads/2025/09/17183125/FOMC-Meeting-Today-Live-Updates-FED-Decision-Time-Today-Jerome-Powell-Speech-Today-1024x536.webp)

The crypto market is tense today.

Hours before U.S. Federal Reserve Chair Jerome Powell delivers a key speech at 11:30 a.m. ET, investors pulled hundreds of millions from Bitcoin and Ether ETFs, signaling a clear risk-off mood. With Bitcoin already struggling near support levels, Powell’s words could decide whether the market steadies or sinks further.

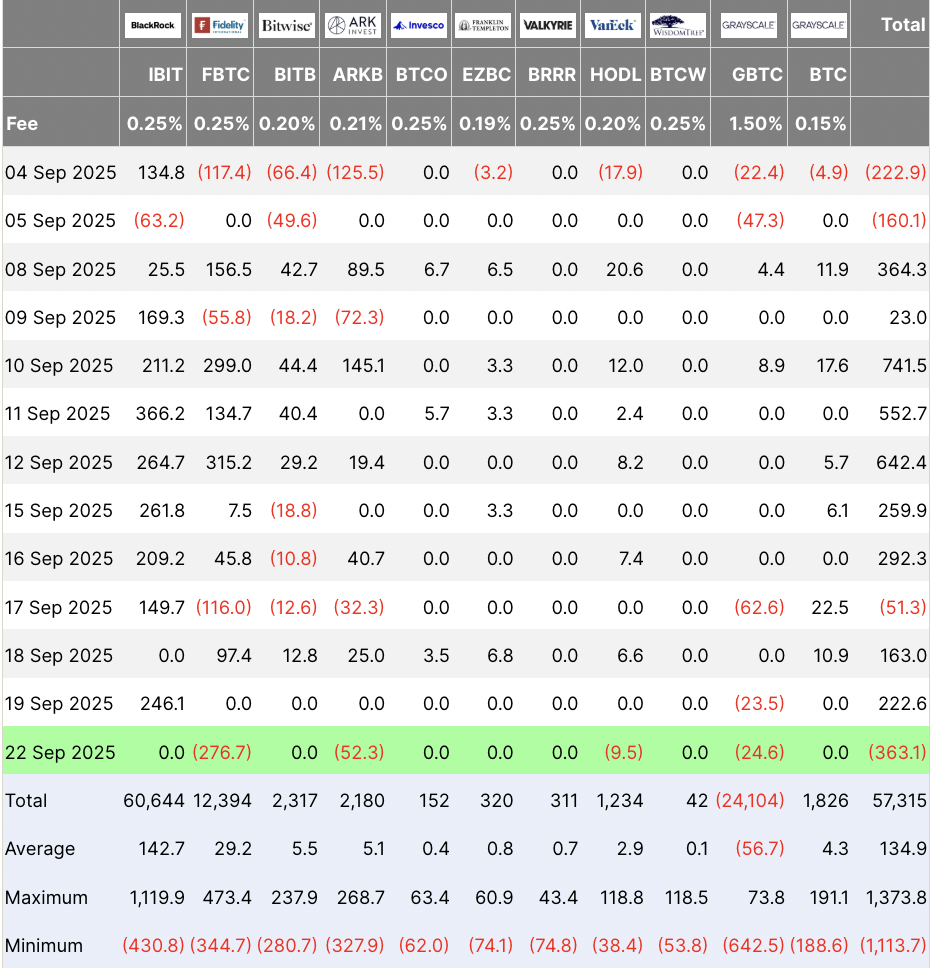

Bitcoin ETFs Bleed $363M

Fresh data from Farside Investors shows spot bitcoin ETFs saw $363.1 million in net outflows on September 23, the biggest this month. Fidelity’s FBTC alone accounted for $276.7 million, followed by $52.3 million from Ark 21Shares’ ARKB and $24.6 million from Grayscale’s GBTC. VanEck’s HODL lost another $9.5 million, dragging total ETF assets under management below $150 billion.

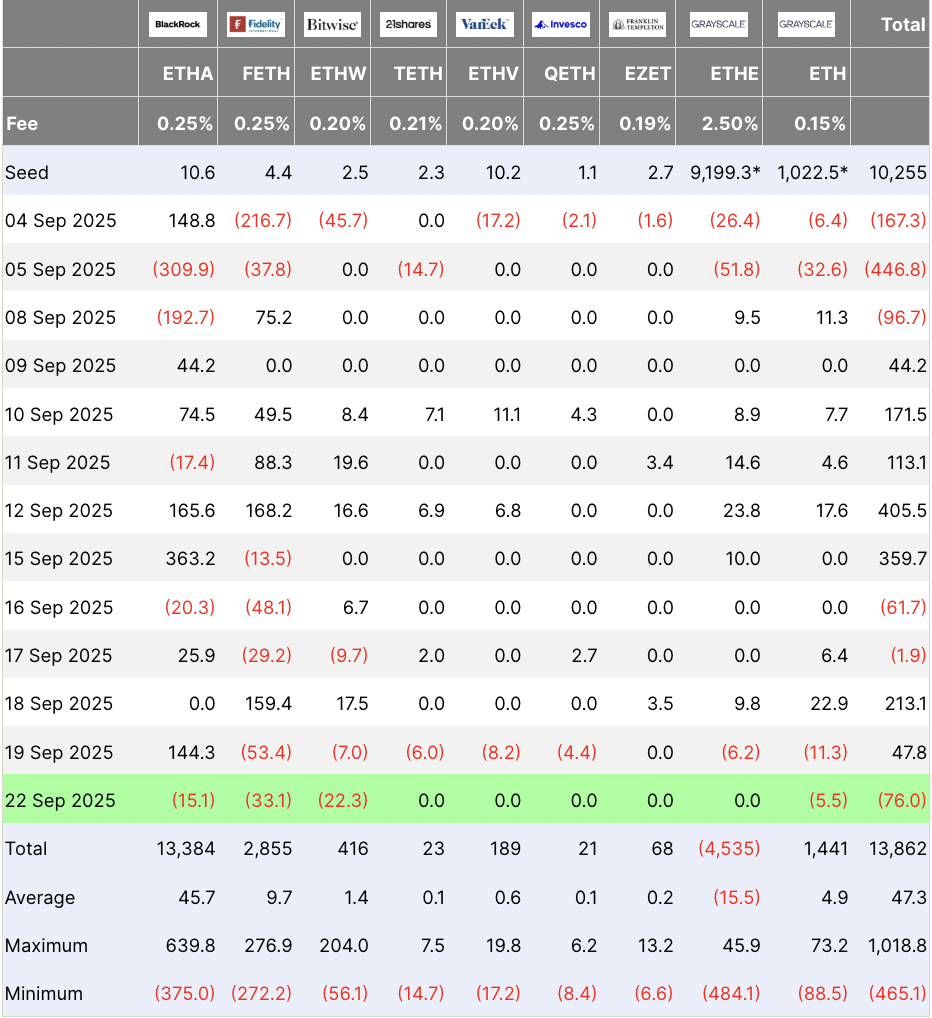

Ether funds faced pressure too. Spot Ether ETFs recorded $76 million in outflows, ending two days of inflows. Fidelity’s FETH led with $33.1 million, while Bitwise’s ETHW and BlackRock’s ETHA also saw redemptions.

Together, the moves show investor caution ahead of Powell’s update.

Powell Steps Into the Spotlight

Today’s speech comes just days after the Fed’s first rate cut of 2025, a quarter-point MOVE that lowered rates to 4.00%-4.25%. Powell warned last week that the decision was about “risk management,” not a signal of aggressive easing.

“With downside risks to employment having increased, the balance of risks has shifted. Accordingly, we judged it appropriate at this meeting to take another step toward a more neutral policy stance,” Powell said during the FOMC press conference.

Markets now want clarity on whether the Fed will stay cautious or open the door to further cuts. That direction could set the tone for Bitcoin’s next move.

Pressure From All Sides

It’s not just the Fed weighing on sentiment. The U.S. Dollar Index is firm above 97.00, while 10-year Treasury yields hold NEAR 4.15%. Gold is climbing, and JPMorgan CEO Jamie Dimon has warned the Fed won’t cut further until inflation eases.

That mix has left crypto investors bracing for more volatility.

Bitcoin, ETH, and the Altcoin Question

Bitcoin is trading around $113,000, with support near $111,000. ethereum is holding just above $4,200. The Fear & Greed Index sits at 40, which is neutral territory for now.

Analysts are divided too.

Joao Wedson of Alphractal says Bitcoin’s cycle “is running out of steam” as on-chain profitability weakens, while Michaël van de Poppe calls the crash a “classic liquidity sell-off” that could set up a rebound.

Bitcoin is already showing signs of cycle exhaustion — and very few are seeing it.

The SOPR Trend Signal is excellent at signaling when blockchain profitability is drying up.

Never in Bitcoin’s history have investors accumulated BTC so late and at such high prices.

Maybe only… pic.twitter.com/I1GBdEJH03

Some analysts, meanwhile, point to altcoins as the next big play. The altcoin-season index hit its highest level since late 2024 earlier this month, signaling growing rotation.