VanEck Makes History: First Spot Avalanche ETF VAVX Hits Nasdaq

Wall Street just opened a direct on-ramp to the Avalanche ecosystem—no crypto exchange required.

The Institutional Gateway Opens

VanEck's VAVX isn't just another fund. It's a spot ETF, meaning it holds the actual AVAX tokens. That's a game-changer for big money managers who've been sidelined by custody headaches and regulatory gray areas. Now, they get pure price exposure through a familiar, regulated wrapper.

Why Avalanche? Why Now?

The timing isn't random. While the old guard debates Bitcoin's energy bill, Avalanche has been building—scaling subnets, onboarding institutions, and quietly becoming a hub for real-world asset tokenization. This ETF is a bet that the next wave of blockchain utility won't be on the slowest or most expensive chains.

The Ripple Effect

Watch for a liquidity surge. Every dollar flowing into VAVX means VanEck's custodians are buying AVAX off the open market. That creates a new, persistent buy-pressure loop divorced from retail sentiment. It also sets a precedent—if Avalanche gets a spot ETF, which layer-1 is next?

A Cynical Footnote for the Finance Bros

Let's be real: this lets traditional funds finally 'discover' a top-10 crypto asset they've ignored for years, all while collecting a tidy management fee for the privilege. The innovation's been live; the money's just catching up.

The floodgates are open. The question is no longer if institutional capital arrives, but which ecosystems are ready to build with it.

This isn't just another ticker symbol on a screen. The debut of the Avalanche ETF VAVX is a massive nod of approval for a network that’s been working behind the scenes to prove it’s more than just "another blockchain." While the broader market has been a bit of a roller coaster lately, VanEck’s move puts AVAX in the big leagues alongside solana and XRP, which fought their way into the ETF club late last year.

Impact of the New Avalanche ETF VAVX on Staking and Markets

What makes the Avalanche ETF VAVX actually interesting and not just a boring price tracker is the staking element. Usually, when you buy a crypto ETF, you're just betting on the price. But the Avalanche network is built on "proof-of-stake," which means the tokens themselves earn rewards just for existing and securing the network. VanEck is actually staking a portion of the fund’s holdings and passing those rewards back to the shareholders.

Think of it like a stock that pays a dividend. You get the potential price growth of AVAX, plus a little extra "blockchain "interest" on top. To get people through the door, VanEck is even playing the "no-fee" card. They’re waiving the 0.20% sponsor fee for the first $500 million that flows in, or until the end of February. It’s a classic Wall Street land grab, and it's great for early investors.

On-Chain Vitality Meets Market Realities

The timing here is pretty fascinating. If you look at the data, the Avalanche network is currently on fire. Last week, active addresses shot up by over 1,700% jumping from a quiet 30,000 to over 600,000. Big names like KKR are starting to put real-world assets on the chain, and even the California DMV is using it for vehicle titles.

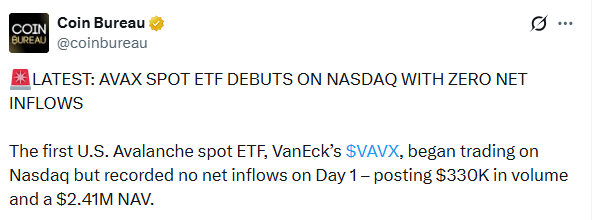

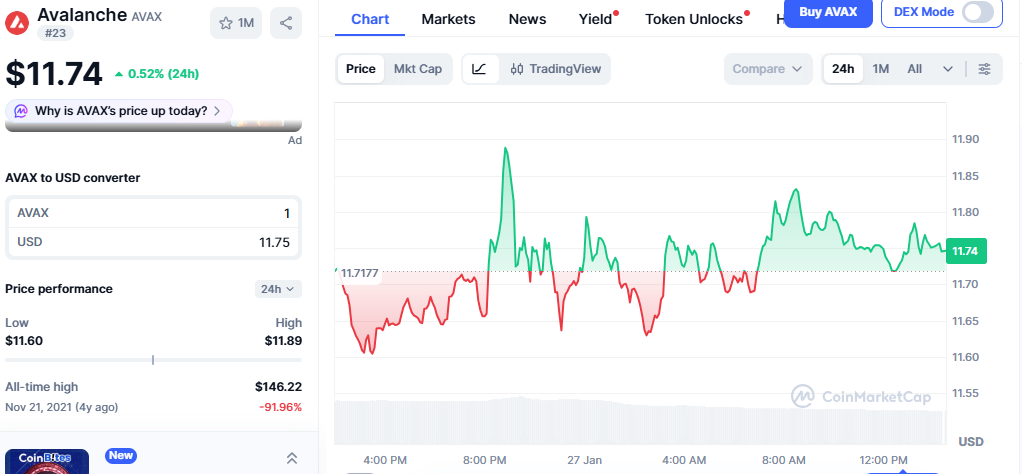

However, the price of AVAX itself is playing hard to get. It’s sitting right around $11.74, hovering over a support level that analysts say must hold. If it can climb back above $14.80, we’re looking at a clear path to $20. If it slips, things could get a bit messy in the $9 range. The launch of the AVAX ETF VAVX might just be the "institutional shove" the price needs to break out of this slump.

Expert Analysis: The Future Outlook

We’re moving into a phase where "altcoins" are becoming "institutional assets." The AVAX ETF VAVX is the perfect example of this. Avalanche’s secret weapon has always been its speed and its "subnets" basically custom blockchains for specific companies.

In my view, the real test won’t be the first day of trading, but how many traditional financial advisors start putting this in their clients' portfolios six months from now. If they can explain to a 60-year-old retiree why "time-to-finality" matters and why they're getting a staking yield, AVAX could become a staple of the modern portfolio. It’s no longer about speculation; it’s about participating in the new plumbing of the global financial system.